Now - 21:29:16

"Renaissance" (pension Fund): licence, rating, reviews

The Renaissance is a retirement Fund that Russia has for a long time. A very large organization. But if I trust her? What information about the company can be found? What to believe? Reviews about the "Renaissance" does not give a clear opinion about what constitutes this company. So often it is necessary to study not only the reviews, but latest news about pension funds. So what people are saying about the organization? Whether it can be trusted? Or is it better not to go here for the formation of the funded part of pension?

Description

"the Renaissance" - non-state pension Fund of Russia. He spent a long time working in the country. Supported by the eponymous financial services company. Operates in the pension insurance of the population.

Here, as we are assured by many, you can create contributions, which will be credited to a citizen of cash at old age. This creates a cumulative part of the pension. No specific activities of "Renaissance" does not. Only the opening of the deposits for pension savings. But should pay attention to this organization?

Transformation

It is difficult to Determine. After all, "Renaissance" - pension Fund non-state type, which for all time of its existence, has undergone very many changes. The thing is that he passed through the merging of several pension funds several times.

The name of the company "the Renaissance - the Sun. Life. Pension". It was under this name can be found mentioned non-state Fund. Therefore, surprising that a "Renaissance" and "the Sun. Life. Pension" retained the same opinions, it is not necessary. It is one and the same organization.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

Frequent change of names, and also combine with other non-state funds many raise questions about the integrity and stability of the company. But what you should pay attention to as accurately to decide whether to invest in the Fund or not?

Popularity

For Example, on the rating company. The Renaissance is a retirement Fund that is not leading. According to statistics, it is 20-ke leaders. But above the 11 positions was not raised.

It is Often stated that "the Renaissance Life and pensions" (NPF) is at the 15th place ranking in the popularity of all similar funds. It is on this indicator many follow it. Not the best place, but nevertheless it is close to the top 10.

This is not the only selection criterion. What other components, many customers pay attention? Can you really trust referred to the pension Fund? Or better to look for another place for the formation of pension savings?

Trust

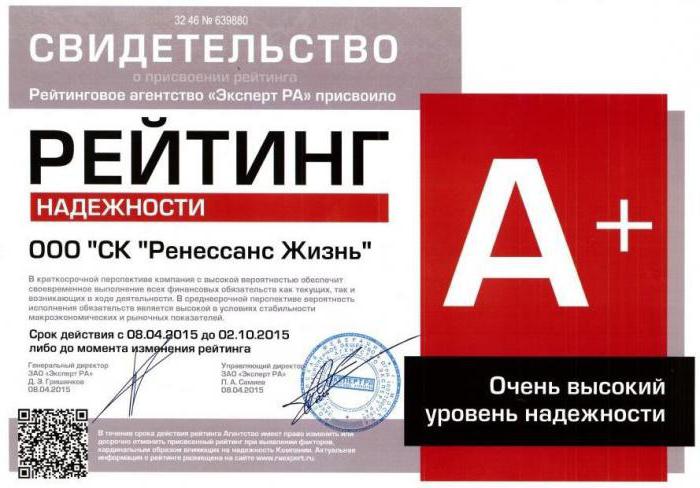

For Example, the following indicator is the level of trust. NPF "Renaissance" has a fairly high confidence. But only according to statistics. Indicates that the organization trust is at the level of A+. In some sources the confidence is equal to A++. This is the highest point of trust.img alt="NPF Renaissance" src="/images/2018-Mar/25/33dc64fe5b40bb56257ef5cc6c4cdfb7/3.jpg" />

Nevertheless, quite often indicates just the first indicator. That is, customers and potential investors trust the Fund, but not 100%. A good level of confidence. Especially considering the fact that the higher the trust have the funds-leaders in Russia.

Profitability

"the Renaissance" - non-state pension Fund with a relatively high level of profitability. This index often attracts potential investors most. After all, the goal of non-state funds is not only maintaining, but increasing the retirement savings of citizens.

NPF "the Renaissance" offers a yield of about 7-8%. Not too much, as some clients. However, this is more than can offer some of the same firms. Therefore, according to numerous reviews, the organization is really possible to exaggerate accumulation. Not too much, but that prospect takes place.

Distribution

"the Renaissance Life and pensions" NPF, which is said many potential investors found in most cities of Russia. More precisely, the branches of this organization exist in every village.

That is a Fund is a very large Corporation. As already mentioned, it is supported by the same Bank. And this fact inspires potential investors confidence in the sustainability of the Fund. Anyway, the "Renaissance" is not small time crooks who just hide behind the status of non-state pension Fund to collect funds from the population. So, you can look at the issue of the formation of the funded component of the pension.

