Now - 14:00:41

Samples of filling of payment orders. Payment order: the sample

Fill the payment order from time to time have both people and organizations. The compilation of relevant documents rather strictly regulated by law. Therefore, it is recommended to follow the criteria established in the legislation. What are the specifics of the formation of the payment orders through which the organization or individual carries out transaction taxes, contributions, duties or other reasons?

Follow the law

Legislation regulating the formation of financial documents in Russia, is often different. Therefore, before studying samples of filling of payment orders, it will be useful to draw attention to a number of important provisions in the legislation relevant to the appropriate procedure. Among the key sources of today — Order of RF Ministry of Finance № 107n dated 12 November 2013, which approved the rules of information in payment orders. What provisions of this source deserve special attention?

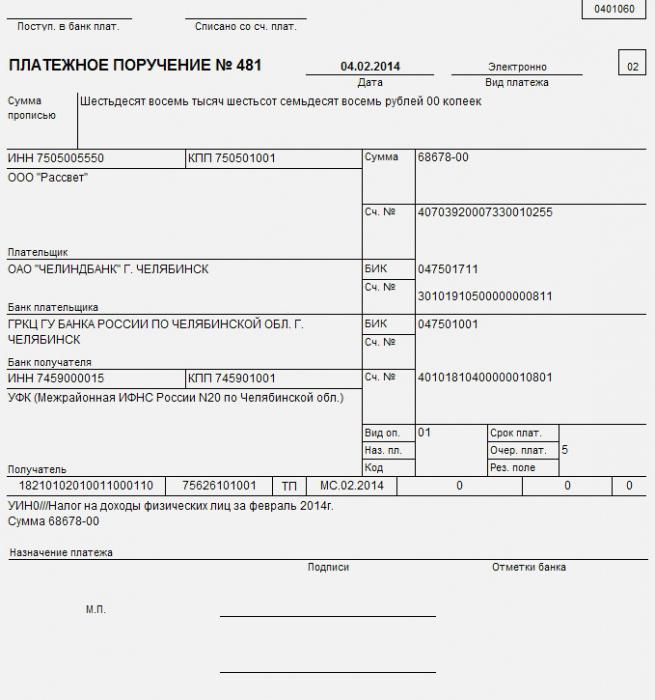

For example, in the field 101 of the payment orders of the company, having the status of a tax agent, should select the appropriate status, namely 01 or 02.

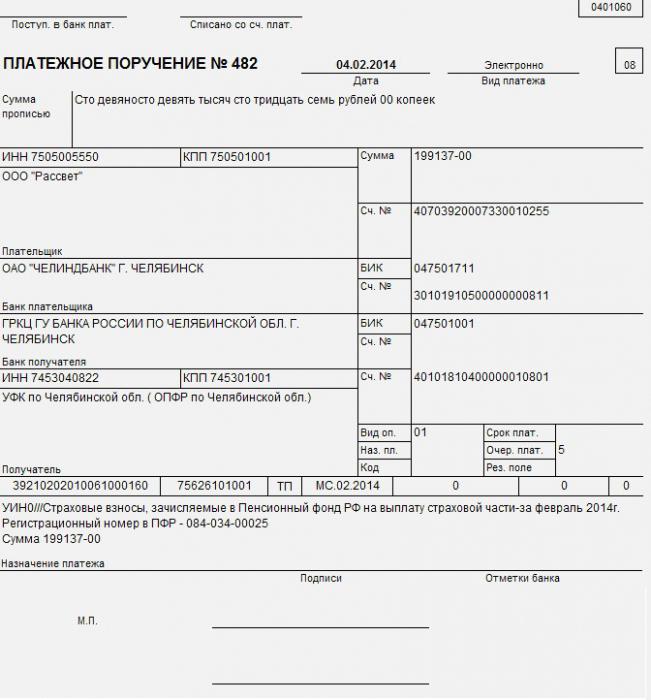

If there is a question on necessity of transfer of insurance contributions-to the pension Fund, social insurance Fund and FFOMS status should be 08. Previously, it was indicated only in case of transactions in the FSS.

