Now - 01:29:37

FIFO method is... Method FIFO means

The Material and production values, but simply put, stocks of goods and raw materials

In the warehouse make up the bulk of the assets in almost any enterprise. They

And also represent the bulk of the costs. Besides, their structure has a decisive impact on the financial results of operations.

As a rule, tangible assets purchased by parties acting on the company's balance at different times and, accordingly, their price may not be the same.

After a time, capitalized reserves are transferred to the manufacture, sale or other disposal. At this point, economists are very important to estimate the cost of the released values.

Methods of inventory valuation

Currently, there are several ways of assessing the cost of transferred material values:

Cost of each unit.

At the weighted average cost.

At cost the first on time of acquisition of material values (FIFO).

At cost last on time of acquisition of material values (LIFO).

When Producing a write-off need to remember that the same method will be applied in tax accounting.

Choosing the Right method

Usually the order of inventory has an internal policy of the company. While different types of values can be offset by various methods. But for the same inventory item method unchanged.

Usually the order of inventory has an internal policy of the company. While different types of values can be offset by various methods. But for the same inventory item method unchanged.

In modern accounting was widespread the first and second methods.

FIFO and LIFO raise many questions among economists and business leaders. However, do not take them into account would be a serious omission.

For Example, the method FIFO is an excellent opportunity to improve the company image in the eyes of partners. Calculation of the cost of released items use are quite simple, it is only necessary to understand the key points.

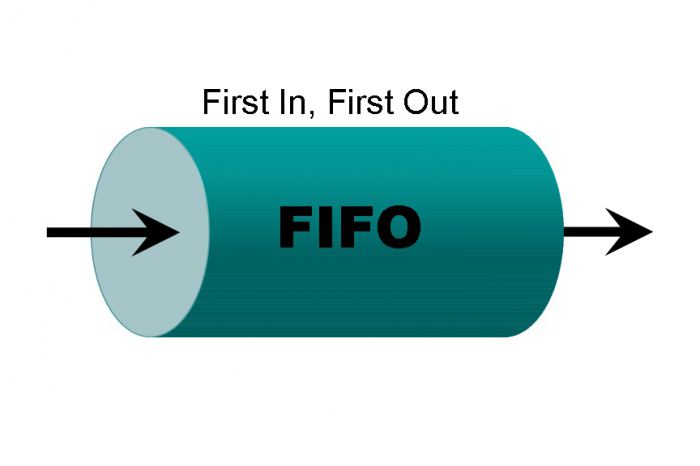

First In, First Out

A First-in-first out, so in English the decrypted four letters that represent FIFO method.

This assessment of goods issued, based on the assumption that the first are transferred to manufacturing (or other purposes) the value of other previously delivered to the parish. That is, the products are offered in the same sequence in which got to the warehouse.

Recommended

Competition – a concept inherent in a market economy. Every participant in the financial and commercial relations, seeks to take the best place in the environment where it must operate. For this reason, there is stiff competition. The struggle ...

The mayor: powers and duties. Elections of the mayor

Normal functioning of all systems of the settlement, competent and timely execution of tasks in the sphere of economic, social and other areas of development is impossible without control of the mayor. But how voters can evaluate the quality of work ...

Francisco Franco: biography and political activities

When the civil war began in Spain, General Francisco Franco (Francisco Paulino of Hermenegildo Teodulo Franco Bahamonde - full name) celebrated its arakatzailea, but he seemed already tired of life and much older than his years. To unpresentable appe...

It's Easier to remember what method FIFO means at home example. Imagine a big stack of anything. Let it be the statements of the applicants in University admissions. Every day on top of the pile, put all new and new forms, but considered in the first place will be lower, since they were filed earlier, despite the fact that they have accumulated a pile of new. And the goods are written off in the beginning those that arrived at the warehouse before the others with the same item.

Each batch of material and production values should be shown in accounting as a separate group if it would be applied the method of FIFO. This condition is mandatory, even if the goods are such items have not been capitalized previously.

When applicable, FIFO method

An Example of the most successful use of this method — the writing off of perishable goods. We are talking about foods (vegetables, fruits, dairy products) or raw materials with a limited shelf life. In order to avoid damage in the first place needs to be implemented (or revised) previously received stocks.

Disadvantages of FIFO method

Since under the influence of inflation over time purchase prices can rise, when accounting using the FIFO method, the cost of released items may be somewhat understated. This contributes to an artificial overstatement of the financial results of operations and, consequently, increase the amount of income tax.

The advantages of FIFO method

The Artificially high profits — the main advantage, which gives the company the FIFO method. It is at first glance surprising, because the same factor was written and shortcomings. However, the large success of the enterprise increase its creditworthiness and attractiveness of the new contracts, attracting investors.

Method FIFO. Sample solution

Calculate cost of material-industrial stocks, withdrawn from stock in two ways:

Calculates the total value of all stocks of the item that was capitalized in inventory during the entire period, and from it is subtracted the cost of material resources at the end of the reporting period.

The Calculation is based on the cost of the item in the first (in time) to the party if stocks of these revenues do not cover the disposal completely, include the value of goods from the second, third, party, etc.

A detailed study of both will help an easy task.

The Company must be the goods price of the supplier and debiting the stock is made using the FIFO method.

At the beginning of the reporting period, on the stock of a company left 100 boxes of nails for the price of 300 rubles each. Total material values for the sum of 30 000 rubles.

Within a month made another two batches of nails at the following prices: 120 boxes of 400 rubles and 200 boxes of 450 rubles. In the same period inproduction order warehouse is out 180 boxes of nails.

In accordance with the redemption rules using the FIFO method, we assume that the expended was 100 boxes of nails at 300 rubles ($30 000) and 80 boxes of 400 rubles ($32 000).

