Now - 15:56:20

The luxury tax. The list of vehicles that are subject to the luxury tax

Many people on hearing such a phrase as the luxury tax. What does it mean? What is this term defined? What is it for? An interesting question. And quite relevant. So, it is necessary to consider this topic in more depth and tell you about all its nuances.

A Little history

The luxury Tax didn't come out of nowhere. On the contrary, it arose with specific intent and for a long time. Already since ancient times, the state has enacted one very effective way to fill their own coffers. This was the luxury tax. A certain amount, which must (!) to pay wealthy people to the state for what they… rich. And this was obliged. The people that owned luxury estates, fine carriages, thoroughbred dogs… they had every year to send to the state rulers a certain amount of money. She allegedly went to support the family life of monarchs at a decent level. The story goes that England – the ancestor of this act.

In Russia, the idea to introduce a tax on luxury came in 2012. But no one turned to flesh out – what for "equation" of the rich. Often it turns out that this idea, in fact, to realize unrealistic. But then, after all the law is approved. Now wealthy people have to become less rich – due to the fact that they can afford. That's the irony.

“Good” news for motorists

A Tax on luxury cars received without delay. In the nineteenth, 2014, the list of the cars fell 187 different models. All – class “Suite”. But in the past, 2015, the list has become much more. The number increased to increased to 279 models! But such growth is caused by changes in the exchange rate.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

The Amount of “wealth” should pay the people who spent on his car more than three million rubles. Last year the cost of machines has increased very markedly. Many dealers did not hesitate to increase prices by about a third! Imagine the appropriate situation. People who purchased a particular model for, say, 2 500 000 rubles in 2014, and in 2015, are already under the luxury tax. The list would be added to this model, as given grown on 30 percent of the cost, it would not cost 2.5 million rubles, and 3.25 million

Indices and calculation

So, before I list a list of automobiles (luxury tax, as you could already understand touched on many models), you need to tell you something about how the amount is calculated and, in principle, what is the process.

To the law was furnished by all the rules, developed a clear classification. It is progressive tax increases. Less age more value of the car – the higher the tax.

The Minimum bar was the mark of three million rubles. From 3 to 5, to be exact. People who bought the car for that amount in the year when the tax imposed, were forced to pay increased vehicle tax. The lucky ones became owners of this model a year earlier, was more fortunate. Their tax increased only 1.3 fold. The owners of the same car with 3 years experience (that is, the car was purchased the year before) and all luck. The amount of tax they increased by only 10 percent. And those cars whose age is more than three years (and if they are worth less than 5 million), no longer considered a luxury.

So the first plank – from 3 to 5 million rubles. the Second – higher, from five to ten million. And in the first five years of the car, facing the money, will be subject to a 2-fold tax. But the most expensive category are the models for which owner has given more than 10 million rubles. Their age can be 10 years or less. The transport tax is increased three times.

Illustrative example

It is Now possible to show that represents a tax on luxury. The cars included in the list of taxable and varied. So, for example, a person buys himself a Bentley Arnage, deciding to be original remaining, acquiring all sorts of Toyota Camry. Will this car be in the so-called “risk”? Because when this car was new, it gave a lot of money. But everything is simple. This machine is not in the list, since it is, first, the old, and secondly is not worth as much as it had to give before.

The Value of ruble

So it became clear that such a tax on luxury. The calculation is also straightforward. And now I would like to tell you about how much it will all be in rubles. Because specific numbers always put everything in its place.

Take, for example, “Audi” with a 3-liter 245-horsepower engine under the hood. It has a rather modest price, so road tax will be 18 375 rubles – and that's without the various additives. And if you buy too “Audi”, but with a 4.2-liter unit 340 "horses"? Then you have to fork out. First, the maximum rate is added for the “horse”. Second, one and a half fold increase in the total amount. Because of the tax for the rich. So more than 50 thousand rubles, which need to give,turn in as many as 76 500 p. Thus, “happy” reported owner is on top of another 25.5 thousand. Because this “Audi” included in the list of cars.

The luxury Tax awaits those people who bought BMW 535d xDrive. No, better to give an example the Bavarian H5M. This car, which boasts a 575-horsepower engine, will cost its owner almost 130 thousand rubles a year, along with all allowances.

For a “Mercedes-Maybach" S400 (S-class – exclusive!) you will have to pay almost 100 thousand rubles. V6 engine under the hood, plus the price is appropriate.

