Now - 22:40:24

"Client-Bank" - what is that system?

This is the job of the chair or sofa. That's what they say about a fairly widespread interactive service called “Customer-Bank”. It is a Unique product in a financial institution. It allows you to perform various actions with customer accounts, but its minimal effort. What is this system? How it works and how difficult is it to install?

Overview

“Client-Bank” is a special service for regular banking customers. Is a specialized software complex that provides access to various account operations.

Under the system, customers can share documents and information with its partners as well as representatives of financial institutions. And to do all this remotely. And the exchange process is performed by computer or mobile phone connected to the Network.

A Little history

The System “Customer-Bank» - this is not a new service. According to preliminary data it financial institutions have for 6-7 years. According to representatives of banks, the system created to facilitate and simplify the work of customers with their accounts. Moreover, with its help the bankers not only get the location of their current clients, but also completely new users.

Where the banks are taking this program?

Most financial institutions wishing to add to their existing services “banking”, try to order directly from the developer. In this case, they do not need to reinvent the wheel. It is only necessary to connect the “Customer-Bank" (it's not hard to do) and adapt it to the specific credit institution.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

Other banks are trying to make an exclusive product on its own. In this case, they create the system in its sole discretion. However, as such the General rules for making such software is not. Is not provided and the General approach of the representatives of the Bank at the service connection. For example, in some financial institutions for access to the service do not take the money. Other such services are paid. Still others offer clients a monthly paid service, etc. in short, every organization has its “banking”. Log on and connect it often involves the use of disposable and permanent password.

What types of services exist?

“Client-Bank” can be divided into two types:

- “Fat client".

- "Thin client”.

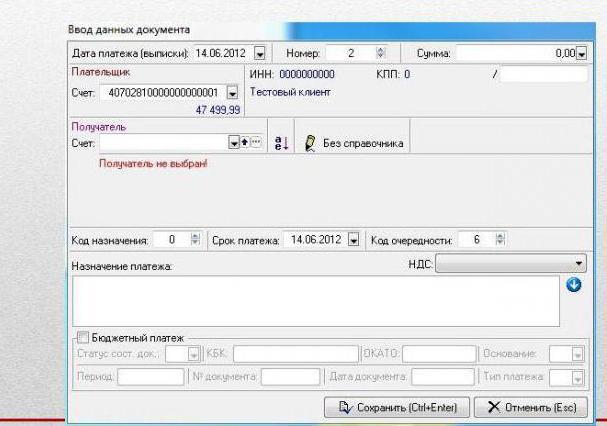

In the first case, this refers to the classical version of the programme, involving the installation of a separate service on the user workstation. What does it mean? In other words, the program is installed on a computer or mobile device. All the necessary information, including various account statements and documents are also saved on the PC and in the ‘Client-Bank”. Input Into the system through handheld devices connected to the Network.

“Fat client" suggests a variety of connection options with the Bank. The simplest among them is the option of using phone lines, modem or Internet connection. This type of system does not require constant access to the remote banking services (abbreviated RBS). The thing is that initially such a program may be installed on its own system management databases. This approach helps you to make a reservation for the appropriate databases and provides the user with the network version of the service. It happens all with a high-speed processing, which is very convenient for accountants and larger businesses.

In the case of “thin clients” log into the system via an Internet browser. While the program itself is installed on the virtual services of the credit institution, and all user data is stored on the Bank's website (in the section "Personal account"). In fact, it's the same Internet banking for your PC or mobile banking for phones and smartphones. However, all the complex is called “banking”. Credit, money transfers, bill payment and other financial functions become available after you connect the program.

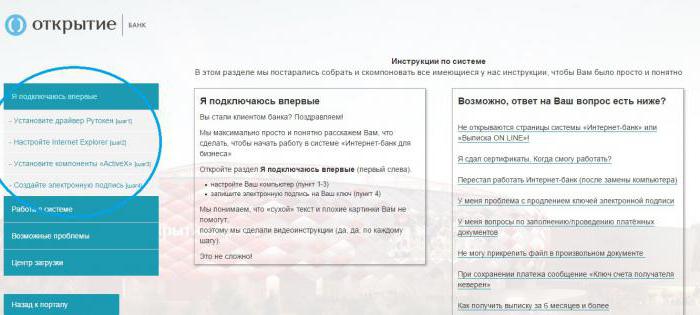

The Bank “Open”: “Client-Bank”

Here is an example connectivity system. As a sample we choose the Bank “Open”. To work with the program financial institutions must complete four steps:

- Install and run the specific driver "Rutoken”.

- Configure the Internet Explorer browser.

- To Install and connect the special components ActaveX.

- Come up with or implement an electronic signature.

All settings can be found on the official website of the Bank ic.openbank.ru. After all the above steps, you can register and login.

What is the purpose of “banking”?

