Now - 16:23:57

"Pension-plus" - a contribution to the savings Bank. The conditions and interest rates

Sberbank is one of the largest financial institutions in Russia. His clients are not only representatives of business and individuals, but also ordinary Russians with average income. Despite the rather impressive on banking standards, the age, the Bank still has not lost its former popularity. On the contrary. His client base is regularly updated with new people. And all because in this credit institution is the financial products designed for different age groups, including elderly people. More recently, it has been developed for them new Deposit program “Pension-plus”. The contribution to the savings Bank as it can get retirees that meet certain criteria. Read more about the design and features of the program we describe below.

The Whole point of the program in a nutshell

“Pension-plus» - the contribution to the savings Bank, which is designed for citizens of retirement age. They must be registered in the Pension Fund of the Russian Federation or non-governmental organizations and to obtain appropriate financial assistance.

Thanks to this interesting program of the Bank its customers can count on additional income from his pension. And this for many is a great help, especially in the absence of other sources of income.

The savings Bank: contribution "Pension-plus" terms and rates

If you are interested in this investment, is not superfluous to learn more about the conditions of such a system of accumulation. To make such a Deposit really only three years. And it can be done exclusively in the national currency. And the minimum Deposit amount can start from 1 ruble.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

Contribution relates to renewable deposits with the possibility of extension and capitalization. It involves a partial withdrawal and the presence of non-combustible minimum balance of only 1 ruble. Accrual of interest occurs every 3 months. On such terms and a savings Bank. Rate of interest “Pension-plus” in this case, is 3.5% and taking into account the executed capitalization to 3.67% per annum. Moreover, interest may accrue and be added to the primary amount of the Deposit. In this case, there will be an increase in income in the following reporting periods.

What is the capitalization of the contribution?

Capitalization Deposit – additional interest on the initial amount of your Deposit. This service allows you to get more passive income by complex formulas of calculation of percent. It is interesting and profitable.

Where and how can I apply?

In order to make “Pension-plus” contribution to the savings Bank, you must visit one of the nearby offices. The only document you will need a passport and pension certificate. Then will only have to sign the Bank agreement and to Deposit any amount to open a savings account. Or apply for participation in the program using terminals and ATMs of the credit organization, as well as Internet banking «Sberbank».

How to calculate the amount of profit on the Deposit?

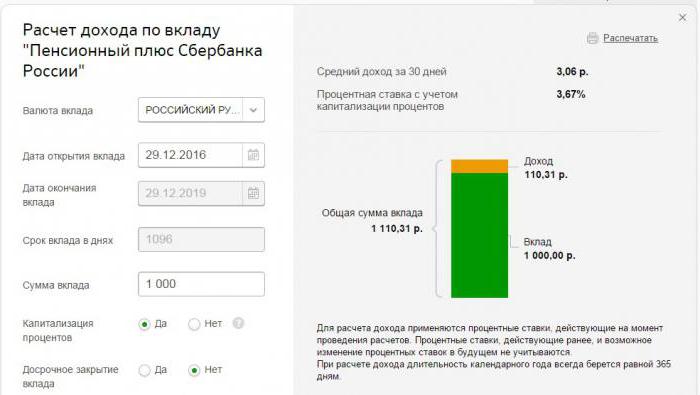

Before you call in the savings Bank (“Pension-plus» - the contribution, the interest on which is charged quarterly), you must perform the relevant calculations on the website of a financial institution. In particular, for this purpose, here has a virtual online calculator. In the absence of access to the network to calculate the remuneration on the Deposit will help the Bank's representatives.

For clarity, we present example calculations. So if you make a contribution 29.12.2016 in the amount of 1000 rubles, the completion date - 29.12.2019, which corresponds to 1096 days.

If there is interest capitalization, the absence of early withdrawal and regular replenishment contributions average monthly income will be 3.06 rubles. For all of the interest period amount of your profit will be equal to 110,31 RUB Them together with the main contributions and give the savings Bank. Contribution (piggy) “Pension-plus" allows you to get the benefit, the amount of which increases along with the increase of the amount of the basic contribution.

What information is specified in the contract?

Before making the Deposit, the retiree must sign an agreement of cooperation. It usually specifies the following information:

- The amount of the selected currency;

- Date of Deposit;

- Final closing date of the contribution;

- The size of the rate on the Deposit;

- Minimum amount of additional contributions paid in cash;

- The frequency of additional premiums;

- The amount of non-combustible residue;

- The order of compounding, etc.

Also in this document lists contact details and details of both parties, and sometimes Trustees of the pensioner. After reconciliation, both parties to the agreement sign the document.

Is it Possible to open a Deposit immediately for a few people?

The Program “Pension-plus" (contribution in Sberbank) does not allow the opening ofDeposit to multiple people at once. Allowed to proxy for other entities. thus the pensioner is still the main owner of the account. However, his trusted persons can access certain operations, e.g., receiving money on his behalf. In this case the power of attorney is issued free of charge directly to the Bank. The procedure does not require the presence of the person who retired trust management of a Deposit, but requires mandatory verification by the notary.

Are There any incentives for investors?

Participation in the program “Pension-plus” is favorable. In particular, the accrual of interest on the Deposit occurs at the highest possible value. However, this percentage does not depend on the initial amount of the investment.

Rollover contribution

Prolongation of this type of Deposit is expected. It is performed in automatic mode in accordance with the terms of the Deposit agreement.

How to withdraw the accrued interest?

The Accumulated Deposit interest added to the principal amount of the Deposit. But at the request of the client can remove them completely or partially at any Bank branch or via service «Sberbank».

Article in other languages:

BE: https://tostpost.com/be/f-nansy/13141-pens-yny-plyus---uklad-u-ashchadbanku-umovy-pracenty.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

And you know how to pay for the phone card of Sberbank?

Modern technology every day are making life of ordinary people easier and easier. Many things can be done with just one mouse click. And of course, the big companies are keeping pace with this trend. "Sberbank" and the big three o...

Productive assets is an important component of production

Productive assets is a combination of all of the tools that can participate in the process of production for quite a long time and maintain their original quality and shape. In world practice the cost of fixed assets gradually tra...

Currency operations and their types.

Under the foreign exchange transactions mean the following transactions: the Acquisition of currency values or their legal exclusion of the resident from the resident;the Use of currency valuables and securities as means of paymen...

The recalculation utility bills: the law, the statement

have you had so that at the end of the month received a bill for utilities, but strongly disagree with those in them amounts? Most likely, Yes. In this case, you have two options: pay for everything as it is and hope that in the f...

Bank "the Renaissance": the feedback from customers and employees

the Bank “Renaissance”, which allow you to compile a variety of views as a credit institution appeared on the market of the Russian Federation in 2000, but its current name was only 3 years later – in 2003. From ...

Most people think that taking consumer credit is very difficult, but in fact, all really does not cause any problems. Documents and certificates required a minimal amount, and the process takes a little time.Creditthe Main f...

Comments (0)

This article has no comment, be the first!