Now - 05:16:33

Voluntary liquidation of OOO: instruction

A Voluntary liquidation of OOO is a kind of official procedure. It is carried out in accordance with the Civil code, other special laws. However, many people who are going to close a certain company, quite often not aware of how to correctly perform this procedure and it is, in principle.

When it is conducted?

In the majority of cases the main reason for that was conducted a voluntary liquidation of the LLC, there may be the following factors:

- Loss of interest from the owners to the activities that guides the organization. In the majority of cases this item is accompanied by the inability to sell the business.

- The Loss of the ongoing financial and economic activities of the company.

- Completion of term for which created the particular organization.

- Full achievement of the purposes for which it was opened.

- State of the net assets of JSC or LLC.

Decision Making

The Solution, according to which is voluntary liquidation, OOO, is taken by some body. He gets the powers spelled out in the founding documents of the company. In modern societies with limited liability that body is the General meeting of participants (members, shareholders or other representatives). It is worth noting the fact that the voluntary liquidation of the LLC in the form of a non-profit Foundation is carried out only if the relevant judicial decision. In the process of the meeting of the General Assembly examines the following issues:

- Decide what should be the order of liquidation of the company.

- Appoints the authorized Commission. Determines its Chairman.

- Establishes the terms of cancellation, including the notification of all creditors to abolish.

From that moment, as he was appointed the special Commission for the liquidation of the LLC provides for the transfer of all powers concerning the management of the Affairs of the entity. The law does not contain any norms that would be completely devoted to the use of a specific mechanism of control over her work. In addition, it is not remains clear responsibility for the actions of the Commission. After all, they can violate the rights of interested persons. It is for this reason we need to very carefully apply to the correct selection of candidates for future members of the Assembly.

In addition, it should be remembered that changes significantly depending on how complex it is liquidation of the LLC, the cost of this event. Often, it starts from 25 thousand rubles. The Commission, which oversees the abolition, decided to include Manager, lawyer, chief accountant. It can also include representatives of the various founders. As President in such a situation, elected mostly by the head.

Enforcement Notice

Set a specific order in which needs to be liquidated, OOO. The price of this event when it is discussed at the first stage. In particular, the founders or some meeting of commissioners of the people who take the decision on the annulment or other legal entity, should be required to report your verdict to the state authorities in order to make appropriate data entry in the EGRUL. It should be noted that this notice must provide, not later than three days after the decision was rendered about the liquidation of the company.

For this purpose in the corresponding registration authority, which acts as a tax on box in the location of the company, provided the following documents:

- Notification about the beginning of procedure of liquidation with a notarized signature.

- A Message that is formed by the commissioners. The signature must also be notarized.

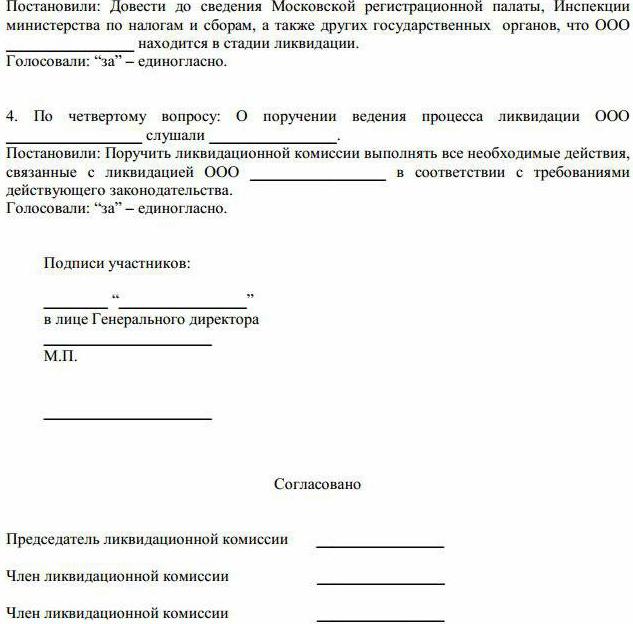

- The minutes of the General meeting at which the decision was rendered about the liquidation of the company, and elected the Commission.

