Now - 16:58:47

What is the key rate of the Bank? The key rate of the Central Bank of the Russian Federation

Considering that this key rate will be logical to note that this concept is a relatively new tool of monetary policy in Russia. The practice of applying this tool in the West very common, because it can have a significant impact on the national currency. If to consider specificity of economy of the Russian Federation, and the key rate has a profound influence on the situation in the country.

A Bit of history and the actual situation

In Studying the question of what the key rate, it should be said that this is the price that is used in the provision of Central Bank financial support to commercial financial institutions. The rate is expressed as interest accrued on the loan to the Bank smaller financial institutions. In Russia, the concept appeared only in 2013. The main purpose of introducing this instrument – controlling the process of inflation. Until 2013 it was decided to use for this purpose the refinancing rate. Modernization of financial policy was carried out due to the fact that the refinancing rate has ceased to reflect the real situation on the market resources. The Central Bank determines what parameters will correspond to the key rate. The refinancing rate, the differences of which from the COP is essential, also formed of the Central Bank. The revaluation of the COP on a monthly basis (based on the actual situation on the market).

How to change the rate over time?

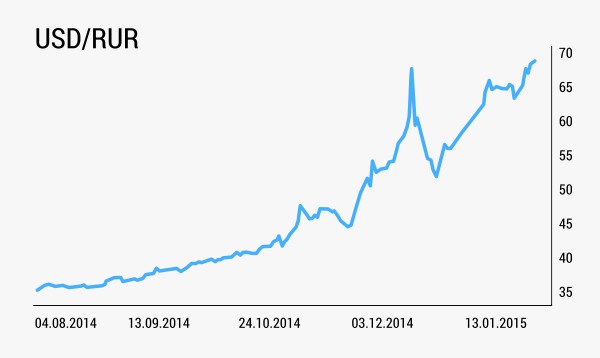

In the past year have changed the setting many times. Initially, the reading was in line with the 5.5%. In the period from March to June 2014, he was repeatedly varied: 7%, 7.5% and 8%. At the end of October 2014, the amount the COP reached 9.5%. On December 12, 2014, in connection with the sharp rise of the dollar, the Board of Directors of the Bank of Russia converged at rate of 10.5%. Due to the fact that the rate change did not bring the expected result and impact in the expected volume on the market was rendered on the 16th day of the same month the rate has already started to reach 17%. 2 Feb 2015 it was reduced to 15%. At the last meeting, which was held on March 16 this year, it was decided to set the rate at 14%.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

What happened before?

The Key rate of the Bank of Russia is an analogue of the refinancing rate. Today CP is used to calculate penalties, fines and taxes. She has long been at the rate of 8.25%. If previously, she served as the starting point for determining interest on loans, today it is this function not execute. Until September 13, 2013, CP has been considered an important economic indicator that reflects the economic processes in Russia. A secondary objective of the SR remains today. It is used as a benchmark indicator for the analysis of inflation and the market in General. The key rate of the Central Bank of the Russian Federation – is a tool that almost completely replaced the CP as an indicator of the economic situation.

The Impact of KS on the situation in the country

Changing to the COP, the Russian government can control inflation. The increase in the key rate leads to the fact that there is a rise in price of resources of commercial financial institutions, there is a sharp increase in interest on deposits and loans. High interest rates make loans unaffordable for most. The reduction of resources led to a sharp drop in the purchasing ability. The pressure on the ruble significantly reduced, the inflation is suspended. If the country slows the economy due to a reduction of production, then there is such a thing as deflation. The Council of the Bank of Russia decides to raise the key rate, and lowering it. Credit becomes more available, it starts lending to the real sector of the economy. The situation is aligned.

Tool

In Studying the question of what is the key rate, it is necessary to say about the absence of the instrument in the legislation of Russia. It remains the refinancing rate, though its role is in fact very insignificant. Everything is limited to a calculation of sanctions, fines and taxes. By the end of 2015, the COP should completely replace CP. The main advantage of using this tool is that it can be used to adjust the level of inflation, therefore, to have a very positive impact on the improvement of the economy of the state. Traders around the world are closely monitoring the COP of major market participants (America, Switzerland, Japan, Canada, etc.). Ahead of the announcement of the bet in the market you can see the most volatility. If the rate changes, there is a significant leap. The key rate of the Central Bank of the Russian Federation – is a financial instrument that is not without flaws. It is necessary to tell about its inertness and low effectiveness in the conditions of crisis. With a sharp deterioration of the economic situation, especially if the impact on the state is to external factors, the rate change does not have time to harmonize the situation, and negative effects effects are manifested.

