Now - 19:20:16

Adjustment of the implementation period in the direction of reduction: transaction

Very often in organizations there is a need to adjust the amount of the previous shipment in connection with the identified error or because of a change in the terms of the contract. The legislation provides a specific order of changes in the implementations of the previous period. Let's consider it in more detail.

Definition

Adjustment of the implementation period in the direction of decreasing (CSF) or an increase can occur as a result of:

- The value Changes.

- If an adjustment of the implementation period to decrease the number.

- When you change the same quantity and value.

- If the defaulter VAT returns merchandise to the seller.

If the parties have agreed to change the terms of the transaction, to issuing the shipping document within 5 days the seller can redraw the texture.

The Workflow

Reducing the cost of production is the business transaction that you want to make primary documents. In case of detection of errors in them changes. Waybill is used to design the implementation of goods and materials third party company. But it cannot serve as proof that the buyer agrees with the conditions of the contract. For issuing corrective invoices must provide payment system account, the new contract or act of the shortage of goods on acceptance. Let us consider in more detail how this process is carried out at NU and BU.

Details

The procedure for filling the CSF are mentioned in the article 169 of the tax code.

If the adjustment of the implementation period to decrease, the difference in monetary terms must indicate in box 8 of the G string without the negative sign. The document must be signed by an authorised person. The PI must specify the details of certificate of state registration.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

If there is incorrect adjustment of the implementation period to decrease, VAT will not be recalculated. CSF should be issued in 2 copies within 5 days of receipt of the document confirming the change: the supplementary agreement, the act of loss of the goods, payment order, etc.

If changes are made in several documents, which were shipped the same goods, the seller may redraw the single invoice for all shipments.

Adjustment implementation period in the direction of reduction: transaction

Let us Consider in detail the impact of CSF in BU from the seller:

- Reversal ДТ62 КТ90 – the proceeds reduced by the difference.

- Reversal ДТ90 КТ68 – the deduction of the amount of the difference.

- Reversal ДТ20 КТ60 – the customer's debt is reduced by the difference.

- Reversal ДТ19 КТт60 – the difference in VAT.

- ДТ19 КТ68 – restored previously deducted VAT.

Consider the impact of CSF on the increase in BU from the seller:

- ДТ62 КТ90 – the increase in cost of revenues.

- ДТ68 КТ90 – admitted to the deduction of tax.

- ДТ20 КТ60 – increased indebtedness.

- ДТ19 КТ60 – changed the amount of the tax.

- ДТ68 КТ19 – admitted to the deduction of tax.

If you make any changes to the invoice, the seller shall submit an invoice, and the buyer – to recover VAT. In both cases, the deduction shall be the difference in the amount of the tax assessed before and after the changes. Any changes in CSF are not the basis for giving of the specified Declaration.

Fixed account, the merchant must reflect in the book of sales (increase value) or book purchases (reduction in value) in the period of its execution, and the purchaser – within the reporting quarter. Deductions on IFSs can be applied within 36 months after the preparation of the document.