Further on will have to make in the register the information that the legal entity is in the process of cancellation. From this point exclude the possibility of changes that could be made to the founding documents. As well as any registration of legal persons the founder of which is the enterprise.

Notification of funds

In accordance with applicable law, after the planned closure, OOO, about this procedureyou need to fail to notify certain funds. Namely:

- Retirement;

- Social security.

It is worth noting the fact that the notice must be provided no later than three days after the decision was made.

Notice to creditors

Immediately after the planned closure of the LLC, the relevant Commission must place in the magazine “the Bulletin of state registration" of the specific post that is liquidation. In addition, the procedure and term of claims by creditors of the company. This Declaration must contain the following information:

- Full name of the legal entity.

- Its main state registration number.

- The Identity of the taxpayer with the reason code of registration.

- The Address at which the person is located.

- Information about what was decided. Specifying on which it was engaged.

- The Date and number of decisions.

- The Timing, order, and telephone and address where creditors can submit their claims. You can specify any other additional information.

In the end, the Commission, which is self-liquidation of the LLC, takes steps to identify all creditors, then notify them in writing to start the process of elimination.

The Commission

For a certain period of time the creditors can submit their claims. At the same time, the Commission conducts its work in full compliance with pre-approved and the plan. In particular, it should include the following list of events:

- Inventory of all property of the company.

- Preparation of information regarding the size and composition of the assets of the organization, including the description of the capital to be sold, its condition and liquidity.

- Collect all the necessary data about the participants who have the right to receive a particular share of the company's assets after liquidation will be conducted, OOO. The regulations provide for the issuance of shares only after settlement with creditors.

- Composing extremely a deployed characteristics of the financial condition of the company at the time of its closing.

- Complete dismissal of all employees.

- The Establishment of all organizations, where a legal entity acts as a founder. The output of their composition.

- Check the calculations for each of the territorial and the Federal payment to the relevant tax authorities and various non-budgetary funds.

- A detailed assessment and analysis of receivables and activities are designed associated with its recovery.

- Install the feature in accounts payable.

- Define the order of implementation of all property closing company. It is grouped according to the degree of liquidity conditions and opportunities.

- Pre-determines the exact order of settlements with the creditors, which relate to a single queue meet the requirements.

- Prepare the documents necessary to exclude the company from the register.

Now that you understand how should be the liquidation of the LLC. A sample of required assignments during this procedure is issued to the accounting Department, as well as all other services and departments of the company.

Recovery of debts

In order to recover debts, the liquidation Committee sends debtors letters. They indicate the requirement of immediate payment of money or the return of some property. If debtors refuse to make payment at this point, in this case, can be served a lawsuit to the court. Moreover, the representation of the interests of the organization will deal directly with the members composed of the liquidation Commission. When the receivable expires, the Statute of limitations, it may be recorded in non-operating expenses, is deducted resulting in a loss.

Inventory

In accordance with applicable law, the duties of the Commission is to inventory all property owned by the company. When is the elimination of zero, OOO, the procedure is no different from the standard. In addition, also carried out a full inspection of all items of assets and liabilities. Discrepancies between actual presence of property and accounting data should be reflected in the respective accounts.

Payments to staff

That man is about to be fired due to the closure of the company, the employee should be warnedemployer at least two months before dismissal. Accordingly, he is entitled to see the document that approved the decision on liquidation of the LLC. Sample information (see below) need to show all employees. With the written consent of the employee, the employer can terminate a labor contract with him, without warning him of dismissal during this period. But he is obliged to pay additional compensation in the amount of average earnings for two months.

In the case of termination of employment due to the liquidation of the company terminated employee must receive severance pay. Its size is equal to the average monthly earnings of the person. But that's not all. A former employee has the right to retain their average earnings in the period of further employment, but not longer than two months from the date of dismissal. In addition, the employee also shall be compensated for the fact that he couldn't use his own vacation. In accordance with the laws, the administration of the company shall carry out the calculation with dismissed employees on the last day of their work. If those are absent, then the money is paid to them the day after treatment.