Alternatives and perspectives

In Considering what the key rate, it should be said that in a crisis, its better to replace command-administrative measures. It may be freezing in the course of state regulation of prices on the market. Can also tightened standards in the financial markets. If we consider the situation on the example of Russia, it becomes obvious that the rate increase to 17 percent did not bring the expected result not only because of the impending devaluation of the ruble, but because of the sanctions from the West. Fundamental change in the indicator due to its little effectiveness, it was soon reduced, first to 15% and then to 14%. At the present moment, the Central Bank has no reason for further raising the stakes. This decision can only lead to higher prices of banking products, which are still inaccessible to the majority of the population. If you consider that Russia is now struggling to provide financing to the real economy, we can talk about further lowering the COP.

Latest news for KC and the changes in tax legislation

The Key rate of the Bank of Russia – this “secret weapon” Central Bank, which was introduced in the monetary policy in order to improve its transparency. The last critical increase to 17% was recorded in the beginning of 2015. In the end, the commercial financial institutions began to actively raise rates not only on loans but also on deposits. Thus, in accordance with the law, the interest on ruble deposits, which is higher than CP by 5 percentage points, should be taxed (personal income tax). If we consider that the CP after the increase of the COP remains the same, the contribution to yield more of 13.25% (which was the majority) were subject to tax. Previously, the number of Deposit programs with more yield of 13.25% was minimal, today they are the majority. Almost all people who have deposits came under the personal income tax.

Workaround for inconsistencies

As a result of legislative inconsistencies depositors had to pay about 35% tax on excess profits. As a result of such developments, it was decided to make amendments in the tax legislation. A surcharge of 5 percentage points was changed to plus 10 percentage points. Ruble deposits with a yield of 18.25% is not subject to the taxation system. The adopted exemption – this is a temporary solution, the validity of which will expire on 31 December 2015. It is planned to reduce the level of the refinancing rate and the key rate to the same value.

What can tell the COP?

As mentioned above, KS – the status indicator of the Russian economy. And studying the question of what is the key rate of the Bank, you need to pay attention to the presence of correspondences between the size of the measure and the state of Affairs in the country. At low interest rate, you can say that the ruble is very weak and the rate of the national currency too low. High interest rate indicates a decline in the rate of economic development of the state in the near future. The amount of money in circulation begins to decline, and the rate of the national currency increases. If you consider that after the winter rate hike in Russia's ruble slowed its fall, it is now rational to say that the next reduction of the COP can lead to the stabilization of the situation and the depreciation of the dollar. The domestic economy will develop rapidly, and the solution to all the problems the state found in the answer to the question about what is the key rate of the Bank for the country.

Article in other languages:

KK: https://tostpost.com/kk/arzhy/25787-b-l-neg-zg-m-lsherlemes-bankt-klyuchevaya-stavka-rf.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Insurance company of Yaroslavl: description, addresses, reviews

Yaroslavl – the third largest city in the Central Russia and the administrative center of Yaroslavl region. The city is a major transportation hub: it diverge roads and Railways in the direction of Vologda, Kostroma, Moscow,...

The currency of Austria: history, characteristics, course and interesting facts

Austria is an active member of the European Union, therefore, became one of the first countries that adopted national currency to the Euro.brief historyCurrency of Austria put into circulation on March 1, 1925 and was the official...

How to verify the debt before you travel abroad and stay at home

Daily abroad leaves a huge number of Russians. The goals are different: excursions, trips, visits to relatives. Amid tougher in recent years measures to recover debts by bailiffs many of traveling are concerned about how to verify...

Fuckbet: reviews about the site with sports predictions. How not to fall for the bait swindlers?

Everyone knows that sports predictions, betting and sweepstakes are a separate business with a huge turnover, which has been thriving for many years. The only thing in this segment has changed – approach. In recent years, su...

International securities in the system of a modern integrated banking structures

Many international financial markets and international financial institutions represented today in the global economic complex of great diversity of types of actors. This often causes difficulties in the accurate determination of ...

equity in the balance sheet reflects the receipt of such funds, as the contributions of shareholders, the additional capital and profit. Its size can constantly change. At the initial stage, when the firm is formed, it has a singl...

Comments (0)

This article has no comment, be the first!