ESN is a... Accrual, contributions, transactions, fees, interest and calculation ESN

The Unified social tax (UST) is a serious innovation in the tax system. He was able to replace the earlier taxes that were received in the three state extra-budgetary social Fund. Prior to the introduction of UST taxpayers were obliged to provide separate report forms to each of the above funds, and to make timely payment within the terms established by the Fund.

History UST

The Idea of introducing a unified social tax (UST), which would cover all insurance premiums originated in the far 1998, when the state tax service has proposed to create a single unified base of taxation by transferring all functions of accounting for and control of a single Department. However, in those years this idea was left unfinished, so it had to be frozen. 2 years later was admitted the second part of the Tax code of the Russian Federation and Federal law dated 05.09.2000, 01.01.2001 earned a new procedure for calculation and payment of contributions to social extra-budgetary funds of the Russian Federation. Chapter 24 part 2 read the introduction of the UST. The tax to the Pension Fund and taxes to the social insurance Fund and compulsory medical insurance funds were consolidated in the composition of the ESN to mobilize funds for the implementation of the rights of citizens to pensions and social security, and Medicaid. In addition, set a fine on contributions for compulsory social insurance from accidents on manufacture and occupational diseases.

ESN: nature and characteristics

The Transition to an open market economy in Russia was marked by radical changes in the financial system, when extra-budgetary funds began to secede from the national budget system. Because of the budget deficit, inflation, recession, growth, contingencies and other circumstances the formation of extra-budgetary funds has become one of the most important elements in updating the mechanisms of activity of establishments of social service. As mentioned earlier, the unified social tax was introduced after the entry into force of the 2nd section of the Tax code of the Russian Federation. In General, SST is a tax designed to replace all insurance premiums, in the above-mentioned funds, but without contributions for insurance against accidents and occupational diseases that must be paid regardless of ESN.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

In 2010, the UST was repealed and replaced by insurance contributions, which, however, was not much different from the last. Significant differences between ESN and insurance premiums became tax payments: earlier citizens pay through the tax service, but with the advent of insurance premiums they began to pay taxes to extra-budgetary funds. In addition, there were several altered tax rates. However, from 1 January 2014 a proposal was made to return to the old scheme of ESN in force until 2010.

In 2010, the UST was repealed and replaced by insurance contributions, which, however, was not much different from the last. Significant differences between ESN and insurance premiums became tax payments: earlier citizens pay through the tax service, but with the advent of insurance premiums they began to pay taxes to extra-budgetary funds. In addition, there were several altered tax rates. However, from 1 January 2014 a proposal was made to return to the old scheme of ESN in force until 2010.

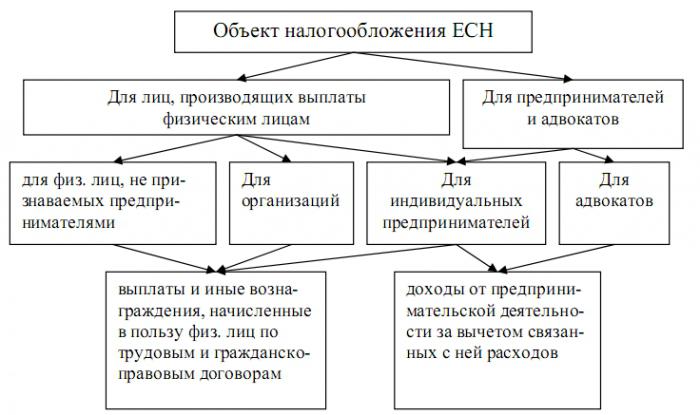

Taxation

For the taxpayers of the 1st group the objects of taxation are charged all payments and interest, premium and other income, including payment for civil contracts, copyrights and licensing agreements, and, finally, payments designed to provide financial assistance. It is worth noting the interesting fact that all of the above, income may not be subject to taxation if they are paid from profits that were remaining on account of the organization.

For entrepreneurs, the objects of taxation are all incomes that they receive from their business/professional activity, but less costs associated with their extraction.

Finally let us say that the objects of taxation do not include various payments, the subject of which is transfer of ownership of property or the transfer for temporary use of the property. For example, such contracts may be a contract "of sale" and lease agreement.

The Tax base for UST

Based on the statutory objects of the taxation, is generated and the tax base. For employers it is defined:

- All kinds of remuneration and disbursements in accordance with the labor legislation;

- Payment for civil contracts;

- Income from copyright and licensing agreements;

- Various payments to provide financial assistance and other gratuitous payments.

When determining the tax base includes all income that somehow accrued to workers by their employers in monetary or natural form, and under the guise of social, material and other benefits, net of non-taxation of income, which we will discuss later. When charging the unified social tax, taxpayers, the employers are obliged to determine the tax base for each employee separately throughout the tax period. The tax base of entrepreneurs is the generalized amount of income that is subject to taxation and was received by them for the tax period, except for costs not related to their extraction. Received by employees income in kind (goods, services) must be considered in the composition of taxable income, based on their value/cost, which are defined according to article 40 of NK of the Russian Federation, proceeding from market rates and prices.

