Audit report: an example. Audit report: the preparation and timing of the issuance of the audit report

The Audit report and conclusion represent the documents reflecting the course of the audit and an objective opinion, formulated at the end of it. Their filling is carried out in accordance with applicable regulations and standards. Let us further consider how to obtain the conclusion of the audit.

Definition

Conclusion audit is a formal act intended for the users of accounting (financial) documents, which present the opinion of the auditor about reliability of inspected information and the compliance of the accounting procedure to the Russian Federation. Its formulation and reflection is carried out according to the current rules. Reliability referred to the level of accuracy of information, allowing stakeholders to draw the right conclusions about property and financial condition of the company, the results of its economic activities and to take on the basis of these indicators informed decisions. For the content of the audit report responsible person carrying out the audit. It is necessary to consider that for preparation and submission of the accounting (financial) documents the responsibility of the management of the inspected person. From this fact it follows that the audit does not relieve the organization from responsibilities in the field of reporting.

Classification

Auditing is of several types:

- Initiative.

- Required.

- For special tasks.

As experience shows, it is advisable to use for all the outcome documents of the uniform model (example). The audit opinion would be issued in the Russian language, values are specified in national currency. The document is provided to the head of the inspected person in so many instances, what is provided for in the agreement.

Federal rule

The Auditor is responsible for the formulation and expression of opinion on reliability of the documentation, in all significant respects. The audit report shall be in accordance is governed primarily by Federal standards. In particular, the fundamental is the rule №6, approved by government resolution No. 696 of 23 Sept. 2002. This standard, like other similar acts, is designed with the international regulations governing auditing activities. The rule establishes uniform requirements for the outcome of the audit.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

The Application

The Audit opinion must be accompanied by financial statements, which is formulated and expressed opinion. It must be signed and sealed by the inspected entity. It also should indicate the date of formation. Documentation is produced in accordance with the requirements of the legislation in the field of financial documentation. Audit conclusion and reporting brochure in a single package. The leaves are numbered prochlorophyta, sealed by the auditor. On the corresponding page indicates the number of sheets in the package. As was said above, the results of the audit report is carried out in such number of copies, which was agreed by the inspector and the inspected person. However, both parties have to obtain at least one packet.

Structure of the audit report

Norms provide a list of key elements that must be present in the final document. These components include:

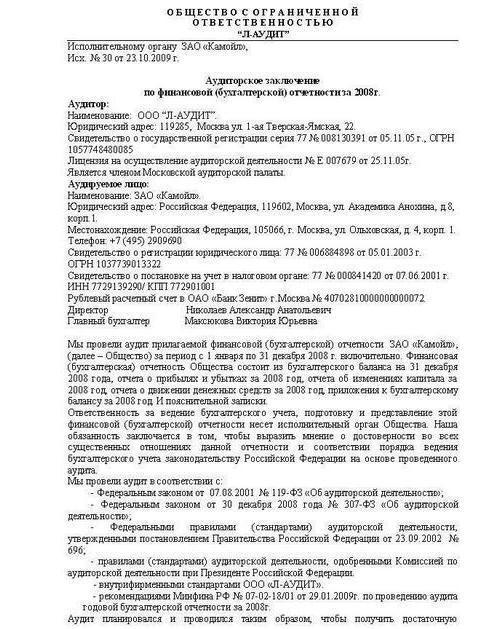

- Name. Example: "auditor's opinion on financial (accounting) documentation."

- The Addressee. According to the agreement or the law, a document usually sent to the owner of the inspected entity, to the Board of Directors and so on.

- Auditor.

- Information about the inspected entity.

- Part of the audit report. They are usually, three. This introductory section, the units describing the scope of the audit and opinion of the authorized expert.

- Date of the audit report. Here shall bear the calendar number of the completion of the audit. Specialist is solely responsible for the expression of opinion on reliability of indicators of financial documentation at the time of audit. On other operations that can be performed after the end of the audit, he didn't answer.

- Signature.

Parties

Information about the auditor should include:

- An indication of the organizational-legal type of the enterprise.

- The name of the organization from the auditor.

- Location.

- Date, room SV-VA about state registration.

- License Information. Specify date, number, name of court that issued the permit to conduct activities, period of its validity.

- Membership of an accredited trade Union auditors.

Data about the inspected person include:

- A reference to the legal status of the entity.

- The Name of the company.

- Address.

- Date, room SV-VA about state registration.

Introduction

In this part there are data about the period of providing information in financial statements, its structure. In particular, it should be:"The balance sheet" (p. No. 1), "Reporting of damages and profits" (p. No. 2), applications to f. Nos. 1 and 2, explanatory note. In addition, in the introductory block includes information on the division of responsibility between the auditor and the inspected entity. Duties associated with the preparation of the financial documentation shall be borne by the head of the audited entity. The auditor is responsible for expressing an informed opinion about the level of reliability of the report in all significant aspects.