At the end of the month, the stock remains 40 boxes of 400 rubles ($16 000) and 200 boxes of 450 rubles ($90 000).

Perform the calculation, using the first method. Calculate the average cost of remaining stock of boxes:

(16 000+90 000)/(40+200)=441,66 ruble.

The resulting value is multiplied by the quantity of goods in stock at the end of the reporting period:

441,66*(40+200)=105 998,40 rubles.

For simplicity of calculations, we round the resulting amount to 106 000 rubles.

Calculate the value of the retired warehouse values:

((100*300)+(120*400)+(200*450)) - 106 000 rubles = 62 000

Total for the reporting period, the warehouse was out 180 boxes of nails for a total amount of 62 000. Therefore, the average cost of one unit amounted to 345 rubles.

Now once again perform the calculation of the cost of goods issued, using the second method. In this case, the calculations are simple and will take less time.

100*300+80*400 = 62 000 rubles.

The Cost of one unit also tempered to 345 rubles.

The Results of calculations coincide, and this proves that both methods are correct.

This example is quite simple, so the calculation was easier the second embodiment. But if you want to post a large range of goods, which enter in the books and dispensed during the reporting period, several times, come to the aid of the first version of the calculation using the FIFO method.

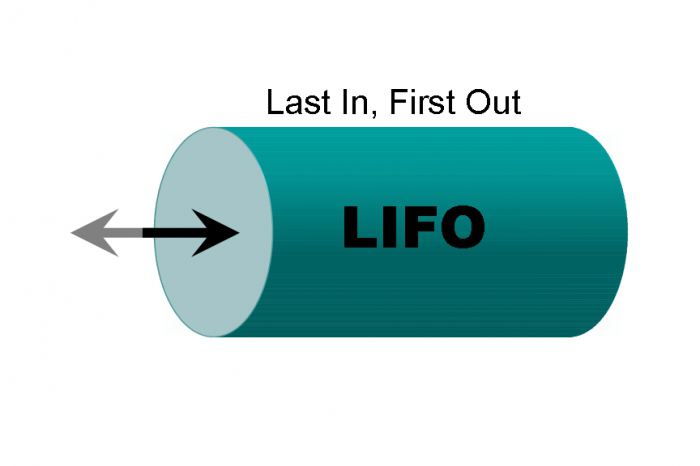

LIFO

This method of accounting is opposite to FIFO method. Also, as in the past, each new batch of product is accounted for as a separate group. However, when you decommission the replaced values considered in the first place, the unit cost of the last of the party arrived.

This method of accounting is opposite to FIFO method. Also, as in the past, each new batch of product is accounted for as a separate group. However, when you decommission the replaced values considered in the first place, the unit cost of the last of the party arrived.

Compare the LIFO method with the familiar stack of forms. Now a member of the admissions Committee will start processing the documents from the top.

The LIFO Method is most effective in terms of rising inflation. In this case, shown in the financial statements, the result will be more real, and the company will not have to pay taxes at exorbitant rates.

Based on the above written, we can say that the method FIFO — is a convenient and efficient method of the accounting of material-industrial values, departures from warehouse of the company in the reporting period. Of course he is not deprived of some drawbacks, but in certain situations its application brings unexpected benefits.

A Professional economist needs a master of all four methods of accounting.

Article in other languages:

BE: https://tostpost.com/be/nav-ny-gramadstva/6430-metad-fifo---geta-metad-fifo-aznachae.html

ES: https://tostpost.com/es/noticias-y-sociedad/6436-el-m-todo-fifo-es-el-m-todo-fifo-significa.html

KK: https://tostpost.com/kk/zha-aly-tar-o-am/6433-fifo-d-s---b-l-d-s-fifo-b-ld-red.html

PT: https://tostpost.com/pt/not-cias-e-sociedade/6430-o-m-todo-fifo-um-m-todo-fifo-significa.html

TR: https://tostpost.com/tr/haber-ve-toplum/6436-y-ntem-fifo---bu-y-ntem-fifo-anlam-na-gelir.html

UK: https://tostpost.com/uk/novini-ta-susp-l-stvo/6434-metod-f-fo---ce-metod-f-fo-oznacha.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Director Claude Lelouch: biography, filmography and interesting facts

“Man and woman”, “Whole life”, “Favourite of destiny”, “Les Miserables”, “Train a novel”, “women and men” films that make famous Claude Lelouch. To 80 years t...

Who was born on 17 September - list celebrities, biography and interesting facts

Who will be particularly interested to know who was born on 17 September of the famous people? Certainly those who were born on the same day under the sign of Virgo. Always curious to reflect on their own possible destiny. Interes...

What is margin and why it is needed?

Virtually anyone, even those who have never engaged in stock trading, I bet you've seen such a thing as margin. But not everyone wondered, “And what is the margin?” This word, translated the same from English ("Margin"...

Cathedrals and churches of St. Petersburg: the list, characteristics and interesting facts

Northern capital of Russia was originally conceived by Peter I as the center of Russian Orthodoxy. The grandiose idea of the king, she had to outshine European administrative centers with its grandeur, grace and power. Every impor...

Real name Valeria, biography and interesting facts

Valery – Russian pop star, a loving mother of three children and beautiful woman. Valeria real name-Alla perfilova, but most fans know is the pseudonym of the singer. The artist was able to assert itself in the second half o...

Otto weninger: biography, quotes. Otto weninger, "sex and character": a brief summary, reviews

Austrian philosopher, a Jew by birth Otto weninger was born in 1880, on 3 April in the Austrian capital Vienna. His fate is tragic: at the age of 23 years, the graduate women's University, a young psychologist and philosopher was ...

Comments (0)

This article has no comment, be the first!