“Budget-luxury” model

Now you can list and list of vehicles. The luxury tax depends on different criteria, and they were all listed above. So, of all almost 300 cars, for which “the rich have to pay", in the category of relatively budget (that is, those that cost 3 to 5 million rubles) is 166 model. Of them – 24 “Audi” (there are diesel and petrol version), substantially all "quattro"; 30 cars of BMW (coupes, sedans, "Gran Turismo" and even convertibles); one “Cadillac” (of course, this Escalade spanlatinum). Four "Chevrolet", two “Normal” three “infinity” and for 19 “Jaguar” – these machines are also on the list. 22 automobile firms “Land Rover”, two "Lexus", one “Maserati” and “Grand Cherokee СРТ8”… 23 "Mercedes”, “Porsche” and “Volkswagen” – about the same number. In General, the machines in the list a lot. And all you have to pay the luxury tax. Cars, the calculation of which is done individually, of course, and so expensive, and then there's the additional costs. I am glad though that the whole amount paid at once, and forget till next year.

The “luxury" vehicles

List of machinery is endless. Nearly three hundred models to list will not work. You can say one thing – in the category from 5 to 10 million rubles came in also “Audi”, “Mercedes", "Aston Martin", "Bentley”, “BMW”, “Maserati”, “land Rover”, “Porsche”, “Jaguar” and one "Lexus".

In the list from 10 to 15 million observed the same brand, but different model. Plus add one instance of “Ferrari”, “rolls Royce" and "Lamborghini".

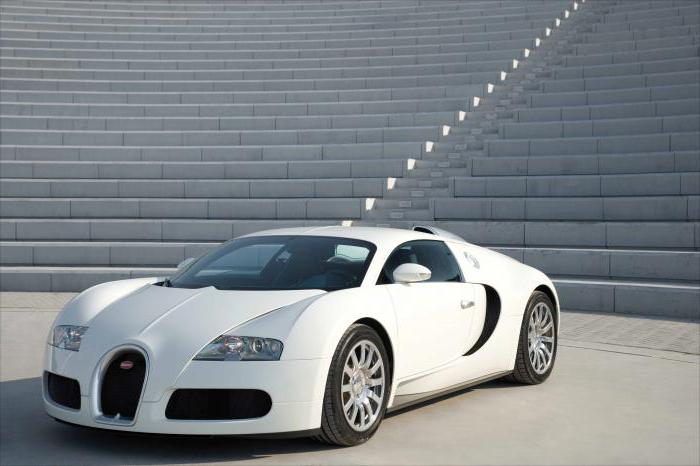

At last, the most expensive category, includes "Aston Martin", "Bentley”, “Bugatti”, “Ferrari”, “Lamorghini”, “rolls Royce", and "the Mercedes G 65 AMG ”. So far, the Bugatti Veyron Super Sport, which boasts a 1200-horsepower engine – this is a Prime example of a fabulous tax. 540 thousand rubles – that's its price.

Article in other languages:

KK: https://tostpost.com/kk/arzhy/32453-nalog-na-roskosh-avtok-l-kter-t-z-m-olar-salynady-bayly.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

How to get insurance for the loan? Early loan repayment

One of the additional services, which are paid by the Russians during the loan, - insurance. It reduces the risk of non-repayment of funds. Upon the occurrence of certain circumstances during the period of the contract, the Bank g...

the US dollar Rate against the ruble in recent years highly variable: after the 2008-2009 crisis, the U.S. currency has fallen in price considerably. In 2013 and early 2014 has increased again. Market experts believe that the situ...

Coins of Switzerland: description and brief history

the Swiss Confederation is a very interesting country with a rich history and culture. Moreover, it is one of the few countries in Europe that have kept their national currency and not adopted the Euro. Perhaps that is why many co...

According to the Russian Tax Code calculation and payment of taxes are mandatory for each registered on the territory of the Federation of the organization or enterprise. The correct determination of the amount necessary budget pa...

Return insurance on the loan. Return insurance on a mortgage

Getting a Bank loan is a procedure in which the borrower sometimes has to pay certain types of commissions, as well as to conclude a contract on insurance of loan. If the entire amount of the debt will be repaid, the borrower has ...

Student loan in the savings Bank with 18 years: design features, conditions and reviews

For education in many institutions the necessary tools. Often the amount is so high that such money may not be. Then you can take a student loan offered by the savings Bank. He is available for a long period and can cover all trai...

Comments (0)

This article has no comment, be the first!