Now - 23:54:27

A self-employed citizen: activities, patent

A self-employed citizen - a concept that began to interest many people in Russia. A term generally used to refer to individual entrepreneurs who have no employees and carry out other private activity. In fact, it is those who work. Often such people can be very problematic to conduct its business, in particular, because of tax fees and paperwork. So at the moment in Russia was made the decision on creation of a separate law, which would help self-employed citizens work for the benefit of the society and to receive the earnings. This idea was actively developed in 2016. What citizens should know about this innovation? What will provide working conditions for those who work for themselves?

Self-Employment is...

What is "selfemployed"? This issue is of interest to quite a few people. Especially those who are planning to open our own small business. It was already mentioned that such a term generally characterize people (at the moment - entrepreneurs) who work for themselves. They have no employees or staff personnel.

To some extent it is the citizens who are their own bosses and subordinates. In Russia such activities are quite common. Only at the moment self-employed citizen is obliged either to get a job officially (as, for example, an employee for hire), or draw yourself as an individual entrepreneur. Quite often you select system USN. Not very convenient. Therefore, Russia began to consider the laws, helping to work properly, citizens belonging to the category of self-employed.

Recommended

Staff evaluation: system and methods

Personnel Assessment allows you to identify how competent the employees involved in the enterprise, and it is the performance of their work – the most significant factor affecting the efficiency of the company. To clarify the impact of performa...

How to start your own business: important aspects.

Many people, tired of working for someone else, are increasingly thinking about how to start your own business. Someone wants to open a salon, someone store, and someone enough and vegetable stalls. Before you throw in the pool with his head, it is i...

Business activities. its essence and basic functions

The Entrepreneurial activity of the citizen – is undertaken at your own risk and independent activity, which aims to systematically profit through the sale of works, goods, services, use of the property. The citizen engaged in such activities, ...

Inconvenience with the UI

Now that it is clear who it refers to self-employed citizens in General (more on this later), you can understand why the country decided to come up with a new law. Indeed, as already mentioned, the population was in the case of self-employment to register their activities as a business.

It's not for any of the activities suitable. Also, you should note one rather interesting fact - the taxes and contributions for PIS even if you select "simplified taxation" in the form of taxation can be quite high. And therefore, the majority of self-employed simply can not be issued. They are, as already mentioned, informality is actually violating an established law. Only often to prove this fact is very problematic.

That is why Russia thought that to pass a law "On self-employed citizens." It needs to help all the people who work for yourself without employees to work without fear for violation of legislation in the country. But what will happen to the studied category of persons? What are the pros and cons have with the proposed system? The preparation of the population?

Patents

The First thing that is offered to pay attention is that the current system of taxation for the specified category of persons will be patent. Often this scenario is very good. Why?

The Activities of self-employed people in certain cases can be a patent. One of the advantages of the system:

- The Lack of payment of insurance premiums and taxes. People just buy the patent and operate for the established document deadline.

- No paperwork. No extra reporting, no additional declarations of profits. A patent for the self-employed also promise to make simplified.

- Lack of in-house audits of tax inspections. Perhaps one of the most significant moments. It is planned that the self-employed citizen who is working under the patent, shall be exempt from tax audits.

The Disadvantages of this system are also available. But they are most often considered as the nuances, not the cons. For example, there are the following points:

The Disadvantages of this system are also available. But they are most often considered as the nuances, not the cons. For example, there are the following points:

- Limited scope of the patent. The maximum term of service of the document is 12 months. A minimum of 30 days. Every year will have to buy a new patent to continue the work.

- Not all work can be framed as self-employment. In some cases, still have to open IE.

- Different value of the patent for activities in the regions. The price tag will be set each city on their own. But the highs and lows of plan still to be adjusted.

No More significant features not. However, the laws on self-employment so far, the population produce predominantly positive impact. People with joy wondering what to expect.

