Now - 00:19:41

What is the tax when selling a car less than 3 years

The Tax on the sale of the car less than 3 years of age is a common and legitimate cause. Citizens have long been accustomed to that in the tax system of the Russian Federation has many features. About them, but in respect of transactions of purchase and sale of transport, and we'll talk. It is always wondering what should I prepare. It may be better to wait some time to make a deal in the later period? Of course, everyone decides for himself. But a few tips to give worth. They will explain to you, what is the tax when selling a car less than 3 years on, do I need to pay the fee, at what time we should meet, and whether to avoid the possibility thereof.

Always do

The First thing of interest to citizens - for example, whether you have to pay some fees to the state Treasury by buying and selling anything. Reply here, thankfully, not exactly - no. There are some cases when people have the possibility of prevarication from these penalties. Unfortunately, our situation any relationships they have.

The Thing is that the tax is not paid for the property was received as a gift from relatives. Anyway, that's the car or the apartment. In addition, speaking about the transactions, do not need to Deposit money in the state Treasury if you sell property that is you have more than 3 years. Up to this point will have to pay. However, different amounts. It all depends on specific situations. That is, in some cases you will pay more, sometime less. But to get rid of such payment as a tax when selling a car less than 3 years, no way. This rule is spelled out in the law. Failure leads to justice and problems with the tax authorities.

Taxes

How to avoid problems? Just enough to pay off all debts to the state. And after you can sleep peacefully. As strange as it may sound, but will have to sell cars to pay to the state Treasury at least two contributions mandatory. What are you talking about?

For Example, there is the vehicle tax. When selling a car it needs to be paid, because you some time in the tax reporting period, we disposed of the assets. There are a number of limitations for exemption from this payment in principle. But it appears not so often in practice.

That's not all. What are the taxes when selling a car will be based on if the property was you have less than 3 years? As we have seen, the first payment vehicle. And the second income. It's paid by taxpayers for profit. Again, this rule does not apply to those who sell a car after owning her for more than 36 months. Now on each "installment" in detail.

Income tax

Well, let's start with the most important. What tax is imposed on the sale of a car, and indeed, any similar property deal? Of course, income. Or, as it is called, is income tax.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

Apply the rule to individuals and organizations. Besides, no matter the country you are resident or not. Income tax paid by all. But in different sizes. It all depends on several factors. First, the type of taxpayer (ordinary citizens pay less than the company), and secondly, from citizenship. According to modern laws, if you are a foreign national-resident, the fee per transaction is almost 2 times higher. Such rule applies on the sale.

How to pay

The Amount of tax on the sale of the vehicle in a fixed amount cannot be established. That is all very individual. It is impossible to say how many citizens will be paying the tax authorities. Except that you can make your own calculations for each period and event.

Income tax is charged at fixed percentage from your profits. But, it is not difficult to guess, income on the sale of real estate is always different. So, the tax on the sale of the car less than 3 years will vary.

However it is precisely known that you will hold the state 13 % of your profit. It is this rule true for individuals. In this the amount of income tax. From the specified rates and should be repelled. However, it is important to consider the cost of transport. It is customary to proceed from the cadastral value. But the tax authorities believe that you should begin from the market price. This is the eternal question that very few people care. After all, the citizens pay income tax from the amount received in the sale of transport.

Non-Residents and companies

What's next? What if you are selling a car to the physical person? Taxes, as we have seen, pay 13% of the transaction amount. In principle, nothing difficult about it. How, then, is the situation with non-residents and companies?

They will also pay income taxes. But in the other dimensions. For example, organizations are charged a standard 20 % of profits, and non-residents - 30 %. Such rules are established for income tax in Russia. That is, the higher the amount stated in the contract, the more you have to pay. Therefore, most of the cars are only individuals. It is more profitable.

Vehicle tax

But the tax on transport is far more interesting. After all, it is regional. This means that in every city these payments to the state Treasury will be different. A lot depends on engine power, the number of months of ownership and, of course, tax rates.

Calculations of this contribution is simple to madness. Simply pay attention to a few formulas. More precisely, it is only one, but, depending on the situation changing. Enough horsepower multiplied by the tax rate established in your area and you will get the tax amount per vehicle.

