How to put stop loss and take profit? Take profit and stop loss - what is it?

Questions about take profit and stop loss: "What is it? How do you identify them?" – affect each and every trader, so only professionals and novices refer to this in different ways. For the first characteristic of honing their own strategy to the ideal. And the second are theory quick jumping from one trade to another, often without paying due attention to the constraints of the transaction.

Limitation of loss and profit

The Main issue arising from the trader after opening the transaction? about how to determine the values of stop orders below:

- Profit is maximum;

- Loss turned out the smallest.

Every newbie interested in the concepts of take profit and stop loss. What are these terms and what purpose are they used? It stops, without which successful trading is impossible. When the transaction is closed automatically, and this happens according to pre-set the price values.

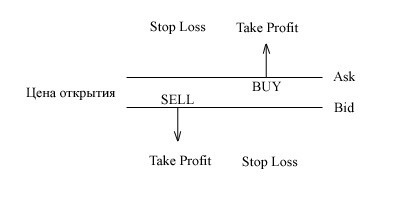

Take profit - the level of fixation benefits. That is, the first method of analysis, the trader determines the value which will reach the price. And puts take profit at the level of getting profit from the market.

A Stop loss is designed to limit losses. Is used to preserve capital in case of unsuccessful transaction. This means that a trader obviously determines the admissible level of losses and puts it on the limiter.

Stop loss for profit

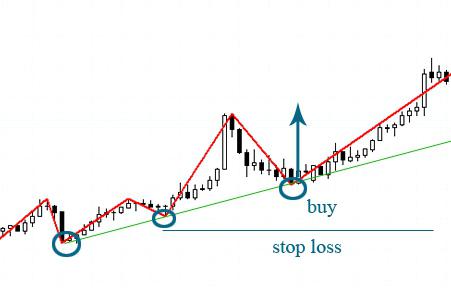

In each rule there are exceptions, this also applies to Forex. Stop-loss and take-profit – instruments, of which the need to always extract the maximum benefit. For anybody not a secret that the most successful transactions are made on the trend reversal. If you see that the direction will persist for some time, then close the warrant is impractical.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

In this case you need to move the stop loss with the trend. The result is to lock in profits. That is the price in any case will turn around and go down, but the dealer will still win. Though not so large as planned in the analysis. This method shows how to put stop loss and take profit to use them for profit.

This is optional to do it manually. Sufficient to establish an available in the terminal trailing stop. When it is activated automatically following the stop-loss behind the price. To do this, open the order, right-click to open the context menu, then "trailing stop" and find the desired value. The lower the level of those offered by the system – 15 points.

Margin call as a stop loss

Merchants with significant experience in the market can stick to the aggressive style of work. As stop-loss by using the margin call. When this transaction is opened with a large lot.

If the price turns in the opposite direction to planned, expected large losses. They are limited to margin call. In the case of a correct forecast and profit of 10-20 points is an increase in the Deposit of 6-15%. When triggered a margin call, losses are 10-15%. That is why the method does not need to apply for beginners. It is understood and acceptable to experienced merchants involved in the scalping and as.

Issues traders

Traders are confronted daily with such problems:

- Price does not reach the limiter profits.

- Trend interrupts him and continues the movement (loss of income).

- The Price are often affected by stop loss.

- Permanent losses.

That is, placing stop-loss and take-profit – it is an integral part of any trader. Merchants have to constantly improve their skills by working on fixing these problems and their prevention.

Stop loss and take profit are chosen depending on various factors

The Correct definition of the constraints depends on the strategy. But also within the same trading method, the placing of stop loss and take profit may vary. Every trader deals with the gradual creation of a reasonable only for his strategy.

Beginners, first of all, learn the fixed stop-loss and take-profit. What is it? In fact, nothing complicated. Limiters are exhibited at the specified distance from the price of sale or purchase regardless of the situation and asset. At 100 p. (TP) p. 50 (stop loss) the objective is to capture part of the movement. This method does not imply the definition of a trend potential. Method has proven itself in practice as the most suitable for novice traders.

Guided by the Fibonacci levels, time zones, round numbers and other ways you can define stop loss and take profit. What it is, not the correctness of actions, strategies and market situation? You need to understand that the point here is not how these values are exhibited. And the correctness of the method.

Previous minimum (maximum)

If the stop loss is placed at previous low or high, then the objective is to prevent a false alarm. It happens that the stop loss is placed at a distance of 50 points (fixed). It is constantly straying a price, but then the trend reverses and againearlier moves in the predicted direction. So it turns out that by predicting the correct direction of movement the trader suffers a loss. It's very frustrating, as it would seem, to correctly determine the take profit and stop loss.

"What is the obstacle and how to deal with it?" – a question which has always troubled the merchants. The solution is to all the time move your stop loss behind the price formed new lows and highs. The result is the closing of the transaction on the limiters, but in any case, in a positive way.

Take profit when rebound and the breakdown

Guided by the lines of support and resistance, you can successfully open the transaction and take profit should be placed at any of two ways:

- If the price bounces from the trend lines. When the transaction opens when hitting graphics from support level, stop-loss is for her. This helps to protect yourself in the event of a possible breakout of the price trend line. The same applies to resistance level.

- At the break of the trend lines. If the transaction is opened at the break through the support level, stop loss is required to place the resistance line and Vice versa.

Convenient Than a trailing stop?