Scope

This section contains the following information that:

1. The audit was performed in accordance with Federal laws, rules (standards) of the activities, internal regulations in force in the trade Union, member of which is the auditor, and other acts.

2. The inspection was planned and performed to ensure a reasonable degree of confidence that financial performance is presented without material misstatement.

3. The audit was performed on selective basis and included:

1) Research evidence on the basis of testing, confirming the value and disclosure of information about financial and economic activity of the inspected entity.

2) an Assessment of methods and principles of accounting, preparation of financial statements.

3) the Definition of the basic evaluation values that are present in the financial documents.

4) evaluating the overall presentation of the financial statements.

4. The audit provides sufficient grounds for formulating and expressing an opinion on the reliability of the documentation in all material aspects and in accordance with the rules of accounting applicable law.

Additional topics

In the block that describes the opinion of the auditor, should be disclosed in the prescribed form, the auditor's conclusions about the level of validity of inspected information. The document must present the painting to the responsible parties. the Signing of the audit report carried out by the head of the organization, from the auditor, or other authorized person or chief auditor. In the latter case, additionally specify the number, type, qualification certificate and its validity period.

Form audit report

They are defined in Federal standard No. 6. The rule establishes the following types of document: unconditionally positive auditor's opinion and modified type. The first is prepared in the case that the auditor was of the view that provided for inspection documentation reliably reflects financial condition of the enterprise and results of its economic activity, consistent with the principles and methods of bookkeeping, the requirements of the legislation. In the presence of a number of circumstances arises the necessity of preparing a modified form of the audit report.

Terms and Conditions

The Auditor may waive the preparation of a positive conclusion in the presence of at least one of the available circumstances and if, in the opinion of the expert, it has an impact or may have a significant impact on the accuracy of information provided. Such factors include:

- A Limitation on the scope of work of the auditor.

- Disagreements with the head of the inspected entity on the following issues:

- The permissibility of the accounting policies selected by the organization;

- Method of its use;

- The adequacy of the disclosures in the accounting records.

Grounds for granting modified document type

Auditing company or private specialist can prepare such an act, if the factors:

- Not influencing the opinion of the auditors, but described in the document. Their goal is to attract the attention of stakeholders for any particular situation, the inspected organization and reflected in the financial data.

- Influencing the opinion of the auditors, the result of which can be insights with the caveat that the rejection of their formulation or a negative audit report.

Regardless of the circumstances that served as the basis for the preparation of the modified act, in a separate section of the auditor to disclose the reasons for its issuance.

Specifications

Upon making the modified document lists specific factors-base. Example: "auditor's opinion to the circumstances influencing the opinion of the inspector" – the act contains a qualified opinion in connection with limiting the amount of specialist work". The reason of preparation of such a document may be a disagreement with the management of the inspected enterprises for questions of accounting policy. It should be noted that depending on the degree of restriction of work of the expert, he is entitled not only to Express opinion with the reservation, but also to the formulation of conclusions. A negative opinion may be prepared in the event of a dispute with the management of the inspected enterprise on issues of the adequacy of disclosure in financial documents.

Types of modified acts

Given the above information, the following categories of reports:

- Do Not affect the integrity of the financial document.

- Clause.

- With the abandonment of the formulation of conclusions.

- Negative.

Qualified Opinionis expressed in the presence of a number of circumstances. In particular, it is valid when the auditor came to the conclusion that to formulate an unconditionally positive conclusion is not possible. However, the impact of differences that arose with the head of the inspected person or the limitation of the scope of work of the expert cannot be called so significant and deep, to use the right to refusal. In this case, the conclusion should contain the phrase: "except For the circumstances…". The auditor may refuse to Express an opinion. This is valid in the case where a limitation on the scope of his work so deeply and greatly that the specialist is unable to obtain sufficient, in his opinion, evidence. Consequently, he is unable to Express an adequate opinion regarding the authenticity of the submitted financial documents.

Significant disagreements with management

Contradictions in opinions of the Director of the inspected enterprise and the auditor can have a decisive impact on the financial documents. In such a situation, the auditor formulates the conclusion that the imposition of a reservation may not be adequate to disclose the misleading or incomplete nature of the statements. For such cases, in practice, developed an appropriate formulation. For better understanding, we give an example. The audit opinion issued as follows:

"In our opinion, therefore, the influence of these factors and circumstances, documentation of an enterprise "And" reflects inaccurate financial as of December 31, 20_г. and results of operations inclusive from 1 January to 31 December. 20_г. inclusive."

Special case

In practice, sometimes there is a false conclusion. It is an act prepared without audit or its implementation, but is clearly not appropriate information present in the inspected documentation. The recognition of the conclusion of false is made only in a judicial order.