Innovation — in the 105 you can specify the rcoad, and other props — the RCM.

Another notable innovation introduced by the Ministry of Finance — win. It is indicated in the field 22 of the payment order. To find out the correct win, you need to seek the advice of the territorial Department on place of business.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

A Much simplified procedure specify the payment type field 110. In accordance with the above mentioned order of the Ministry of Finance, there are 3 ways of specifying the appropriate props — PE (interest on taxes in the budget), PC (percentage of charges) or 0 (other charges).

Another important innovation, approved by authorities — in a single payment, you can specify only one CAC.

Interesting things with props in the box 106, in which records of the base payment. It includes such items as repayment of the investment loan (or IN), of debt during the bankruptcy (TL, RK), current debts (ZT).

In the fields that reflect the information about the payee, you must specify the full or abbreviated name of the entity. Many lawyers, forming for its clients fill pattern of the payment order UI, pay attention to the fact that the entrepreneur must specify in the appropriate field name, and status.

The Practice of working with payment system

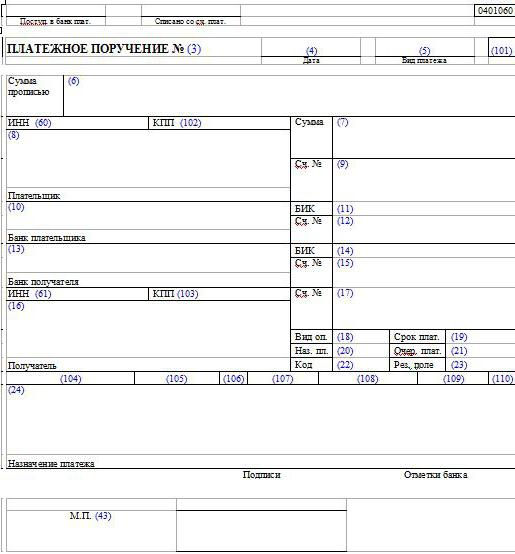

So, after reviewing the basic legal nuances of filling platezhek, go to practice to work with these documents. What criteria must comply with the payment order? Sample filling, whatever it may be, will include in its structure a few key fields, each of which has a unique code. Examine their combination.

Information about the payer and recipient

Any samples of filling of payment orders will include such props as the INN of the payer (with code 60). If for some reason the subject of legal relations there, you need to put 0. If a payment order fills by individuals, not registered as individual entrepreneurs, provided in props 108 corresponding ID field ID 60 is optional. If the company transfers a part of the employee's salary in the budget, indicates the INN of the employee concerned.

Props CPT code 102 to fill the legal entity having the appropriate certificate. Individuals do not possess them, so in this box put 0 (as companies which transfer funds from staff salaries in the budget).

Payer information

Props "Payer" ID 8 — the most important in the document. Regardless of who forms the payment order, the sample source will include information about the corresponding subject. Payers can be:

- the legal entity (in this case, you specify their name);

- notaries (they enter in the document name and its status, address);

- the head of farm (indicate name, status, address);

- individuals (enter name and address).

- the consolidated group of taxpayers (indicate the name of the responsible party);

the company retaining part of the salary with the purpose of transfer to the budget (enter name).

If you want to specify the address, it is recommended after him to put two forward slashes //.

The Next important requisite “was the recipient of the funds" ID 61. It can be found in the appropriate state Agency administering a particular type of collection. This prop is adjacent to another - "transmission of the payee" ID 16. Similarly, it is necessary to know the relevant government agencies.

Data compiled bills

A Very important requisite code 101, which records information about a subject that generates a payment order. Fill pattern (taxes, fees, fines) this document will always include the item. There are 26 possible values of the correspondingprops (for example, 01 — the taxpayer, 02 — tax agent, 09 — Yip, etc.).