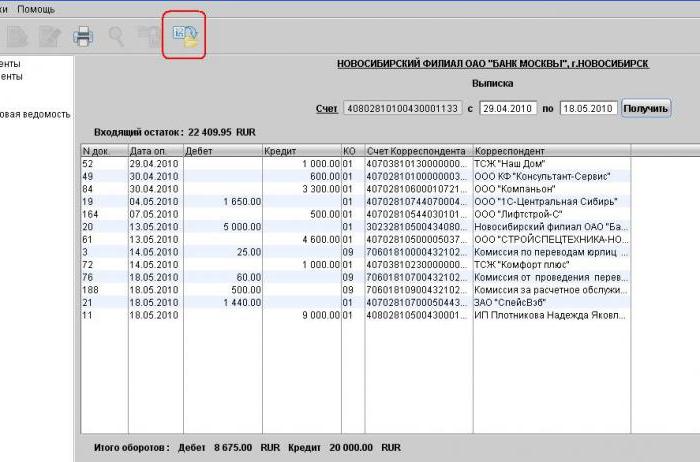

The Main function of the system “Client-Bank” (for legal entities this is a real find) - runpayments to businesses without personal visit to the financial institution. Moreover, this service allows you to track movements in the current accounts of the company. Typically, these duties are placed upon the shoulders of accountants. With the help of this service they are, for example, can learn about the transfer of funds from the customers of the enterprise. After the payment is processed, the organization has the right to ship the item.

In addition, the limits of the system managers of the company or their authorized people can get ready account statements, view the current exchange rate, to keep records of the applicable contractors. And by using “banking” you can always be aware of the most recent news, financial institutions, including the emergence of new products, lower interest on loans, increase interest rates on deposits and a variety of events.

What are the benefits of the program?

Among the main advantages of the software banks are the following:

- Easy to connect.

- Easy management (no need for extra training and skills).

- Ease of use (no need to visit a Bank branch).

- Control all movements on the accounts remotely.

- The Ability to create templates for executing payments.

- Receive the latest news about the Bank products.

- Providing information about current exchange rates (essential when performing exchange transactions).

- Ease of use of electronic document management.

And of course, the system is known for its efficiency. When using the Bank's clients, including legal entities, admire the high speed of payments. Moreover, all data is stored in a single electronic registry and does not require documentary evidence. Since the majority of documents is the electronic signature of the head of the organization, this equates to their real forms and eliminates the need for printing or scanning.

And finally, the system operates around the clock. This allows clients to monitor their accounts throughout the working day. Moreover, the system reliably protected. It controls actions using one-time passwords, and additional electronic keys.

Negative aspects of working with the program

Sometimes the system may occur an unpleasant situation. In particular, most of them connected with uncoordinated actions of the leaders of the company and the Bank. Particularly acute problem is felt when a system is purchased and installed independently. In this case, the Bank may act completely different software. In the end, they are not compatible, and the workflow is aborted.

Article in other languages:

AR: https://tostpost.com/ar/finance/6864-client-bank---what-is-that-system.html

BE: https://tostpost.com/be/f-nansy/12276-kl-ent-bank---geta-shto-za-s-stema.html

DE: https://tostpost.com/de/finanzen/12278-kunde-bank---was-ist-das-f-r-ein-system.html

ES: https://tostpost.com/es/finanzas/12285-el-cliente-banco-es-que-por-el-sistema.html

HI: https://tostpost.com/hi/finance/6871-client-bank---what-is-that-system.html

JA: https://tostpost.com/ja/finance/6869-client-bank---what-is-that-system.html

KK: https://tostpost.com/kk/arzhy/12279-klient-bank---b-l-zh-ye.html

PL: https://tostpost.com/pl/finanse/12270-klient-bank---co-to-za-system.html

PT: https://tostpost.com/pt/finan-as/12265-o-cliente-de-banco---que-para-o-sistema.html

TR: https://tostpost.com/tr/maliye/12281-m-teri-banka---bu-ne-sistemi.html

UK: https://tostpost.com/uk/f-nansi/12277-kl-nt-bank---ce-scho-za-sistema.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

If you study the subject of money, one of the most interesting aspects is the field of financing. Here you can learn about the many possibilities of the use of funds. We are in the framework of the article will consider mezzanine ...

Does insurance CTP MSC? What is MSC insurance?

Along with the joy of acquiring a car come new responsibilities. In particular, the need to insure the civil liability. Everyone knows that when accident damages are awarded by a company that sold the policy. The question arises, ...

RC "Gorizont", Tyumen: address, floor plans, deadlines, reviews. The New Tyumen

Now all over Russia actively conducted the construction of a beautiful modern residential complexes in which to live comfortably and pleasantly. Do not lag behind the overall performance and the new Tyumen. At the moment there are...

The right of ownership of legal entities: how is who is sent

a Legal entity, by definition, are created to be independent of market or public relations. Therefore, the right of ownership of legal entities legally separated from the rights of ownership of individuals. Creating a commercial o...

If you have the deed to the apartment, the tax is paid not in all cases!

the Legislation takes into account the nuances of different cases of transfer of immovable property. Accordingly, the taxes paid also to the type of transaction. If you are in the moment executed the deed to the apartment, the tax...

The card top Arrow: popular ways

Map for “Arrow” issued for the payment to travel in the capital. It is very convenient because it allows you to quickly calculate. With its help, controlled the flow of funds for travel. The cardholders have the possib...

Comments (0)

This article has no comment, be the first!