Tax consequences of interest-free loan between legal entities. Interest-free loans from legal entities

An interest-free loan-it is a common phenomenon among business entities. Until recently, the attitude of tax authorities to this issue was unequivocal: the creditor is obliged to pay income tax. Therefore, any reallocation of funds within the holding company became risky. But the decision of the higher courts made positive adjustments.

The bottom line

Organisations often need additional funding. For businesses of a holding company, this problem is solved by providing a loan. Such transactions are used within financial planning. Creditors provide funds on a grant basis. But the recipient of such a deal threatens to recover tax on profit (NPP).

Classic design

The Company creates a legal entity that concluded with several agreements. This enables the company to quickly start production activities. After the receipt of the revenue the organization takes “inbound” VAT. So the problem of determining the sources of taxes are easily covered by cash gaps. In BU transaction is processed as a loan, and in UU - as a redistribution of Finance, for example, in the form of payment for the shipment. Issues are the consequences of an interest-free loan between legal entities, in particular VAT and NCE.

Legal regulation

The Lender provides in need of the side material assistance. The debtor undertakes to repay the amount in specified time. The parties enter into legal relations.

Terms of the transaction are determined by the contract. He begins to act from the moment of transfer of the object (the sum of money, securities, promissory notes, etc.). According to article 809 of GK of the Russian Federation, the transaction automatically becomes an interest-free, if you are things.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

Details

The agreement must specify the following:

- The time and place of its conclusion;

- Parties to the transaction (full name of companies the initials of the founders);

- Object - an interest-free loan;

- Timing of issuance and method of repayment (most frequently used scheme with monthly payments);

- The sanctions in case of delay of payment;

- The liability of the parties: the causes and conditions of termination of the contract, force majeure event;

- Company details.

- Signature.

It is Very important to test the validity of the registration of securities and all of the details. Attendance is encouraged at the conclusion of the transaction the notary. If the loan is provided in foreign currency, you need to follow the exchange rate. If the agreement does not specify the repayment period, it shall be calculated within 30 days from the date of the request.

Features

The loan Agreement between legal entities (interest-free) it is possible to repay ahead of schedule. These operations do not affect the profitability of the transaction: the Commission fee is still not charged. Therefore, in this scheme, the main interest of the lender. But even after the payment of the debt relationship of the parties does not end there. They have to pay fees. We consider in detail the tax consequences of interest-free loan between legal entities.

According to FTS, a borrowing relationship can be described as the provision of financial services. But are not charged for those. Interest-free loan to the tax authorities relate to non-operating income in the form of property rights or services (article 250 of NK). Assessing the economic benefit is for discount rate of refinancing of the Central Bank on the day when principal is repaid interest-free loan.

Records

The Tax consequences depend on the form of ownership of participants of the transaction.

Legal entity to obtain from the lender a certain amount, then put it into production. Then these funds will not be included in the taxable base. The company is not obliged to pay taxes.

If the lender and the borrower-the physical person, the payment of fees. Interest-free loans from legal entities shall be accompanied by payment of personal income tax to 35 % from 75% of the current refinancing rate.

To get rid of claims on, you need to prove that the loan is not a service, the results of which will be used in the activities.

Requirements

Borrowers can be legal entities which:

- Have official permission to enter into the transaction;

- Agree to use the adopted funds for the purposes specified in the agreement.

The Lender can be a company, which under the Charter and not legally prohibited to provide funds in the loan. It is required only the existence of the right of ownership of the object. The subject of the loan is transferred in full but on time.

Refunds

The Time to maturity of debt is not restricted by law. This period shall be agreed between lender and borrower and usually depends on the solvency of the second participant of the transaction. The lender may require additional guarantees: a pledge of property, surety shareholder or officer. The payment of funds – this means crediting the full amount to the account of the lender. In the case of formation of debt within a month (sometimes quarter) the lender may go to court.

NK VSGK

Interpretation of an interest-free loan to the Tax and Civil codes differ in these settings:

- In the civil law the loan agreement and services – two separate documents that could not be compared. In this case, transmission means in use repeatedly considered by the courts as providing property.

- The Service shall be any activity which results have no material expression. The provision of funds is not. In addition, the money is used after receipt.