Not to monitor the market continuously, moving stop losses, you can apply a trailing stop. Its value remains constant, as it is placed at a certain distance from the profits and moves the price in accordance with this indicator. That is, it means the profit by increasing prices by 35 or 50 points. At the turn chart trader remains by far the closes in profit or break even transaction.

Trading in high volatile pairs requires the use of an advanced form of trailing stop. In such programs, its value is moved after the price specified by the trader the number of points, for example, every 50.

How to determine take profit and stop loss?

The Quality of work depends not only on the correctness of the tools, and the nature of the trader. Therefore, only depending on personal preference you need to choose a system that determines the take profit and stop loss. What does it mean? The selected constraints are calculated depending on the strategy. This system works all traders differ from each other.

Do Not ignore the stop loss, hoping that out manually to close the deal on time. In cases of increasing minus a novice trader can expect a reversal of the chart or put that to use this order optional. After all, what if the deal closes, and the price again will unfold in the right direction. After repeated loss of Deposit attitudes are changing. And to avoid internal divisions, the stop loss should be used.

How to set stop loss and take profit, suggest tips:

- The Limiters you want to apply always.

- The Ratio of stop loss and take profit to each other should not be less than 1:2, preferably 1:3. That is, when the location of the stop loss distance 50 pips from the value of the purchase price take profit must be equal to 100 points, at least.

These orders close the contract once the price reaches a certain level. It does not matter whether the work computer.

Stop-loss

There are several ways of determining stop loss. One of them is to identify the lows and highs on a chart of price change. And for that you need to build a trend. For an uptrend the graph opens a deal to buy, for these conditions, the point of minimum. While the trend should be guided by the highs. Then, if the greatest width of the channel is 30 pips, then the stop-loss is the same.

You can Also follow the trend lines. In this case, the transaction for the purchase of stop loss is placed at a distance of 10 points from the support line.

You Can set the limiters depending on types of currency:

- GBP – 30–35 p.

- CHF – 30–35 p.

- EUR – 25–30 p.

In this case the volatility of currency pairs. Should be based on the daily indicator and place stop-loss at a distance of 30% from the value. If EUR/JPY volatility is 60 pips, then stop loss is 20 pips. This method is acceptable for time intervals of at least 4 hours.

If the price is moving in the right direction, then the resulting profit should be fixed. To do this, the stop loss is moved closer to the current price value. Therefore, the new point of its installation during an uptrend you should choose the closest to the current price at least.

Define TP

The Greatest value of the function is evident in the instant cases, touch price proper level. When she is not delayed at this value, but only one-time hits, the trader is not physically able to respond. Science must learn, so how to put StopLoss and take profit-is an art, and the result really is worth the effort.

You Should always consider that the take profit must exceed the stop loss of the same transaction. That is, when the same number of successful andunprofitable orders should be profit.

Tips for take profit:

- It is best to put the limiter arrived before the anticipated reversal of the trend, using in the calculation of built price channel.

- For upward movement using the backward design approach. You need to set take profit at the point indicative of the maximum before the new rollback.

- By analogy with a stop-loss take-profit can be set based on the volatility of the currency pair. But you need to correctly predict the trend movement.

How to place orders automatically?

To facilitate the installation of restrictors there is an indicator. Stop loss and take profit are determined when opening a position system, which greatly facilitates the work. This method is very convenient, especially on specialized sites for download, there are a number of free programs.

To set the automatic stop loss and take profit, you can use the Advisor. After installing the program, the graph shows two bands: blue (TP), red (stop-loss). Special settings allow you to make the program work in accordance with the preferences of the trader.

In fact, placing constraints manually disciplinarum merchants, accustomed to the systematic work based on previously compiled a trading plan. The trader before opening a position to make a thorough analysis of the situation on the market.

If you learn how to set stop loss and take profit then you can increase the number of profitable trades. The correct placing of stop-loss and take-profit – the key to successful trading. I want to wish all traders a lot of orders closed right at the set take profit.

Article in other languages:

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Bank borrowings – life by instalments on beneficial terms

the credit System, which every year becomes more and more advanced, for many people has become a real salvation. With the advent of lending programs, many were able to become owners of their own property, to resolve the issue with...

The balance of the money market of Russia regulates the monetary system of the Russian Federation

Today the monetary system of any country consists of the following elements: monetary unit, money, scale of prices, emission system and state or credit machine. The monetary system of developed countries have their own distinctive...

Accounting of credits and loans

Every head of an enterprise of any organizational-legal form of facing periodic shortage of funds. For a production process is characterized by a temporary lack of available financial resources, the restoration is being financed b...

Correspondent account - it is something without which can not work banks

Correspondent account – it is a necessary requisite for transactions between credit institutions. The combination of these accounts is reflected in the banking account balance room 301 with further detail depending on the ty...

Map "Corn": how to spend points. "Corn": how to earn points on the card

«Smart» map "Corn" - means of payment which is issued free of charge in stores «Euronetwork». What are its advantages and how to use it, how to spend points "Corn" read the article.Why m...

Bank "Tavrichesky": problems. Bank "Taurian" (St. Petersburg): reviews

the Bank “Tauris” characterized by an average size of assets, low liquidity, large corporate credit portfolio. Since the beginning of 2015 went down a lot of the credit institution rating. The Bank “Tauris”...

Comments (0)

This article has no comment, be the first!