Now - 03:14:34

Credit card credit limit – what is it?

Almost every Bank offers its clients credit cards with a limit. The borrower can use the money, and then have to return them in due time. The limit is usually renewable, so the client can again remove the card money. It is very convenient because you can use the money at your convenience. Not require a collection of documents, no need to spend extra time. But if you have a credit card, the credit limit can stimulate on purchases that are not always necessary.

Credit limit

What is the credit limit? This is the sum of money provided by the Bank to the client in constant use. Obtaining a Bank product it is already money, so the borrower can withdraw cash or pay for purchases. To return the debt on time to avoid unnecessary charges.

Almost every financial institution provides a grace period, including "PrivatBank". The credit card limit which at first may be small, is used by the client for 50-60 days without interest. Specific conditions in all banks may be different. If you correctly use the service, then the client has the opportunity to withdraw funds more than once.

If non-payment means a specified period for accrual of interest. This service is only a credit card. Credit limit may increase, but that is determined by the Bank.

No limit

With the order card is provided with a limit, otherwise the issue does not occur. But there is a card with a zero balance. Usually they are debit. For example, such is the Visa Platinum product "Binbank". About the peculiarities of use and maintenance it is necessary to contact companies.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

This card is considered a debit and credit that is available immediately. In issuing her no money. For several days by the decision of the Bank is granted a specific amount, what the customer will inform by SMS or call. Then the map acquires the status of the credit. That such is the card "Corn", "Euroset" gives the opportunity to draw cash in the debt.

Limits

The Bank sets a limit, depending on the client's solvency. Here is also considered wages. If the customer was issued a credit card, the credit limit may increase. It affects the improvement of solvency. Usually provided 50-100 thousand rubles.

When the client is not solvent, in the limit refuses. Calculation rules in each Bank is different. As a rule, payment should not be higher than 25% of revenues. We consider all the client's expenses. The size limit affects the content property of the estate.

Increase the limit

If you have a credit card, the credit limit can be increased. Each Bank is calculated differently. For example, "VTB 24" the client submits an application, proof of income, document of ownership. Consideration of the application lasts no more than 3 days, after which a decision is made.

"Binbank" has the discretion to increase the amount if the client constantly uses the services and return the money without delay. Therefore, the limit can be increased if:

- All documents;

- Constant use of the funds.

How to know the credit limit?

To learn about the amount of provided amount, you can use the following options:

- Should be familiar with the contract that was issued when applying to the Bank;

- The amount is specified in the receipt from the ATM;

- The customer can order a statement of the Bank;

- Have a convenient service online banking.

These options are available with each card, including a card "Corn". "Euroset" provides the ability to use the personal office. It is easy to make various payments and transfers.

Costs

The Amount may be not only increased but also decreased. This occurs when:

- Have an outstanding balance;

- There is a risk of non-payment of debt.

This is done in simplex mode, as indicated in the contract. If desired, the client has the opportunity to reduce the amount. For example, there will be 300,000 rubles, and the client does not remove the money and is afraid of losing the card. Then he can make a statement in which ask to reduce the amount of funds to the desired amount. The provision limit is a good service because if you want to search for, where to borrow money. It is only necessary to time to return the debt.

Article in other languages:

AR: https://tostpost.com/ar/finance/2769-credit-card-credit-limit-what-is-it.html

BE: https://tostpost.com/be/f-nansy/4908-kredytnaya-karta-kredytny-l-m-t-shto-geta.html

DE: https://tostpost.com/de/finanzen/4907-kreditkarte-kreditlimit-was-ist-das.html

HI: https://tostpost.com/hi/finance/2770-credit-card-credit-limit-what-is-it.html

JA: https://tostpost.com/ja/finance/2769-credit-card-credit-limit-what-is-it.html

KK: https://tostpost.com/kk/arzhy/4910-nesie-kreditt-k-limit-b-l-ne.html

PL: https://tostpost.com/pl/finanse/4911-karta-kredytowa-limit-kredytowy-co-to-jest.html

PT: https://tostpost.com/pt/finan-as/4909-cart-o-de-cr-dito-limite-de-cr-dito-o-que-isso.html

TR: https://tostpost.com/tr/maliye/4915-kredi-kart-kredi-limiti-bu-nedir.html

UK: https://tostpost.com/uk/f-nansi/4911-kreditna-karta-kreditniy-l-m-t-scho-ce.html

ZH: https://tostpost.com/zh/finance/2989-credit-card-credit-limit-what-is-it.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Advice to borrowers. Do I have to pay the loan if the Bank burst?

In the context of the global economic crisis, we almost every day we learn of bankruptcy or other financial institutions. Many borrowers are learning that their Bank suddenly ceased to exist, it is naive to believe that they now d...

The creation of a reserve for doubtful accounts: posting to accounting and tax accounting

In the case of accounting for bad debts the company is obliged to form a reserve of the same name. This requirement is contained in paragraph 70 of the PBU. It does not matter, took place the creation of a reserve on doubtful debt...

Basis of payment 106: transcript, rules for filling

In 2014, has changed the form of payment orders on transfer of funds in the budget. In particular, the document was a paragraph "Base payment" (106). Banks now do not control the correctness of filling in all the fields....

What documents are needed for auto loan? A list of documents

more and more people take out loans for larger purchases. This is the simplest and surest way of obtaining the desired. Lending in Russia is actively developing. Every year people are more and more turning to the banks for obtaini...

Credit cards "Svyaznoy Bank" is the fast design and easy use

Credit card “international Bank” is a card MasterCard®, that operate worldwide. They can pay for various purchases and services. Any ATM the money is withdrawn without a fee.to apply for a credit card “intern...

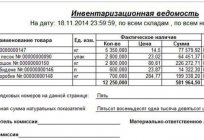

Inventory: the form and the sample

availability Control assets the company performs the audit. As check objects can be goods, cash, stocks and other assets. The inventory reflects the results of the audit. Enterprises used the unified form INV-26. Next, let's consi...

Comments (0)

This article has no comment, be the first!