- Service recognizes the grant, if the recipient is not obliged to transfer the property to the lender. But the loan agreement provided always return values.

Benefit

There are many questions about the consequences of an interest-free loan. Calculation of NPP tax called the identification of savings percentage. But in NK the Russian Federation the material benefit occurs only when calculating personal income tax. In article 212 clearly described the process of calculating fee amounts. This norm, on trying to apply to NPP. Tax consequences of interest-free loan between legal entities in the form of fines usually are contested claims.

Court practice

Despite the fact that the majority of claims on this issue was decided in favor of taxpayers, the number of claims from FNS for a long period of time. The situation changed when the SAC passed a resolution which stated that NK is not considered saving benefits for the use of borrowed funds as basis for calculation of NPP. Such operations are not recognized as service for purposes of charging VAT, and the funds under the loan agreement are not received free of charge. Therefore, the negative consequences of providing an interest-free loan is minimized.

Risks

A Detailed consideration is necessary for operations in which funds received under the credit agreement are used in order to issue interest-free loan between legal entities. The tax implications in such transactions is more serious.

The Costs, reducing the base for calculation of NPP recognizes all the costs that are made in the implementation of activities aimed at making a profit. That is, the account of expenses for payment of percent on credit contracts need to confirm that the use of funds aimed at generating income. It's hard to do when it comes to getting an interest-free loan. The organization could not take into account interest on loans in non-operating expenses. That is, the tax consequences of interest-free loan between legal entities are challenging such transactions on the court.

Withdrawal UI

Under the terms of the contract, the borrower receives any items or cash and agrees to return them at the expiration. Recognized interest-free loan on which:

- Provided the amount does not exceed 50 times the minimum wage.

- One of the parties to the transaction are not engaged in economic activities. It is possible to provide a document confirming that the lender listed on the contract means that he has received from the sale of the property.

- The Borrower gets the values defined by generic characteristics.

Tax consequences of interest-free loan between legal entities can not occur if the document will be assigned at least the minimum rate for the use of funds. It is possible to conclude an additional agreement and provide it that at the time of refund, the borrower will have to pay, for example, 1% per annum.

Consequences of default

The lender has the right to demand the return of funds through the court within three years from the day following the stipulated in the contract repayment date. If the loan is 5 years, then the litigation can be stretched up to 8 years. Only after this period can be attributed to accounts payable and to include its size in the base for the calculation of NPP.

If the borrower every 3 years following the date of expiry, send the creditor a letter with the willingness to repay a debt, the Statute of limitations will never expire.

In Order to take into account the amount of the unreturned funds in the taxable income, you need to:

- Set the maximum term of the loan;

- After its onset and after 2 years and 11 months to send the lender a letter of acknowledgement of the debt by mail with return receipt requested.

Article in other languages:

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

The types and purpose of valuation market value of the property

the Estimated activity today is in considerable demand, so experts do not sit without work a single day. Assessing market value of different types of property refers to the most common types of such services. Appraisers perform a ...

Promsvyazbank: the reviews of experts and ordinary consumers

After the collapse of the Soviet Union and total collapse of its economic system, the financial market of Russia immediately began to appear new players. One is the PSB reviews, which allow you to create a completely different opi...

Needed cash loan? Trust-Bank will help to solve this problem

recently there has been a growing interest of citizens of the Russian Federation for loans. It is largely associated with the Russian government in terms of legislation governing the activity of financial institutions. Recently ad...

Banking is a remote banking service. The System "Client-Bank"

Banking is a convenient and modern type of service, which is successfully implemented by credit institutions. But what you can get from this system? What services it provides? If it is a good way of cooperation? How you can connec...

the Value of the national currency and the oil price are interrelated in direct proportion.Many in our country wonder why the ruble depends on oil. Why if dropping the price of black gold, imported goods are more expensive, harder...

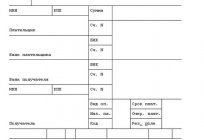

Payment order: fill the order, the appointment

payment order reads the Position of the Central Bank No. 383-p of 2012, This design document is created in the Bank for making partial payment. Next, let's consider the features of the payment order. General informationFor the for...

Comments (0)

This article has no comment, be the first!