Tax holidays

A great advantage is the idea of tax-exempt self-employed people. Statements like these are made very often. Because the studied category of persons, as a rule, must first "roll out" business, that he has brought income, and then pay taxes. Otherwise, the covering of SP and ceases to operate officially, going often into the shadows. This loss to the state Treasury.

For this reason, the government proposed to exempt self-employed people from taxes, give them tax holidays. For which term? For 3 years. That is, people will be able to avoid paying taxes 36 months.A very interesting perspective.

The proposal was also made in relation to IP, which works only for itself, without bosses, managers and employees. 3 years from the date of registration of this category of persons would not pay taxes to the state Treasury. You will need only to transfer mandatory contributions to the social insurance Fund.

Taxes in General

What else should pay attention to people? In Russia provides for full exemption of self-employed citizens from taxes. How will it happen?

The Thing is that citizens need to acquire patents. Their value fully covers the anticipated costs. In fact, a self-employed person pays in advance. The value of a patent is and taxes and all mandatory fees.

Thus, we can say that there are no extra payments to make throughout the validity of the patent will not need. For this reason, the law on self-employment is of interest in the population. The main problem for which people hide their income taxes. And she, as promised in the government is exhausted.

Differences from the UI

What activities the self-employed differ? It should be noted that entrepreneurship and study the type of work is a few different things. Therefore, we need to clearly understand what are the differences from each other they have.

The self-employed citizen is different from an individual entrepreneur? If not to take into account the new opportunities offered in Russia for the first category of employees, there are the following features:

- Self-employed can only work under the patent. To combine the taxation it is impossible.

- Wage earners with self-employment is prohibited. Sole traders can employ staff and pay them a salary.

- Self-Employment is work only in certain areas. They must be specified in the patent.

- There is No tax reporting of those who decided to work only on themselves. SP at least once a year hand over relevant documents about income and expenses.

Accordingly, cannot be considered a sole trader is self-employed citizen. This term can only be applied in certain cases.

Who can work as a self-employed person

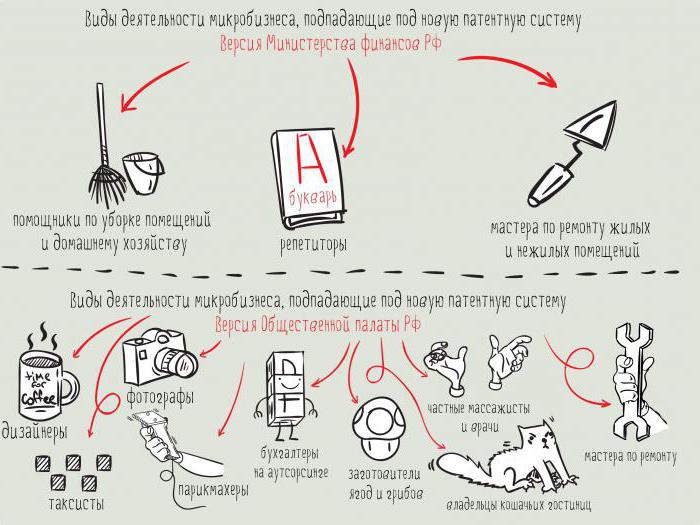

And now a little about the activities of the study. has been said that not all businesses without employees provides for a patent for the self-employed. So who exactly will be eligible for the issue of this document?

Now there are the following persons, who from 2017 will have to work according to the special patent as self-employed:

- Seamstress at home;

- Nanny;

- Maids and governesses;

- Tutors and home teachers;

- Photographers and videographers;

- Driver;

- Journalists;

- Freelancers (in particular, copywriters and rewriters);

- People who are engaged in repair of jewelry;

- Master appliance repair.

You can also include Here people who manufacture hand-made, as well as Soaps and handmade chocolates. A huge advantage of the adopted law is that now the work of copywriters for a very long time which caused a lot of issues, will be issued officially without any problems.

About the cost

Perhaps the only significant disadvantage is that the patents for the self-employed will cost money. Normal, but it makes many people wonder. Has been said that the cost will be to identify in each city specific otnositelno their activities. For example, a nanny in Moscow will have to pay for the patent more than in Kaliningrad. On the one hand, all right. On the other - it is not clear how much will have to pay for their activities in advance.

