The application for refund of income tax for the cure: sample and example

Is not the first year working on the white salary, the taxpayer has a legal right to a return or a social tax deduction. Regulates their 219-I article of the tax code. Social deduction is made at the local branch of Federal tax by filing a Declaration.

To Return these taxes to the state can be for:

- Paid training or their own children;

- Co-financing of future pensions;

- Contributions that went to charity;

- Paid expensive treatment or purchase medicine.

Return can be made either through a tax or through an employer. The documents in this case is a bit different, but the main statement remains. What is the application for a refund of income tax for the treatment? Sample guidelines present in the article.

What costs are refundable?

The Taxpayer receives the right to return personal income tax, if there is costs

- Treatment (or its close relative), including dental services;

- Medications (and only those listed by the Government of the Russian Federation);

- Diagnostic procedures or medical consultation;

- Treatment Spa directions excluding accommodation and meals (form of request for refund of income tax for the treatment, see below).

Social deduction will be approved if you paid for medical services or medicines on their own treatment and to the treatment of parents, spouse and children up to 17 years, inclusive.

Documents

For conversion to the IRS, you need to prepare:

- Declaration under the form 3-NDFL;

- Application for refund of income tax for the treatment (sample provided below);

- Certificate attested by the chief accountant, under the form 2-NDFL (it discharged the tax deduction for the year);

- Documents proving the kinship (if the deduction is made not for himself);

- Documents from the medical institution or pharmacy to prove the amount of expenses.

What are the deadlines to apply?

Application for refund of income tax for the treatment (sample and entering the data given in the article) is served in the next year, the year of medical services or buy medicines. Specific deadlines are not set by law.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

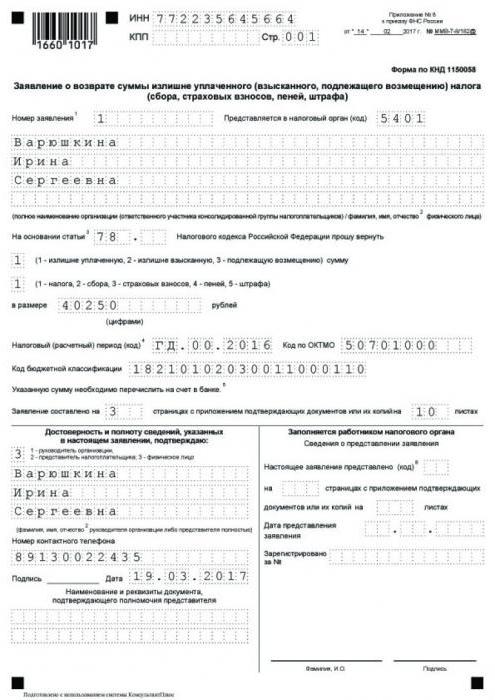

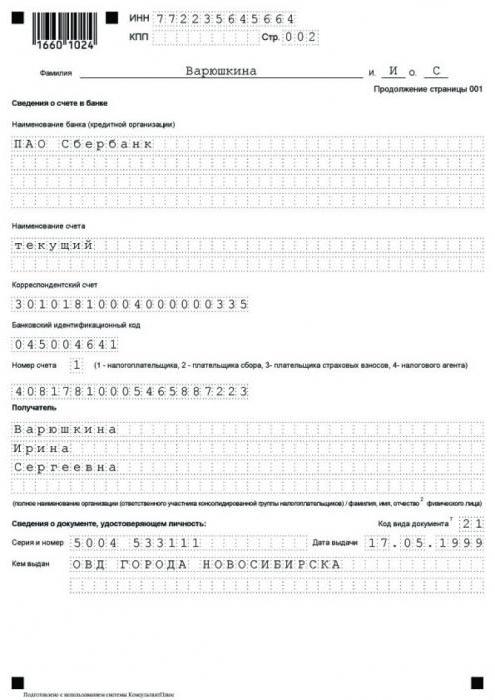

This year adopted a new form application form for refund of income tax for the treatment. Sample:

It was approved by the order MMV-7-8/182@ 14.02.2017. Form on KND 1150058.

Accepted form filled by hand or typed on computer. Examines the documents submitted 3 months and in case of approval, during a calendar month are listed on the money specified in the application details.

Social deduction for a visit to the dentist

Legally set limit on the cost of medical procedures at the dentist: 120 000 rubles. That is, in other words 13% of the limit amount will be the maximum social benefit - 15 600 roubles (How to fill out an application for a refund of income tax for treatment see above).

The Services provided to relatives are aggregated, and the tax return is filed with the totals. Also note that this tax deduction cannot be greater than the amount of income tax withheld during the year.

Another important caveat is the concept of “expensive treatment”. There is a list of these services. And if helping the dentist gets under it, the refund will be made with the full amount of the services (even if it is much more than 120, 000).

Prepare deduction

The Documents you will need the following:

- Tax returns are filed on form 3-NDFL;

- A certificate signed by the chief accountant on the income for the preceding calendar year;

- Passport and copy of the first page + check;

- Application for refund of personal income tax for dental treatment (the sample is presented in the article);

- A copy of the contract for medical services, dental office and the hospital;

- Copies and originals of checks for services rendered.

In conclusion

To Write the application in any form, but it is better to use a special application form for refund of income tax for the treatment (sample posted above).

Download the form on the official portal of the Tax service of the Russian Federation or any other. It is public and free.

Documents can bring personally to the tax authority, you can send a registered letter with a notice in the mail. Have the ability to transmit documents with the attorney, do not forget to attach a notarized power of attorney. Appeared legislated ability to apply for a social deduction by the employer.

If a taxpayer has a personal account on the portal nalog.ru then a refund can be issued here (but it is necessary to authenticate a document, WCAP).

Article in other languages:

KK: https://tostpost.com/kk/arzhy/11547-aytaru-a-t-n-sh-ndfl-emdeu-lg-s-zh-ne-toltyru-mysaly.html

TR: https://tostpost.com/tr/maliye/11548-a-klama-iadesi-pit-tedavi-rnek-ve-rnek-doldurma.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Mission possible: how to get loans with bad credit history?

One day, have compromised themselves, it is difficult to continue to interact with banks. When there is a need to take loans with bad credit history, efforts will have to make significantly more than the presence of positive exper...

The functions and risks of the acquiring Bank

Contactless payments over the last years strongly rooted in the lives of Russians. The technology allows users that have no paper bills, to make purchases. We consider in detail the process of acquiring and all participants of thi...

How to calculate the cost of production in the enterprise

Calculation of cost of production and the cost of services is a necessary attribute for any company in the analytical reports.One of the most important indicators of the correct calculation which aff...

Quickly where to get a credit card without income certificate?

Credit card today is a versatile tool that quickly and easily allows you to solve many financial issues. Every day non-cash payments are becoming increasingly popular. Many banks have decided to do everything possible in order to ...

Credit Bank of Moscow: the opinion of a professional

Credit Bank of Moscow, a review of which can be left on the main website of the company at the moment is one of the largest financial institutions of the Russian Federation. The financial market of the country, the Bank came almos...

Balance is the difference between income and expenses

Almost everyone has heard about such terms as balance. What it is, of course, known to all accountants and economists. But for most ordinary people the word is synonymous only with the concept of "difference". A term that is famil...

Comments (0)

This article has no comment, be the first!