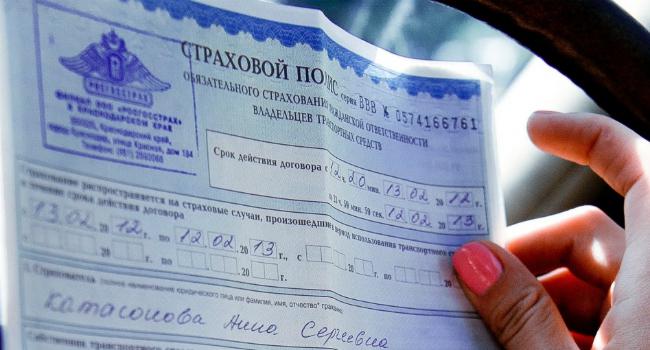

How to buy insurance without life insurance?

The recent increase in complaints of Russians on companies that sell policies of insurance. To buy insurance without life insurance is almost impossible. In addition, from October 2014, the Central Bank changed the rate, so insurers still refuse to sell pure insurance. How to be in such a situation?

The problem

On the Whole territory of Russia, there are 104 insurance companies that have a license to sell insurance. Do I need life insurance when you make this service? The law – no. However to buy a policy “wheels” it is impossible. Often employees refer to the lack of forms. This argument is immediately rejected in RSA: problems with the documents the insurer has no and can not be. Some companies do not issue a clean policy without an appointment, a place which lasts two or three months. As a way out of the situation offer to buy some insurance right away. The costs increase in 2-2,5 times. This situation does not satisfy many Russians. Although some agree to pay a few thousand, not to stand in line to receive the form.

Cause

The Reluctance about a thousand to give insurance without life insurance appeared out of the blue. This decision has pushed the losses incurred due to the spread of the law on consumer protection in the insurance market. Increase in the number of complaints of disgruntled customers in court. The profitability of companies fell sharply.

Financial results

According to the Russian Union of motor insurers, in 2014, 102 companies have collected premiums for insurance in the amount of 150 billion 292 million rubles, which is 11.2 % more than in 2013. During the same period, payments amounted to 88, 816 billion. A considerable role was played by increase of rates of the Central Bank. Since the 01.10.2014 the minimum cost of insurance policy is 2440 rubles, and maximum - 2574 rubles. While the amount of payments also increased: for property damage – 400 thousand rubles., for damages to life and health – 500 thousand rubles.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

Critical situation on the market

The RSA believe that the growth rates crossed the difficult economic situation. The increase in average payment will cause the company to leave the market. Many go with the highly loss-making ones of the regions because of high risk. In their place come the unscrupulous insurers. Avowedly do not feel much difference as you receive payments from the Fund. But if you disappear, RSA, the return showdown on the roads.

A payment under the contract in the same insurance period may occur in another. In this case, the company formed reserves. They are taken into account when determining the financial result, but not as a profit. Bona fide market participants are forced to compensate for the losses of bankrupt companies. In addition, the portion of premiums returned to the policyholder. Therefore, to calculate the financial result as a difference between award and payment, is incorrect.

Power on the client side

FAS joined the work. By the beginning of 2014, the organization received more than 700 complaints by 20 companies from 46 regions of the country, which impose life insurance. CTP is the hardest to buy “Rosgosstrakh”, the largest player in the market. In the Sverdlovsk region against the company has filed a criminal case for abuse of position, which is punishable by a fine in the range of 1-15 % from the fee for insurance. In 2012, this figure amounted to 1.6 billion rubles.

FAS also conducts explanatory work. All applicants to send a memo on how to deal with arbitrariness. In particular, one of the ways is the following: if the company refers to the absence of the forms, you must send a registered letter (no later than a month before the end of the policy) with the notification in which to present the request to sign a new contract. The insurer may not refuse.

Alternatives

In IDGC, you can buy a insurance policy without life insurance, but provided that the client has a copy of the passport of the owner of the vehicle. Under the law, for the design of the policy requires the following documents:

1. Statement on the conclusion of the contract.

2. Passport (for physical persons) or certificate of state registration of legal entities.

3. A driver's license.

4. Passport of the vehicle.

5. Diagnostic card, which confirms the completion of inspection.

Some companies for customers with a street reserved the morning hours. In particular, “thank you” you can buy insurance without life insurance, previously standing for under the Cabinet one day. According to customer reviews, one person served per hour. According to statistics, this procedure takes 30 minutes. This is enough time to paper to sign and cars to see. By law, the insurer has the right to do. Another issue is that at the request of the client, the inspection should be conducted at the place of his residence. Of course, you can buy insurance without life insurance and without a diagnostic card. But not everywhere. And it will cost 800-900 roubles is more expensive. Especially in companies scheduled for several months ahead. To speed up the process in a similar method – by purchasing several policies at once.

Why do I need life insurance

The product Itself is very useful. It gives some assurance that in the event of an accident, all expenses on treatment and health restoration will be paid by the insurance company. Here in Russia this service is strictly voluntary. Mandatory life insurance when insurance is not written in the same Federal law. So many claims of owners against the unlawful actions of the companies had a result. In addition to a positive decision, the Supreme arbitration court has imposed a fine on the violator in the amount of 50 thousand rubles. suffered “Rosgosstrakh”.