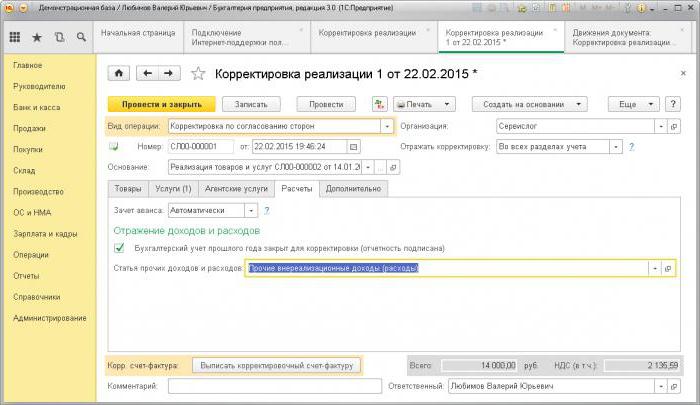

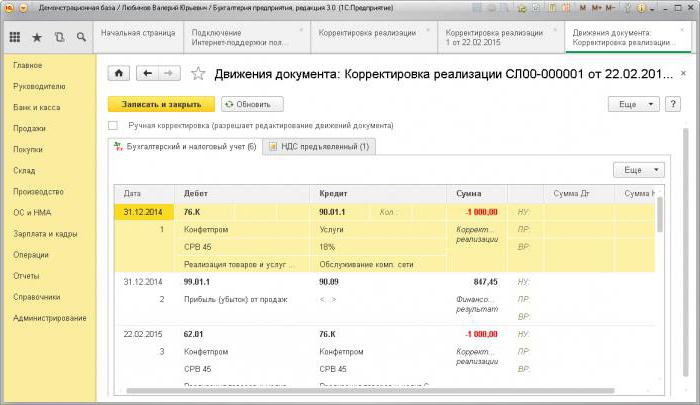

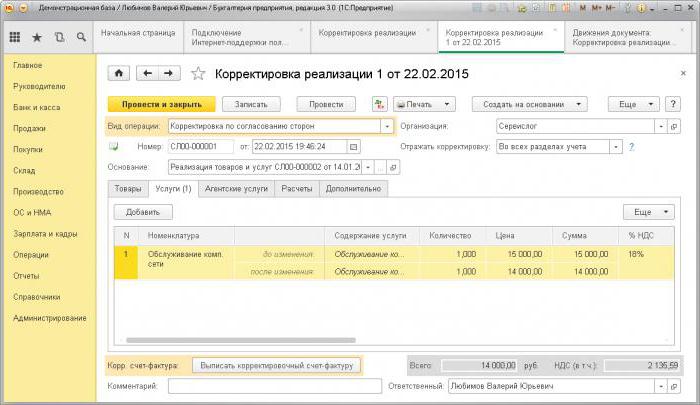

Adjust the implementation of the previous period to decrease in 1C

To register changes delivery to 1C is provided of the same name document. If shipment amount is reduced and statements are delivered, the "Adjustment implementation" reflect the amount of settlement payments and changes to income tax. The document forms of the transaction account and / 76K. Debt is calculated after the transaction date of the adjustment. Analytical accounting is carried out for each counterparty, agreement and document calculations.

If the statements are delivered, it is necessary in the formation of the document to check the "BU last year closed" and be sure to include source of income/expenditure. In this case, the transaction formed the current date. If there is an increase in the sales value, then the program will automatically increase the tax base.

VAT

According to article 168 NK, if there is a correction of the implementation of the previous period to decrease after the implementation of the seller shall be transferred to the account within 5 days from the date of receipt of the document-base. SKF is the basis for the adoption of the tax deduction. In this case the adjustment shall be the amount of the tax assessed before and after changes. Expenses of previous years are taken into account when calculating VAT per month of their identification.

Taxprofit

According to article 54 of the tax code, taxpayers-organizations shall calculate a base for each period on the BU register-based or based on any data about the objects. The detection of errors of past periods need to recalculate the tax base and the amount of the fee payable to the budget. If the period of the Commission of the error detection is not possible, then allocation should be undertaken in the current period.

Revenues from sales of goods is recognised on the date of sale. Adjustment of the implementation period to decrease in BU should be carried out in WELL. That is, the taxpayer must change its tax obligations. Here's how to adjust the implementation of the previous period to decrease. Profit organization it also reduces and forms overpayment of tax.

If the change in cost is due to the granted discount, the seller may adjust the tax base in the period of re-registration of the contract. In this case the amount decreases the income, should be reflected in the non-operating expenses. The resulting loss can be transferred to future periods, that is, to reduce it to the amount of profit the future. The only condition-you cannot reduce the income derived from the activities taxable at 0 %. Transfer loss to the future periods within 10 years.

Example

18.12.15, OOO signed the act of carrying out repairs in the amount of 236 thousand rubles Funds were transferred to the contractor 20.12.15. In March next year, LLC conducted a review to assess the quality of the work, the results of which was paid discovered, but the backlog (18 thousand roubles). OOO sent to the contractor claim, and the additional agreement on reduction of costs. In April 2016, the documents were oversubscribed, and the account was refunded the money. Reflect these transactions in the BU of the customer.

2015:

- ДТ20 КТ60 — the cost of repair of the object related to the cost (200 thousand rubles).

- ДТ19 КТ60 — reflect VAT (36 thousand rubles.).

- ДТ68 КТ19 — VAT accepted for deduction (36 thousand rubles.).

- ДТ60 КТ51 — paid jobs (236 thousand rubles.).

2016:

- ДТ76 КТ91 — accrued income (15,254 thousand rubles.).

- ДТ76 КТ68 — restored the tax (2,746 thousand rubles.).

- ДТ51 КТ76 — the funds received from the contractor (18 thousand rubles.).

Article in other languages:

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

"Rusfinans Bank" – newly formed company, which is one of the best organizations of this type. It develops in the field of consumer lending and offers a wide range of services, among which are avtokreditovanie, which became p...

Reviews investors "dal'piterstroy" about the Builder

for Those who have decided to purchase property in the building, should give preference to reputable construction companies that are on the market for years and can boast a large number of positive reviews. These firms can be attr...

Where is the CRR? The scheme of construction of TsKAD

One of the most significant infrastructure projects of Federal importance last few years, without exaggeration, can be called the reconstruction of the Central ring highway. Of particular significance to this project, add those ge...

Deferral of tax payment is what? The order and types of delays

Often the subject of because of certain circumstances, may have difficulties with the payment of taxes. Delay in payment of tax – it is a way to buy time if necessary, due to the difficult life situation that somehow affects...

The Albanian currency is Lek. The story of the creation, the design of coins and banknotes

the Albanian currency Lek got its name by reducing the name of the legendary military leader of antiquity Alexander the great. Similarly, the people of this country decided to declare to the world about his involvement in this out...

Today we are interested in the date of lodgement of the tax return. And not only him. It is also important to know what documents are needed in a particular case. After all, without a specific list, you simply deny the clearance d...

Comments (0)

This article has no comment, be the first!