Payments are not included in the taxdatabase

These include the following:

- State benefits;

- Compensation for dismissal;

- Travel expenses;

- Compensation for health damage;

- Compensation for use of personal things of employees;

- All sorts of compensation to the athletes;

- Other compensation;

- Providing free meals;

- Income received by members of the farm;

- Reimbursement for increase of professional level of workers;

- The contributions for compulsory/voluntary insurance of workers;

- Material payments to state employees;

- One-time financial payments;

- The free provision of housing;

- The income of the members of tribal communities of small peoples of the North;

- Other payments, established by article 237 of the tax code.

Contributors

Payers ESN will be the same persons who pay contributions. Speaking on the merits, now there are only 2 groups of taxpayers where the first group includes employees, organizations, entrepreneurs and corporate entities that have civil capacity, while the second was selfemployed (lawyers, notaries, tribal communities of the small peoples of the North, engaged in traditional agriculture and others).

If taxpayers belong to both categories, then they pay taxes on two grounds. For example, a sole proprietorship, which uses work of hired workers, is obliged to pay UST received from business activities revenues and accrued for the benefit of their workers. Notaries, detectives and security guards who are engaged in private practice, not specific to a particular class of taxpayers, for the reason that they are already included in the group of "individual entrepreneurs", which is enshrined in paragraph 2 of article 11 of the tax code.

If taxpayers belong to both categories, then they pay taxes on two grounds. For example, a sole proprietorship, which uses work of hired workers, is obliged to pay UST received from business activities revenues and accrued for the benefit of their workers. Notaries, detectives and security guards who are engaged in private practice, not specific to a particular class of taxpayers, for the reason that they are already included in the group of "individual entrepreneurs", which is enshrined in paragraph 2 of article 11 of the tax code.

The UST Rate in 2013 and 2014

In Russia there is a gradual increase of the tax burden, which is caused by the "aging nation", and subsequently the decline in the number of able-bodied and employed citizens. Of course, the older generation should be treated and regularly pay these people a pension. Now the smallest insurance premiums paid individual entrepreneurs and other self-employed citizens. They pay a fixed insurance premium that is markedly lower than the "average" employee working for someone else. As for the interest on the premiums (UST), while in 2013 they amounted to 30% of salary. Plus, since 2012 has withdrawn additional rate of 10% for salaries over 512 thousand roubles, and 568 thousand in 2013 and is expected to wage more than 624 thousand in 2014, the UST in 2014, expected to rise to 34%. Because of rate hikes in 2010, which grew by 8% (from 26% to 34%), the majority of small enterprises has been moved to "shadow", as not had to bear such a significant burden on their business.

How to calculate ESN?

Calculation of ESN in 2014 is the following algorithm:

1. First, you must determine the tax base, which is the amount of income individuals. It can be received as salary (employment contracts) or under other payments, outstanding civil contracts: royalties, the reward for doing work and stuff. Plus, the payers of UST will make both the organization and individual entrepreneurs who use hired workers.

2. The next step is determining the tax rate. It has a regressive scale, in which greater amounts are held less interest. For the majority of taxpayers total percentage 30% (for income from 1 to 624000 rubles): UST payments in the Pension Fund of Russia-22%, in Fund of obligatory medical insurance-5,1%, the social insurance Fund-2,9%. On top of the maximum amount (624 thousand) will be deducted 10%.

3. Compare your salary with the right group (<624000<) and simply multiply your amount by a certain percentage. That's it, your individual calculation of ESN over.

Fiscal periods

The Tax period is 1 calendar year. At the same time for the 1st group of taxpayers there are three reporting periods (a quarter, 6 and 9 months). 2-nd group of such periods do not exist. At the end of the tax period taxpayers must file a tax return.

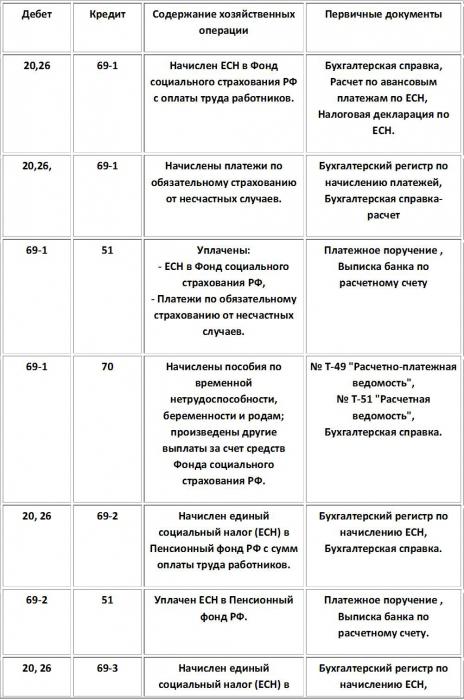

Standard accrual transactions ESN

UST. Posting on its accrual

Tax benefits

According to Russian tax legislation it is established that a tax-exempt (until the abolition of CST in 2010) the following organizations and individuals:

- Organizations In charge of the UST is not charged on sums of payments and other compensation which over the tax period does not exceed 100 thousand rubles for each natural person who is disabled I, II or III group.

