Now - 05:31:55

The nominal rate and real rate – what is the difference between them?

Quite often you can see, at first glance, the best deals, which promise to ensure financial independence. It could be Bank deposits, and opportunities for investment portfolios. But if all are as beneficial as the commercials say? This is what we will discuss in the article, finding out what is the nominal rate and real rate.

Rate of Interest

But first, let's talk about the cornerstone in this matter – interest rate. It shows a nominally benefit that can be paid to a person when investing in something. It should be noted that there are many possibilities of losing their savings or the interest rate, which a person must receive:

- The Nebula is composed of the contract;

- Emergency (crisis of the company or of the banking institution, whereupon it ceases to exist).

So you need a very detailed study of what you are going to invest. It should be remembered that interest rate often is a reflection of the riskiness of the studied project. So, the most safe are those that offer a rate of return to 20%. The high-risk group includes assets, which promise up to 70% per annum. And anything more than these figures – it's a danger zone in which without having any experience to go should not be. Now that we have a theoretical basis, we can talk about what is the nominal rate and real rate.

The Concept of nominal rate of interest

To Determine the nominal rate of interest is very simple - it understands the value that is given to market assets and evaluates them without taking into account inflation. As an example, you can lead you, the reader, and a Bank that offers Deposit at 20% per annum. For example, you have 100 thousand rubles, and want to increase it. So I put it in the Bank for one year. And at the expiration of the period took 120 thousand rubles. Your net profit is as high as 20 000.

Recommended

Competition – a concept inherent in a market economy. Every participant in the financial and commercial relations, seeks to take the best place in the environment where it must operate. For this reason, there is stiff competition. The struggle ...

The mayor: powers and duties. Elections of the mayor

Normal functioning of all systems of the settlement, competent and timely execution of tasks in the sphere of economic, social and other areas of development is impossible without control of the mayor. But how voters can evaluate the quality of work ...

Francisco Franco: biography and political activities

When the civil war began in Spain, General Francisco Franco (Francisco Paulino of Hermenegildo Teodulo Franco Bahamonde - full name) celebrated its arakatzailea, but he seemed already tired of life and much older than his years. To unpresentable appe...

But is it really? Because during this time could significantly increase the food, clothing, travel – and not, say, 20, 30 or 50 percent. What to do in this case to get the real picture of Affairs? What all do you need to give preference to when you have a choice? What should be chosen as a reference point for myself: the nominal rate and the real interest rate or just one of them?

Real interest rate

That in such cases there are indicators such as the real rate of return. It is noteworthy that it is quite easy to calculate. To do this, from nominal interest rates to take the indicator of expected inflation. Continuing the previous example, one can say that you put in the Bank 100 thousand roubles under 20% annual. Inflation was only 10%. As a result, net nominal profit will be 10 thousand rubles. But if to adjust their cost, 9 000 purchase opportunities last year.

This option allows you to receive though small, but profit. You can now consider another situation in which the inflation rate was already 50 percent. No need to be a math genius to understand that the situation forces to look for some other method for saving and multiplying of their funds. But all this while it was in the style of a simple description. In the economy to calculate all this using the so-called Fisher equation. Let's talk about it.

The Fisher Equation and its interpretation

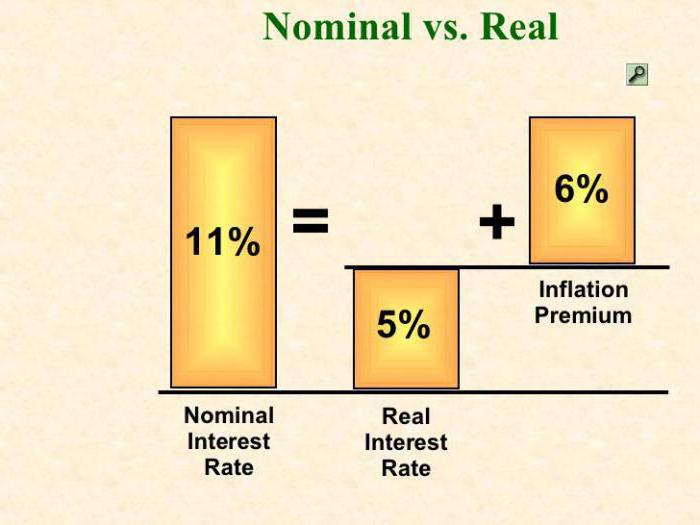

To Talk about the distinction that you have the nominal rate and real rate, only in cases of inflation or deflation. Let's look at why. For the first time the idea of the interrelation of nominal and real rates of inflation advanced by the economist Irving Fisher. As a formula it looks like this:

NS=RS+OTI

NS & ndash; is the nominal interest rate yields;

OTI – the expected rate of inflation;

MS – the real rate.

The Equation used for the mathematical descriptions of the Fisher effect. It is the nominal interest rate is always changed to the value at which the real remains unchanged.

It May seem difficult, but now we will understand more. The fact is that when the expected inflation rate is 1%, the value also grows 1%. Therefore, to create high-quality process of making investment decisions without taking into account the differences between the rates impossible. Previously, you only read about the thesis, and now have mathematical proof that everything narrated above, it is not a simple invention, but, alas, the sad reality.

Conclusion

And what can we say in conclusion? Always given the choice, should approach the election of the investment project for himself. No matter what it is: a Bank Deposit, participation in a mutual Fund or something else. For the calculation of future income or possible losses always use economic instruments. Thus, the nominal interest rate can you spell a pretty good profit now, but in the evaluation of all options will be possible that not everything is so rosy. And economic tools will help to calculate the making of any decisions will be most profitable.

Article in other languages:

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Reticulated Python is the largest snake in the world

People trying to offend the interlocutor, sometimes call him a reptile, Viper, serpent, Cobra, keeping in mind the presence of these reptiles deadly venom, aggressive behavior and irritability. These reptiles during the period of ...

Who are the niggers? The meaning of the term and variants of interpretations.

Despite the fact that communicating with people of a different race-bred people use the correct terms, still offensive names missing: Muscovites, Russians, Ukrainians, Bulbash, etc. Although their "bidnosti" they do not go to any ...

The former vocalist of the group Bravo - Zhanna Aguzarova. Biography and personal life

Zhanna Aguzarova, biography, children and career which will be addressed below, today rarely appears on TV screens, showing us their new songs and videos. You can even safely say that it is in the shade. However, the singer remain...

Bill Lawrence: movies, biography, personal life can be

the Profession — one of the most popular in the world, as the representatives of this sphere of activities receive rather high wages. Many children and teenagers want to become artists in the future, but do not realize how d...

Ilya Medvedev: biography of the son of the Head of the Government

well-known personalities Often hide information about their children and relatives. Presidents and chairmen of the government - is no exception. The media knows about these personalities and their personal lives a bit. Unlike Vlad...

How to determine the water levels?

the Definition of ground water level – a compulsory study in highly populated areas near reservoirs, rivers, lakes, seas. Any person who acquires a land plot for construction of residential houses or commercial buildings sho...

Comments (0)

This article has no comment, be the first!