If the car is owned for less than 1 year, the resulting figures are multiplied by the quotient of the number of months of tenure 12. Luxury cars also have their own characteristics. By the way, we are talking about transportation (cars), which on average is worth 3 million rubles. Then there is the multiplying factor. In the possession of transport for more than 12 months coefficient multiplied by the horsepower in the engine and on the tax rate set by the state. And when you are less than a year when the first car, you need the second formula to multiply by the coefficient. Actually anything difficult in this process.

Terms and procedure

There was a car sale by an individual. Taxes in this case, as we found out, will have to pay. Indeed, in our case, the transport was owned for less than 3 years. The exact amount already counted, what's next?

Now you need to understand the payment procedure and terms the payment is made. Usually citizens are allowed to pay up to 15 July of the year following the transaction. But the report will have to be done earlier - by the end of the tax reporting period, i.e. until 30 April each year. Most often, it is to this date is the payment of all taxes. This technique is called the down payment. It is made optionally, for the convenience of the citizens.

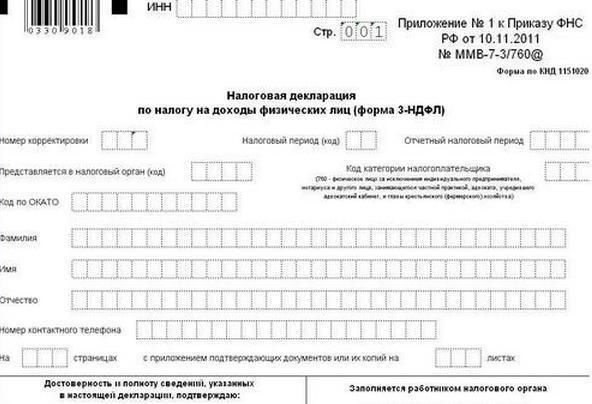

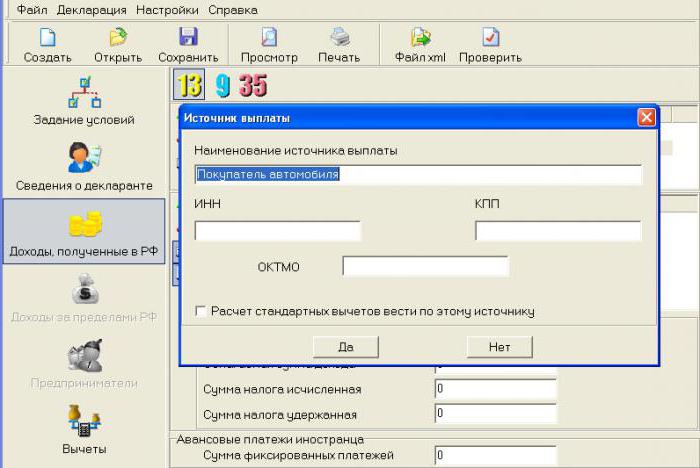

When making sales of cars less than 3 years, you need to provide to the tax a special report. It's called 3-pit. Is filled very easily. Especially if there are no costs for the deal you had.

Documents report

What tax is imposed on the sale of a car, we have already found. What's next? Now, you must know which documents will be useful for the report. After all, the Declaration is an important point in the question of payments to the state Treasury.

Should not be Afraid. You need to prepare basically just help 3-pit. This is the main source of income Declaration of natural persons. to Fill it is not difficult. For this you will need the following documents (of their filing is also better to show):

- Information about the buyer (name, date of birth, specified as a funding source);

- Your passport;

- TCP and the technical passport of the car;

- The contract of sale;

- Certificate of ownership;

- SNILS and INN (seller);

- Inquiries about the costs (if any, for deduction).

That's all. With a simple electronic program Declaration form and attached documents (or rather, their copies), and further reports are submitted to your tax office. Nothing difficult or special. Don't forget about the time frame in which you want to meet. Preferably along with submission of the Declaration to draw back and pay all taxes. Including transport. By the way, it is usually paid before 1 December. Tax after the vehicle is paid income and pre - transport. It is better to pay off your debt before the state.