- Previous principle applies for the following categories of taxpayers:

- For public organizations of disabled persons (OOI). In this category, taxes are not being withheld, if among the participants there are at least 80% of disabled persons and their legal representatives. Apply this to their regional offices.

- For agencies where the Charter capital is formed from contributions (OOI), the average number of which [people with disabilities] is not less than 50%. Plus, the share of wages shouldto be at the level not lower than 25%.

- Organizations that were created to achieve social objectives, including assistance for the disabled, disabled children and their parents. It is worth noting that property owners should only be OOI.

- Individual businessmen and lawyers with the status of invalid I, II or III group. The income from their business/professional activities also must not exceed 100 thousand rubles during the tax period.

Now grace the percentage of UST (insurance contributions) are also present. For example, in 2013 the most preferential rate of 20% - to the pension Fund, FSS-0%, HIF – 0%.

Background return to the UST

For many, the information on the return does not seem surprising, because the ESN is an important component of the tax system of the Russian Federation in 2000-ies. Most experts refer to the fact that the main causes of return to the UST was the fact that the replacement of UST insurance premiums, the scale of which is changed in favor of a more regressive and increase the rates of mandatory contributions from 26% to 34% of the PAYROLL (payroll), did not provide a balanced pension system, but only led to the increase in the tax burden and the various complications of the administration. From this we can conclude the conclusion that the return to the UST are likely to be perceived favorably by business (especially small), and the system will suit both the government and business. In 2010-13. all entrepreneurs were forced to turn in three (!) body, which in turn increases the cost of bookkeeping.

The Country is also not profitable to include increased state civil servants, which complicates the control of financial activities of entrepreneurs. In addition, we mentioned that due to sharp increases in the rates many small companies have gone "in the shadow". So while projected only positive changes. On the other hand, in 2014 increased the rate of siperia, after all, UST is now 34% (ordinary) and 26% (grace) that not much will please businessmen.

The Country is also not profitable to include increased state civil servants, which complicates the control of financial activities of entrepreneurs. In addition, we mentioned that due to sharp increases in the rates many small companies have gone "in the shadow". So while projected only positive changes. On the other hand, in 2014 increased the rate of siperia, after all, UST is now 34% (ordinary) and 26% (grace) that not much will please businessmen.

Conclusion

It's been quite a long time to the system of taxation ESN was close and understandable for all taxpayers. Meanwhile, it should be noted that certain provisions in the tax code require additional modifications and clarifications. Abolition of CST does not impact too negatively on the tax system, however, the practice of introducing insurance premiums not brought any improvements, increasing the tax burden. Now interest rates on UST account for 34% and 26% for the majority of payers and beneficiaries, respectively, which are not too loyal to the owners. However, it should be noted that the UST is a good alternative insurance contributions that can improve the tax situation in the country.

Article in other languages:

AR: https://tostpost.com/ar/finance/11715-esn-esn.html

HI: https://tostpost.com/hi/finance/11726-esn-esn.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

How to find out balance card "VTB 24" - a step by step guide

the Bank "VTB 24" has developed for its customers several options for checking your card balance. In order to choose the most suitable method, it is necessary to know some nuances. How to know the balance of the card "VTB 24" will...

The rating of the insurance companies. Insurance company: security rating

In the Russian Federation, as in other countries of the former Soviet Union, to insurance are ambiguous. Why it happened is unclear. Perhaps because of the mentality of the Slavs, who always hope for the best and afraid to think o...

Banknote 10000 rubles: projects and reality. The issue of new banknotes in 2017

In 2014-2015, the Network can meet a lot of discussion about the issuance of the Central Bank of Russia major new banknotes in denominations of 10,000 rubles. Now, after several years, we can easily understand by looking at these ...

Up to what age can you give a mortgage on a house? Mortgages for pensioners

If you want to buy an apartment or a country house right now, but do not have sufficient amounts of cash, you have only one way out — mortgage. Up to what age to give «Sberbank», and other financial institutions ...

Operating lease – why is it beneficial?

This kind of transactions in Finance leasing are well known businessmen and owners of their own business. This is a great alternative lending, which is suitable for large businesses and for small businesses. Varieties and types of...

E-money: how to use? KIWI wallet

Electronic money into our lives not so long ago, but has already become commonplace. The only question is which payment system to choose, since there are plenty to choose from. And the user today meticulously eyeing each virtual t...

Comments (0)

This article has no comment, be the first!