The Sanctions, the Central Bank

At the end of may 2015, the regulator imposed restrictions on the license issued by the “Rosgosstrakh”. The company was forbidden to conclude new contracts for insurance or change existing ones. The insurer must comply with the obligations of the earlier signed documents.

Despite the ban, the staff offer to come to the office for the conclusion of the contract CTP. Individuals can apply for a policy right on the website. The Central Bank explained the ban on mass violations by the company of the current legislation, in particular the refusal to charge customers a discount for break-even, the imposition of additional services.

What are the consequences of lack of insurance?

The Federal law “insurance” said the owner of the vehicle within 10 days from the date of purchase is obliged to insure its civil liability. Violation of this deadline faces a penalty of 8 thousand rubles. By the way, CTP with additional wrap is cheaper. Except that without the policy will reach only up to the first policeman, and the border crossing will not work. In the event of an accident to appeal all of the claims of the traffic police (in particular, about the lack of policy from the driver) will have a court. But better not to risk it and managed to learn how to make insurance non-life insurance.

Preparation

To Begin to address the issue of registration of the policy need not for a day or two before the end of the contract, and for a couple of months. As practice shows, the solution to the problem of “wheels” will cost several times more expensive.

To begin with you must schedule an appointment to apply in five or six companies at once - at different times. First contact your insurer from whom you received the previous policy. There is a small chance to make a new one without extra charge.

Then you have to prepare the vehicle for viewing. Although, according to the law, the issue of insurance non-life insurance is performed by the diagnostic map, which confirms the fact of inspection, many companies did not accept, requiring individual examination. They do have that right. So you have at least to wash cars.

In “day” to appear at the appointed time. Even if three fail, one someone let it be. High probability that no one at all to look at the car, and immediately discharged the net policy.

It is the cheapest, but at the same time, the long option.

The second Way – to postal service

The Statement of a registration policy it is possible to write not only in the branch of the insurance company. You can send it to a registered letter with acknowledgment of receipt to the address of the main office. In this way are advised to use FAS. After receiving the notification mail that the package is awarded, you can go to the office and sign contract. Then the staff just can't refer to the fact that the paper will be considered a month, or that “you are not in database".

How to purchase insurance without life insurance: the option for the extreme

No matter How many policies people at a time will not be issued, payment orders for each of them write out...

Article in other languages:

AR: https://tostpost.com/ar/finance/411-how-to-buy-insurance-without-life-insurance.html

BE: https://tostpost.com/be/f-nansy/682-yak-kup-c-osago-bez-strahavannya-zhyccya.html

DE: https://tostpost.com/de/finanzen/679-wie-kaufen-ctp-ohne-lebensversicherung.html

ES: https://tostpost.com/es/finanzas/684-c-mo-comprar-osago-sin-seguro-de-vida.html

HI: https://tostpost.com/hi/finance/411-how-to-buy-insurance-without-life-insurance.html

JA: https://tostpost.com/ja/finance/410-how-to-buy-insurance-without-life-insurance.html

KK: https://tostpost.com/kk/arzhy/682-alay-satyp-alu-osago-zho.html

PL: https://tostpost.com/pl/finanse/685-jak-kupi-oc-bez-ubezpieczenia-na-ycie.html

PT: https://tostpost.com/pt/finan-as/682-como-comprar-ctp-sem-o-seguro-de-vida.html

TR: https://tostpost.com/tr/maliye/688-nas-l-sat-n-al-n-r-ctp-olmadan-hayat-sigortas.html

UK: https://tostpost.com/uk/f-nansi/684-yak-kupiti-osago-bez-strahuvannya-zhittya.html

ZH: https://tostpost.com/zh/finance/481-how-to-buy-insurance-without-life-insurance.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

The concept and classification of fixed assets, their valuation.

In the production process along with the objects of labor are means of labour or, in other words, fixed assets. These include equipment, machinery, inventory (both economical and production) and other means of production through w...

Financial risks insurance in modern business

Almost every business faces challenges in the conduct of their business. As a rule, they are based on the risks that accompany the entrepreneur. Required special protective mechanisms that will effectively cope with their tasks. O...

How to withdraw money from webmoney

do you Often use e-wallet from the famous webmoney payment system? If you are on a Network or make any commercial transaction using the electronic wallet, sooner or later the question arises how to withdraw money from webmoney. Th...

Salary cards of VTB 24: design and benefits

In many loan organizations offer relevant today program for payroll customers. For example, one such product operates in a large Russian Bank VTB 24. How to open salary card of VTB 24, connect online banking, overdraft, and much m...

If you do not pay for the repair, what will happen? Mandatory repair of the house

Activities for the repair and maintenance of their apartments and houses, the Russians traditionally assume, only in extreme cases using the services of specialists. Such an attitude to the contents of their own homes is in contra...

Belarusian currency and stock exchange. Markets and auctions, the organization and tendering

a Private organization "Belarusian currency and stock exchange" started on 29 December 1998. It is an open joint-stock company, whose shareholders are the 124 individuals. It is engaged in the provision of services related to the ...

Comments (0)

This article has no comment, be the first!