Compiling instructions for the payment of taxes, fines and penalties

Consider the specifics of formation of bills when paying taxes, fines and penalties. The details, which we now learn will include almost any document — for a listing of personal income tax, USN, payment order of VAT. The fill pattern of this type of sources will be optimal for ensuring the conformity of its structure to the following criteria.

Among the most important things — that has the code 104. This is the CSC. You are recommended not to make mistakes in it, otherwise financial transactions will simply not reach the intended recipient. This item — is almost always included in the fill pattern of the payment order. PFR, FSS, FOMS, on — entities that have their CSC. Perhaps, of course, in case of an error, indicating the CSC to send to these companies and documents corrective in nature, but if the term of the relevant transaction has passed, it is an indication of the relevant code can be initially interpreted these agencies as a deviation from the payer's statutory obligations.

Samples of filling of payment orders always include a code OKTMO — in a field of 105. Previously it was an rcoad code.

In the box 106 is fixed to a base financial transaction. Samples of filling of payment orders is also always turn it on. There are a large number of options for specifying appropriate props (e.g., TP — current FROM — the repayment of the delayed debts, TR — payment of debts at the request of FNS, etc.).

Right to specify the period

Code 107 corresponds to the props, to record the tax period. In its structure — 10 characters (of which have practical value are 8, the other — the separation). In the first two specify the frequency of the transaction — MS, KV, PL, GD (month, quarter, half-year or year). In the fourth and fifth number of month, quarter, half-year for associated payments. If the transaction is to be implemented once a year, then you need to put 0 if timing of transfer of funds a few, then you need to put the date of transfer of funds. The remaining characters in the props are used to indicate the year in which you pay a fee.

To Correctly specify the document number

Code 108 corresponds to the props, which records the document number, which acts as basis for the implementation of the transaction. There is also probably a large number of options (for example, TR — the room of requirements on the payment of duties, — a decision to postpone a debt, TP — definition of arbitration, etc.). It can be noted that individuals who pay the taxes, specified in the Declaration, must set to 0.

Right to specify the date

Code 109 corresponds to the props, which specifies the date of the document acting as a basis for the transaction. Its structure is also represented by 10 characters. In the first two put a specific day of the month, in the fourth and fifth — a month, in the seventh, eighth and tenth — year. As the third and the sixth character is used point. If the payment has a status of current — TP, you need to specify the date corresponding to that Declaration or other document was signed by the payer. If we are talking about a voluntary debt repayment for the expired periods, it is necessary to put 0 in the corresponding props. If the basis of the payment — the requirement in TR, then you need to specify the date of its formation. The same — when you repay the debt. If the requisite fills the physical person who pays the tax Declaration, then he needs to put the date corresponding to the filing of this document with the IRS.

Code 110 - simplified

Code 110 corresponds to such props as a type of payment. Compiled for almost any enterprise fill pattern of the payment order (personal income tax, fines, interest) is to turn it on. It is possible, as we noted above, 3 options — NE (fine), PTS (percent) or 0 (for taxes, penalties, advance transactions). Similarly, 0 is placed, if the originator of the document is difficult to specify the correct type of payment.

Code 21 corresponds to such props, as the order of payment. It is recommended to set the number 5 — in accordance with the provisions of 855-th article of the civil code.

Win

Code 22 corresponds to the above-noted new props — UIN (unique identifier or accrual). To know him, as we noted above, it is necessary to FNS, which will be provided in payment order. Some lawyers recommend, however, to seek relevant information in banks. For example, if the payment order is made (fill pattern) Sberbank, then perhaps the best option — to consult with professionals in the financial organization. However, according to experts, if it is impossible to specify the UIN in the appropriate props can be set at 0.

Code 24 is associated with the payment. This can be, for example, payment for services, goods. But if we are talking about the transfer of the organization of the employee's salary in the budget, it is necessary to indicate in the appropriate field personal information specialist — full name, INN.

So we looked at what criteria should correspond to the payment orders for transferring taxes to the budget, penalties and fines. In General, the same rules apply if the basis forpreparation of such a document as the payment order — stamp duty. Fill pattern of the source will correspond to the considered algorithm.