Events

A Calendar number, which is affixed in conclusion, should correspond to the date of completion of the audit and follow up after the date of approval of financial documents of the inspected entity. Special attention should be paid to the order of the reflection events. In PBU 7/98, there are several requirements relating to this issue. In accordance with these regulations formed the terms of the audit report. There are two categories of events. The first arise in the period between the reporting date and calendar number approval to sign. In addition, there are facts that were revealed after registration of the audit act. All these events belong to the category occurred after the reporting date. Their definition and rules for the reflection recorded in the PBU 7/98, and Federal standard No. 10. In accordance with the latter, the auditor should consider the impact on the state of the financial documents and the conclusion of the events that occurred after the reporting day. When this is taken into account both the favorable and negative factors. Financial records, recorded the event:

- Proving the existence on the same day the economic environment in which the inspected entity conducts its activities.

- That occurred after the control calendar the number of circumstances in which the company carried out the work.

After the date of the formation of financial statements, events may occur:

- Arising prior to the date of approval of the audit act.

- Appeared after the signing of imprisonment and up to calendar day of its granting to interested persons.

- Identified after the delivery of the final act of the users.

Required procedure

Regarding the events that occurred prior to the date of approval of detention specialist shall conduct a series of events. They aimed at obtaining appropriate and sufficient evidence that all these facts exist which may require adjustment to the financial records or the disclosure of the information in it, installed. Treatments focused on defining the events are implemented as close to the day of signing the conclusion. If the specialist will identify the facts that could materially affect the financial documentation necessary to establish whether they were adequately reflected in accounting records and adequately disclosed if the information about them.

Federal rule 10

In this standard are requirements for action of the expert regarding the events that occurred after the date of signing of the conclusion, but before the calendar date of the granting of its stakeholders. After certification of the final act in the duties of the auditor do not include procedures or requests regarding financial documentation. The responsibility for informing the auditor about the events that may have an impact on the financial statements, from the date of approval of the conclusion lies with the management of the inspected entity.

Activities specialist

If the auditor became aware of the event that can significantly affect the condition of financial documentation after the date of signing of the conclusion, it must be:

- Establish the need for changes in the accounting files.

- Discuss the resolution of this issue with the head inspectedentity.

- Carry out required activities with the specific circumstances in which the expert became aware of these events.

The Facts discovered after submission of the document to users

If was discovered the events that existed at the date of signing of the conclusion after its transfer to interested parties, but prior to its approval by them, in connection with which it was necessary to modify the act, the specialist decides on the revision of the financial documentation and discusses it with the head of the inspected entity. Upon adjustment of the accounting of securities, the auditor performs appropriate procedures. His responsibilities also included the preparation of a new final act with responsibility, attracting attention, describing the grounds for re-investigation documentation and feature the earlier of the conclusion.

Controversial issue

If the expert considered it appropriate to review the financial documentation, but the management of the inspected entity has not taken appropriate action, it shall notify the persons subordinate to which is the Director of the company that the users will be informed about the impossibility to rely on the final act. Upon the day of reporting for the forthcoming period and disclose adequately information about the facts of economic life the need to re-study papers and assessment may not appear. The head of the inspected entity responsible for the information present in the accounting records, and making necessary changes in the identification of events which have a significant effect on the reliability. Audit company or private specialist is responsible for the adequacy opinions on the evaluation of these facts.

Article in other languages:

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

an interest-free loan-it is a common phenomenon among business entities. Until recently, the attitude of tax authorities to this issue was unequivocal: the creditor is obliged to pay income tax. Therefore, any reallocation of fund...

The types and purpose of valuation market value of the property

the Estimated activity today is in considerable demand, so experts do not sit without work a single day. Assessing market value of different types of property refers to the most common types of such services. Appraisers perform a ...

Promsvyazbank: the reviews of experts and ordinary consumers

After the collapse of the Soviet Union and total collapse of its economic system, the financial market of Russia immediately began to appear new players. One is the PSB reviews, which allow you to create a completely different opi...

Needed cash loan? Trust-Bank will help to solve this problem

recently there has been a growing interest of citizens of the Russian Federation for loans. It is largely associated with the Russian government in terms of legislation governing the activity of financial institutions. Recently ad...

Banking is a remote banking service. The System "Client-Bank"

Banking is a convenient and modern type of service, which is successfully implemented by credit institutions. But what you can get from this system? What services it provides? If it is a good way of cooperation? How you can connec...

the Value of the national currency and the oil price are interrelated in direct proportion.Many in our country wonder why the ruble depends on oil. Why if dropping the price of black gold, imported goods are more expensive, harder...

Comments (0)

This article has no comment, be the first!