Calculation of base

Also a very interesting point in the question of income tax is the calculation of the so-called base. It is the main source of our current payment. The smaller the base, the lower the tax.

In General, if there is a sale of a vehicle is usually meant by this is that base is the amount of the transaction. This is the standard scenario. In some situations a car involves some costs. Then the base is calculated according to the principle: income minus expenses. And the costs can be covered with the completion of the related deduction when filing 3-pit.

Loss

Rarely, but sometimes it turns out so that the car is sold at a loss. For example, was bought for 600 000 rubles, and now sold for 500 000. It is obvious that the seller do not receive any income. Oddly enough, from tax completely, this fact does not exempt.

Nevertheless, to be afraid is not necessary. To pay you still will not. But the Declaration submitted to the tax authorities have to. It is mandatory to attach in such a situation, documents about your expenses, and this contract of purchase and sale. It is not so difficult.

By the way, the tax on the sale of the car less than 3 years are not charged when the transaction amount does not exceed 250 000 rubles. However, statements still must be provided to the tax authorities. As you can see, the amount of tax on the sale of the car is not constant. But to calculate it you can always. If you do not handle yourself, contact the so-called calculators. They online will allow the source data to give you the amount, due for payment. Income tax on the sale of the car, as you can see, you will be charged almost always. Rareexception. Citizens are advised to delay registration of the transaction with real estate and transport, to be free from additional costs.

Article in other languages:

AR: https://tostpost.com/ar/finance/3481-what-is-the-tax-when-selling-a-car-less-than-3-years.html

BE: https://tostpost.com/be/f-nansy/6137-yak-padatak-pry-prodazhy-a-tamab-lya-mensh-za-3-gado.html

ES: https://tostpost.com/es/finanzas/6143-un-impuesto-a-la-venta-de-un-coche-de-menos-de-3-a-os.html

HI: https://tostpost.com/hi/finance/3483-what-is-the-tax-when-selling-a-car-less-than-3-years.html

JA: https://tostpost.com/ja/finance/3482-what-is-the-tax-when-selling-a-car-less-than-3-years.html

KK: https://tostpost.com/kk/arzhy/6140-eger-avtok-l-kt-satu-kez-nde-kem-nde-3-zhyl.html

PL: https://tostpost.com/pl/finanse/6142-jaki-podatek-przy-sprzeda-y-pojazdu-poni-ej-3-lat.html

TR: https://tostpost.com/tr/maliye/6144-hangi-vergi-ara-sat-nda-en-az-3-y-l.html

UK: https://tostpost.com/uk/f-nansi/6141-yakiy-podatok-pri-prodazhu-avtomob-lya-menshe-3-rok-v.html

ZH: https://tostpost.com/zh/finance/3775-what-is-the-tax-when-selling-a-car-less-than-3-years.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

LCD "sail" (Krasnodar), construction company "Yug"

Krasnodar, which is the unofficial southern capital of Russia, is in the top three (after Moscow and St.-Petersburg) in the volume of new real estate. Here new housing complexes put in operation annually. Great interest among pote...

the leadership of the Russian Central Bank is developing and it is difficult to forecast, however, it is shown that the control scheme for the system of monetary circulation and credit resursov. The above structure is positioned a...

Forex – so-called international currency market. That is, the interbank market, which perform current conversion operations. Forex was formed in 1971. This is the year all the world's countries and States have moved the issu...

In this article we will be interested in road taxes. In Kazakhstan and other regions, he came for a long time. And still bothers many citizens. After all, late payment of all possible charges and taxes entails certain consequences...

How to sell a share in the apartment in accordance with the law

How to sell a share in the apartment? This question is primarily interested in those who own real estate together with other owners. And it occurs when you need to increase your living space. As with minimal losses to arrange a de...

The revenue officials. Declared income

Revenue officials have always been interested in ordinary people who are curious how the MP car worth over 10 million rubles, given that his salary is only 50 thousand.This at a time when ordinary people working in the public sect...

Comments (0)

This article has no comment, be the first!