Services

"the Renaissance" - the pension Fund, which causes constant arguments. What does it mean? You can't just judge the quality of the services the organization offers. The views of clients in this area seriously divided.

The offer of NPF "Renaissance"? Customers indicate that all of the employees here are pretty quick to answer all questions. But the speed of the actual service leaves much to be desired. Speaking aboutpayments of pension savings, it should be noted that they come with serious delays. Of course, this state of Affairs can not please people.

"Renaissance" provided by the Internet service. Or rather, "Personal Cabinet", where each customer can order a statement about the status of his account. Such a service often makes investors a lot of negativity. Because the system is not working properly. Very often, even the authorization in the appropriate service not get pass.

Therefore, NPF "Renaissance", whose rating is the highest in Russia, has its pros and cons in relation to the service. And this fact must be taken into account. From the pension Fund should not expect perfect operation. And there are well-founded reasons. One of them causes some people to panic and worry over your retirement savings. What are you talking about?

License

About the license. She deserves this Fund. Why? What are so attracted to this area of the NPF "Renaissance"? License study of the company is suspended. Or rather, recalled. And we are talking about the Fund "of the Sun. Life. Pension". What does it mean?

"the Renaissance" no longer has any rights to the implementation of the insurance population. Operate as private pension Fund does not take place. Therefore, to consider the organization as a place of formation of pension savings is clearly not worth it. Even on the official website of the FIU published the information that "the Renaissance" no longer has the license for implementation of pension insurance.

Why it happened? The Central Bank has decided to reduce the number Npfov in Russia and leave only the best of the organization. "Renaissance" - the pension Fund, which, according to many sources, could not cope with their obligations. He did not pay the citizens money, if investors wanted independently to translate savings into a different pension Fund. The actual violation of the law.

However, the management of the organization does not agree with this statement. And now it wants to sue. Yet "Renaissance" did not resumed its work. It is unknown whether the return to the company a license for pension insurance. If this happens, it is recommended to separate caution to the company.

Article in other languages:

AR: https://tostpost.com/ar/finance/8412-renaissance-pension-fund-licence-rating-reviews.html

BE: https://tostpost.com/be/f-nansy/15046-renesans-pens-yny-fond-l-cenz-ya-reytyng-vodguk.html

HI: https://tostpost.com/hi/finance/8415-renaissance-pension-fund-licence-rating-reviews.html

JA: https://tostpost.com/ja/finance/8413-renaissance-pension-fund-licence-rating-reviews.html

KK: https://tostpost.com/kk/arzhy/15048-renessans-zeyneta-y-ory-licenziya-reyting-p-k-rler.html

PL: https://tostpost.com/pl/finanse/15044-renesans-fundusz-emerytalny-licencja-ranking-opinie.html

TR: https://tostpost.com/tr/maliye/15051-r-nesans-emeklilik-fonu-lisans-derecelendirme-g-r-ler.html

UK: https://tostpost.com/uk/f-nansi/15048-renesans-pens-yniy-fond-l-cenz-ya-reyting-v-dguki.html

ZH: https://tostpost.com/zh/finance/9204-renaissance-pension-fund-licence-rating-reviews.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Townhouse: the pros and cons of housing reviews

Townhouse – from the English. townhouse (in a literal translation on Russian – “town house”) is a relatively new offer in the Russian market of residential real estate. Realtors offer such housing to those ...

Money plays a major role in the economy of any country. All economic and business entities regularly conduct operations and make transactions using cash and non-cash. That is, it is a tool with which to develop economic relations ...

Simple and bills of exchange. What is the difference?

Bill – this is a type of security that represents the promissory note a legally prescribed form. The bill is considered certain and unconditional sales document, it is of two types simple and transferable. The promissory not...

Loans secured by land: my Kingdom for a loan

Loans secured by land as diverse as the many mortgage programs for home purchase. Hundreds of banks offer a way to solve the financial difficulties for clients who own land. The specific settings of the borrowings depend on Bank a...

Method declining balance depreciation: an example of the calculation formula, the pros and cons

depreciation deductions are one of the most important processes of accounting firm. Due to the depreciation extinguished the value of acquisition of fixed assets and immaterial (intangible) assets. In addition, amortization includ...

Bank "Svyaznoy": default or not? The problems of banks in Russia

ZAO “international Bank” — a credit institution of the Federal scale. He has a license of the Central Bank, FSFR, a professional member of the RZB group, as well as on the issue of plastic cards Visa, Mastercard....

Comments (0)

This article has no comment, be the first!