However, as the government indicates, a self-employed citizen will have to pay a minimum of 10 000 rubles for a patent. Some sources indicate that the amount of money deposited to be paid, will be 20 thousand. This cost is based on the year. Here, as already mentioned, included and mandatory contributions, and tax revenues. In principle, not so much as it seems. Given full tax exemption when working with patents, this is probably a huge advantage over individual entrepreneurs.

Registration

One More thing - a bit of documents self-employed will have to run. The thing that every person who works "on" should be listed in a special register. It will be fixed all the citizens who work for themselves.

Now say that have a little to pay for the registration. The approximate cost of this activity is 100. A small thing, but to consider it will have.

Results

Now it is clear what constitutes the category of self-employed people, as well as what to expect in Russia in the near future. In fact, the proposed changes are really interesting. But experts still Express their concerns. Some self-employed can remain in the shadows.

This Applies to people with low or unstable income. They simply unprofitable or IP open or patent to buy. And to prove their activity is very problematic. Therefore laws thoughwill help but not completely rid the country of the shadow economy self-employed people.

Article in other languages:

AR: https://tostpost.com/ar/business/2952-a-self-employed-citizen-activities-patent.html

BE: https://tostpost.com/be/b-znes/5231-samazanyatasc-gramadzyan-n-dzeynasc-patent.html

DE: https://tostpost.com/de/business/5229-samozanyatyy-b-rger-t-tigkeit-patent.html

ES: https://tostpost.com/es/negocio/5235-samozanyatyy-ciudadano-las-actividades-de-la-patente.html

HI: https://tostpost.com/hi/business/2954-a-self-employed-citizen-activities-patent.html

JA: https://tostpost.com/ja/business/2952-a-self-employed-citizen-activities-patent.html

KK: https://tostpost.com/kk/biznes/5233-z-n--z-amtushy-azamat-yzmet-patent.html

PL: https://tostpost.com/pl/biznes/5235-samozanyatyy-obywatel-dzia-alno-patent.html

PT: https://tostpost.com/pt/neg-cios/5231-samozanyatyy-cidad-o-atividade-patente.html

TR: https://tostpost.com/tr/business/5237-samozanyatyy-vatanda-faaliyetleri-patent.html

UK: https://tostpost.com/uk/b-znes/5235-samozaynyatiy-gromadyanin-d-yal-n-st-patent.html

ZH: https://tostpost.com/zh/business/3206-a-self-employed-citizen-activities-patent.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Copper plate, foil, ribbon: production, characteristics, application

Working with metal is people have very long time. Mankind uses a variety of types of metals for the production of functional and decorative objects, creating various alloys having other than the original material characteristics.I...

The garden galvanized with polymeric coating: photos, reviews

in the cultivation of vegetables, root crops and greens is important, including and properly plan the site, making a neat patch. Options breakdown the past there are many. Most often, gardeners make them just from the land or usin...

Fukushima-1 accident and its consequences

the Accident on the ‘Fukushima-1” has been caused by the earthquake and ensuing tsunami. By itself, the station had a stock of strength and would one of the natural disasters.the accident resulted in the fact that nucl...

Planning in management – the key to successful production and business.

Planning in management is one of the most important and basic functions. In the broad sense of the term “planning management” refers to the activities aimed at defining the specific goals and objectives for the organiz...

Automobile plant AZLK: history, products and interesting facts

Automobiles "Muscovite" continue to drive along the roads of the former Soviet Union, while a steelworker have long been officially ceased operations. Moscow automobile plant named after Lenin Komsomol produced several l...

Unaddressed distribution mailbox flyers and commercials: features and recommendations

Unaddressed distribution in the mailboxes of brochures, flyers, leaflets and other printed materials – it is safe and quite effective form of targeted advertising. Usually they are small and medium-sized commercial organizat...

Comments (0)

This article has no comment, be the first!