The Specifics of making a payment to the funds

Certain characteristics is characterized by the preparation of payment orders to the state funds. Fill pattern of the payment order (FFOMS, PFR, FSS can be addressed) of the corresponding type will be optimal for its conformity to the following criteria.

So, in this type of documents, as in the case of payment of taxes, fines and penalties will be triggered field 104, that is CSC. As in the case of the payment system of the preceding type, only one CCC may be specified in a single document. Correct CPM to be obtained from the Fund, which is sent to the relevant transaction.

Similarly, code 105, suitable props such as the RCM, you must also specify in the payment. He, as in the case of documents for transfer of taxes, fines and penalties, replaces OKATO.

If you pay a fee, a public Fund, the details of the codes 106 and 107 can be set at 0.

Important code 108. If the 101 above — that is, in fact, which contains data on the status of the subject, forming a payment system — marked by such figures as 03, 19, 20, or 24, the requisite 108 need to put the ID of individuals. This can be, for example, social security number, his passport number, series and number of driver's license, etc.

The Variability of identifiers

It is also Important to specify the correct type ID. It can be represented in the following range:

- 01 (the main document certifying the identity of the citizen of the Russian Federation — passport);

- 02 (the birth certificate);

- 03 (seaman's passport);

- 04 (the identity document of the military);

- 05 (military ID);

- 06 (a document that certifies the temporary identity of the person);

- 07 (certificate of release of a citizen after serving his jail term);

- 08 (alien's passport);

- 09 (residence permit);

- 10 (document authorizing the temporary stay in the Russian Federation);

- 11 (document certifying refugee status to humans);

- 12 (migration card);

- 13 (USSR passport);

- 14 (SNILS);

- 22 (driver's license);

- 24 (certificate of state registration of the vehicle).

In the fields 109 and 110 can be set at 0.

Versatility of precedence

In the field 21, that is, the order of payment shall be 5, as in the case when we looked at the first scenario of drafting such a document as the payment order (fill pattern). A fine, tax, levy to the state Fund always put thus, with precedence 5.

Props ID 22, that is, UIN, as in the case of payments previous type, you should learn either in a public institution that sent the funds or in a Bank.

Props ID 24 assumes the correct indication of the purpose of the transaction. This can be, for example, insurance premiums for OPS.

Article in other languages:

PL: https://tostpost.com/pl/finanse/23772-wzory-wype-niania-zlece-p-atniczych-zlecenie-pr-bka.html

TR: https://tostpost.com/tr/maliye/23832-rnekleri-dolum-deme-emirleri-deme-emri-rnek.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Credit card MTS – user reviews.

Several years ago a telecommunication company MTS launched a new service – “MTS Money”, which allows you to make payments directly from home. By using this service you can pay for various goods and services with ...

Consolidation is a new step of development

Most modern applications intended for use in computer networks, so their effective operation usually does not depend on the physical location of computing power. If the company has a developed network infrastructure, it can be eff...

Homeowners insurance in the mortgage cost, is it compulsory documents

when the mortgage Insurance is a separate type of insurance. There are some peculiarities you should be aware of before you sign the documents for registration of the mortgage. How to obtain a policy of insurance with the mortgage...

What is the currency in Liechtenstein?

the Principality of Liechtenstein is a microstate in Central Europe, bordered by Austria and Switzerland. The population of the country speaks German. Despite the presence of the Constitution, the Prince is in fact an absolute mon...

What is preferential loan program?

a private car — it's good to argue with this statement, not everyone can. However this purchase is not cheap, and you can afford to look in the showroom may not all our compatriots. That is why every year are gaining more an...

Is there any available loans for pensioners?

If you are a pensioner, you may be granted a loan on special terms. There are many prejudices about the solvency of such social groups as young people and pensioners. It's very difficult to get a job as the first little to no expe...

Comments (0)

This article has no comment, be the first!