Whether in the change of residence was to change: where to apply, documents

Whether in the change of residence was to change? This question is of concern to many citizens. Yes, permanent residence rarely changes. But what if this happened? INN is directly associated with the tax services. So, if you use an invalid number, you can run into trouble. So will have to thoroughly study this issue. Maybe you don't really need to do additional paperwork?

Definition INN

Whether in the change of residence was to change? Before making final conclusions, it is necessary to understand with what document we generally will deal. Often in the definition of specific concepts for lie the answers to certain questions. So, INN-taxpayer identification number, and the individual. Is assigned to all citizens in Russia, as well as organizations that need to remit taxes to the state Fund.

This combination of numbers is there for all taxpayers, but some do not suspect at all. Was issued at his residence. Or rather, to the IRS in your area. Accordingly, registration of a role, but plays when you receive this document. What if you changed residence? Do I need to change INN? And what documents will be required in this case?

Forever

To be honest, the question is not so difficult really. After all, if you are wondering whether or when change of residence was to change, ponder what we're dealing with. Has been said that it is not that other, as a number assigned in order to be able to remit taxes. Is it required in certain situations to change?

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

Not at All. After all, Russia is by changing the names or name of the document is not changed. And, then, the new residence also does not affect the need for replacement. As practice shows, only if you lost the document, you will need to restore it. Or rather, to duplicate. And nothing more. Therefore if you are thinking whether or when change of residence was to change, then the answer will be negative. You should not even head to a break on this topic.

Actions when changing

And, in General, something needs to be done when you change the place of registration? In principle, no. Because this document is only required for tax services. And in Russia they are all interrelated. And when a person moves to a different residence, all information is transmitted automatically. Including INN. The tax office of your district will report on the move at the office, which is tied to your place of residence. Automatically will replace the data about your personality.

It Turns out that was the place of residence is not bound. This number is issued to citizen once. And for a lifetime. Under any circumstances he can't change. Moreover, the change of registration does not require you any additional actions, or alerts, with rare the exception.

Exception

Whether in the change of residence was to change? No. And if you are an individual, even independently notify the tax authorities at the new place of residence is not required. As has been said, there are exceptions to the rule. Or rather, it is one. Talking about the change of residence you only have when you are an individual entrepreneur. But it will not change your INN. The IRS will require to fill in a special statement, in which you'll need to specify a new place of your registration. Nothing difficult about it.

How to apply? Find the tax authorities at the place of your new residence and come back with a passport and a certificate of registration FE. The INN and SNILS also take. Then ask for an application form-notification for change of residence. Fill it, attach copies of your documents and leave the tax.

Get a room

Since change was not necessary under any circumstances, you should at least learn how to initially get this paper. Actually, it wasn't that difficult. But remember – INN without a residence permit you are unlikely to accept. Therefore, registration will have to worry in advance. Fortunately, the process is not burdened by any difficulty and paperwork. If you already have 14, you will only need a passport and application for a taxpayer identification number. But the citizens who still need age limit is not reached, will have much more difficult. After all, for was need the presence of legal representatives.

Exactly What is need in this situation? Citizens under the age of 14 years, unable to was only in the presence of parents. Plus, it is legal representatives should write the corresponding application. It is applied passport (copy) from the parent, birth certificate of the child, information about the registration of a minor. Further, appeal to the tax authorities at your place of residence and submit the documents for processing. In approximately 2 weeks (sometimes a month, but it's rare), you can obtain a certificate of INN.

Over the Internet

In principle, nothing complicated. Only modern citizens have special abilities. If you have changed residence, do I need to change INN? No. Moreover, even reportwill not have when you move. Except when you're self-employed.

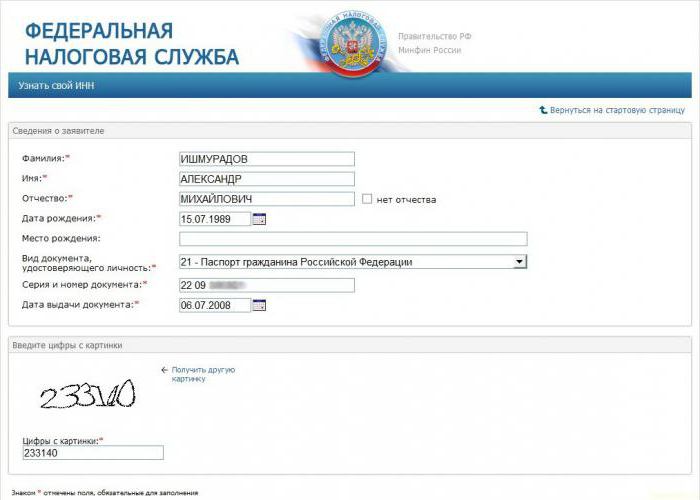

In Addition to a personal appeal to the tax authorities for obtaining a certificate INN you can use the Internet. To apply you have the full right through the portal «public Services" of having an account there. Usually there are no problems with it. Either will help official site FNS. The second option is suitable in a greater degree, because for the first you might want INN. And if you don't know, will have to abandon the portal «public Services».

To begin with get yourself an account on the site on and go out there authorization. Next, fill in the electronic form of the application form for the certificate was, if necessary, provide copies of your documents with a digital signature. And then just wait for some time. You will be able to obtain the certificate in electronic format (to download directly from your "Personal account" on the site FNS), to personally pick it up at the tax office at your place of residence or by mail to (extremely rare).

Insights

Whether in the change of residence was to change? No. Remember, this document is issued once for life. Even a change of residence does not. Only with rare exception.

A certificate was also not cause any trouble. However, and without the document you will be able to live from time to time. Hurry with obtaining it is not worth it. As a rule, was to get to the moment of your first formal employment. And nothing more. No fines for absence of the document is not allowed. After all, you are entitled to when it deems it necessary, if not arranged formally for work.

Article in other languages:

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

How to make a map of the savings Bank? The process of registration and card types

I do Not know how to make a card, but have long dream to become a customer of a leading Bank in the country? There is nothing easier than to just come to the office, taking the minimum package of documents. Except that it is neces...

Accounting is... the Features of the process of generalization of information

Accounting – element of management of economic objects and processes. Its essence lies in the fixing of parameters and the state of facts and events, the collection, compilation, accumulation of information and its reflectio...

Technical passport of the property: the paperwork where and how to

Every person, being the owner of a residential property, should be well versed in what documentation on the object should it be available. It certainly applies to the technical passport, which contains information about the differ...

Residential complex "Ilyinsky" description, reviews

a Private apartment in the city center - the dream, which is to exercise hard enough. Thinking about buying an apartment, many are horrified. The high cost of real estate in Moscow forced to take out a mortgage, to go into debt. T...

How to decide which Bank is better to take a loan

the Author of this article works in one of the large European banks, which are widespread in Russia. Are familiar with the specifics of financial services, particularly loans and credit cards. This article will not promote specifi...

Eclipse yacht Abramovich - the most expensive private vessel!

Eclipse (yacht Abramovich) today is one of the most luxurious motor boats. Boat price us $ 800 million. The translation of the title is "Eclipse". Indeed, the ship literally overshadows luxury, richness and beauty any other yacht....

Comments (0)

This article has no comment, be the first!