Taxes

By law, the obligation to pay taxes from the liquidation of the company is vested in the assembled Commission at the expense of those who come in the process of implementation of the company's assets. If it sold certain assets, in this case, it is mandatory to pay taxes associated with the sale. A liquidation Commission is obliged to provide to the tax authorities of the relevant declarations for each individual fee that is payable to the budget until the immediate closure of the organization.

But there are other situations. For example, if monetary funds of a liquidated company, including those received from the sale of its property and is not enough for full performance of the obligation to pay fees, taxes, and also owed penalties and interest, then the repayment of the remaining debt must deal with the founders. But only within the limits and order established by the current legislation.

Tax audit

After receiving notification of the start of liquidation, on which is a potential creditor of the organization in neonataleia taxes, starting your own inspection. She performed for all taxes regardless of what time audited previously. It should be noted that in this case the procedure is carried out over the past three years. She is visiting.

When the need arises, all persons who have been authorized by the tax authorities and do this kind of checking, can carry out a full inventory of the property of the organization. And engaged in the inspection of warehouse, commercial, industrial and other premises or areas, which the payer uses to generate income. Or if they have a connection with the contents of any objects of taxation. Based on the acts of reconciliation with the state authorities, as well as the protocols of documentary verification of the calculations, set the total amount of debt the organization. Now you know how is the liquidation of the LLC (single member or more) that it represents. Presented in the article information will be useful and instructive for everyone.

Article in other languages:

AR: https://tostpost.com/ar/business/19407-ooo.html

BE: https://tostpost.com/be/b-znes/30963-dobraahvotnaya-l-kv-dacyya-taa-pakrokavaya-nstrukcyya.html

ES: https://tostpost.com/es/centro-de/31859-voluntario-de-la-liquidaci-n-de-sa-paso-a-paso.html

HI: https://tostpost.com/hi/business/17347-ooo.html

JA: https://tostpost.com/ja/business/21697-voluntary-liquidation-of-ooo-instruction.html

KK: https://tostpost.com/kk/biznes/30930-er-kt-taratu-zhsh-adamdy-n-s-auly.html

PT: https://tostpost.com/pt/neg-cios/30844-liquida-o-volunt-ria-llc-passo-a-passo.html

TR: https://tostpost.com/tr/business/36531-stifa-ltd-ad-m-ad-m-talimatlar.html

UK: https://tostpost.com/uk/b-znes/30913-dobrov-l-na-l-kv-dac-ya-tov-pokrokova-nstrukc-ya.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

"The Finnish district" LCD: apartment from the developer, layout and reviews

to Live almost in town, but at the same time, surrounded by wonderful nature and the favorable ecology – is not this the dream of every inhabitant of the metropolis? Today such a possibility exists. Construction companies ac...

Industrial boilers: description, types, functions. Examination of industrial boilers

Equipment for the production of thermal energy for several centuries used. During this time of construction aggregates has varied, allowing the owners to obtain higher performance. In our time, this segment of industrial machinery...

Independent examination of the car repair from the center for judicial expertise and research, Saint

the Center for judicial expertise and research, "the Saint" offers his professional services to all in need. Our specialists arrive on the scene and impartially evaluate the property. If you surrendered the vehicle ...

How to earn 100,000 rubles per month? Profitable business, the real earnings

If someone convinces you that knows how to make 100000 in a month, moreover, says he already has the income with no investing a dime and does almost nothing – do not trust this man. Most likely, you are dealing with a scamme...

Ultrasonic testing of welded joints, methods of control

there is almost No industry, which would not have carried out welding work. The vast majority of structures are assembled and are joined together with welds. Of course, the quality of carrying out such work in the future depends n...

Corporate standard: rules and implementation stages

have You ever thought about what makes a successful, dynamically developing company from the hundreds of small shops, sales of which over the years remain at a low level? Every prosperous organization has a corporate standard. He ...

Comments (0)

This article has no comment, be the first!