The contract of financing under concession of a monetary claim: characteristic and sample

Not always business partners can timely and fully meet its financial obligations to each other. In such cases, there is a need to find the best way out of difficult situations. Options for addressing financial difficulties, occupies an important place in the financing agreement under a concession of the monetary requirement that are negative consequences to get out of this situation, every participant of market relations.

What is this type of transaction

The Concept of a contract of financing under concession of a monetary claim it is in the Russian world of market relations is relatively recent, but already firmly entrenched in it. Its definition is given in section 1 of article 824 of the civil code. In accordance with this article, the contract of financing under concession of a monetary claim seals the deal by which one party reports or plans after a certain time to pass to the next participant funding, the requirement for which the return is subsequently submitted to a third party. It turns out that, despite the bilateralization of this agreement, it binds the legal obligations of the three parties, involving them and someone who does not put his signature in the agreement.

In practice, such agreements are also referred to as factoring.

Participants

Parties to the contract of financing under concession of a monetary claim are:

- Factor (financial agent) – enterprise, characterized by a commercial focus and outstanding funds under the assignment of financial requirements (condition required commercial basis the agent ravlanda required).

- The Creditor (client) – have not received due payment for the provided services and/or goods by the person and addressed to the financial institution for the contract.

The Person has not paid the received goods/services – the debtor. It will be applied to cash requirement, and it will be a third party involved in the legal relationship of the parties to the transaction.

Recommended

Calculation and payment of sick leave

Sick Pay provided by the legislation of the Russian Federation, in particular TC and FZ No. 255. In addition, some rules are governed by the provisions of the civil code. Any employee upon the occurrence of a certain disease should contact a health f...

Employee certification for compliance with the post: purpose, procedure, result

Employers perceive the order of certification of employees as a formality. Regulations intended for commercial organizations, were not issued. Certification is required only for employees of the organizations designated in the laws of the spheres, le...

Registration of vehicle: procedure, sample application, certificate

Every person who buys a car needs to do its registration in the traffic police. It is necessary when purchasing new or used cars, as well as no matter whether the seller of natural persons or legal entities. Check the vehicle is in the traffic police...

Financial requirement based on a client-supplied goods or provided the services/the works of the debtor, which the latter has not been paid at the time of the transaction. It can also be assigned by the client for other purposes (for example, if the client has a financial debt to the Bank, he can enter into a factoring agreement and thereby close its debt).

Characteristics of the contract of financing under concession of a monetary claim, its features

The Contract of financing under concession of a monetary claim is:

- Mutual – establishes bilateral rights and obligations of the counterparties to each other;

- Paid – regulates the payment for the execution of its obligations to counterparty.

The agreement may be real or consensual. In the first case, the contract is valid only after transfer of a thing, which one participant must transfer to another (in this case, funding), provided that the parties came to an agreement and legally secured it.

A Consensual agreement takes effect immediately upon its signing by the parties. Which of these types will relate to the contract of financing under concession of a monetary claim, the parties decide for themselves. Their decision should be reflected in the text of the agreement that sets the time at which the document becomes effective.

A Feature of such transactions is:

- Combination of the two types of agreements: the assignment of claims (assignment) of loan/credit;

- Can also be the agreement on the provision of other financial services to the customer by the agent (such as, maintenance of its accounting).

Agreement Form

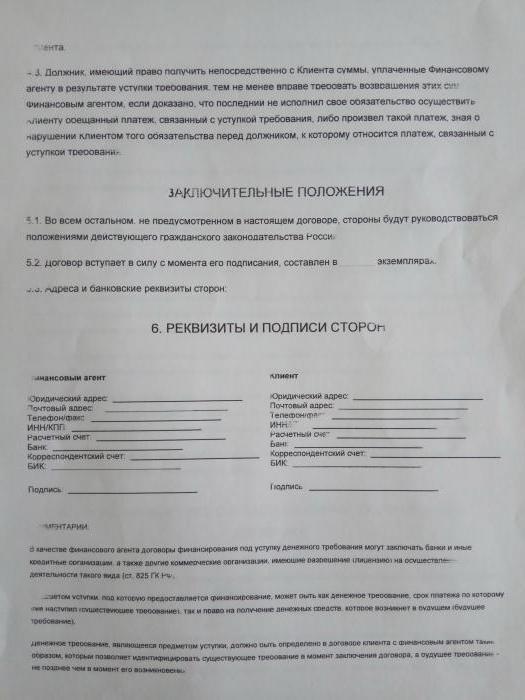

Like all standard transactions, the form of the contract of financing under concession of a monetary claim - a simple writing. This means that the agreement is a document in which are reflected all the terms of the transaction and which shall be valid after it is signed by the counterparties. The document is issued in two copies, each present signatures of the parties. A notary, or otherwise certification is not required, unless otherwise determined by the parties.

In Addition to the standard of writing, the legislator allows to conclude the contract of financing under cession of monetary claim (factoring) through an exchange of telegrams, letters and other documents, including e-mails. The main condition-the possibility of credible establishment of the fact that information is actually received from the counterparty. The main requirement governing the validity of agreements – the receipt of the acceptance (consent) from the other participant of the transaction. Consent is deemed to be received if the person receiving the offer (the offer), begins to perform the actions stipulated by agreement text (services, shipping of goods, etc.) within the term established by agreement of the counterparties.

At the request of the parties to the transaction, contract financing under the assignment ofmonetary claims can be certified or registered in Rosreestra. If the parties want to conduct a state registration of the transaction, the agreement must be in 3 copies to submit an original to the registering authority.

Entire agreement

The content of the contract of financing under concession of a monetary claim is no different from other standard agreements that are issued in this form. The text of the document consists of the following mandatory items:

- Preamble (this includes the document title, and the date and place of its execution);

- Information about the participants (name or company name in full, indicating the postal and legal address and passport data);

- The subject of the agreement (this is the essential condition of the contract, reflecting the essence of the transaction);

- The price of the contract (the amount of client funds – determined by agreement of the parties);

- The term of the agreement (as determined by the parties);

- The rights and obligations of contractors;

- Responsibility for failure to perform its obligations;

- The possibility of occurrence of circumstances, accept the force majeure;

- Other conditions (prescribed solely by agreement of the parties);

- Details of the parties.

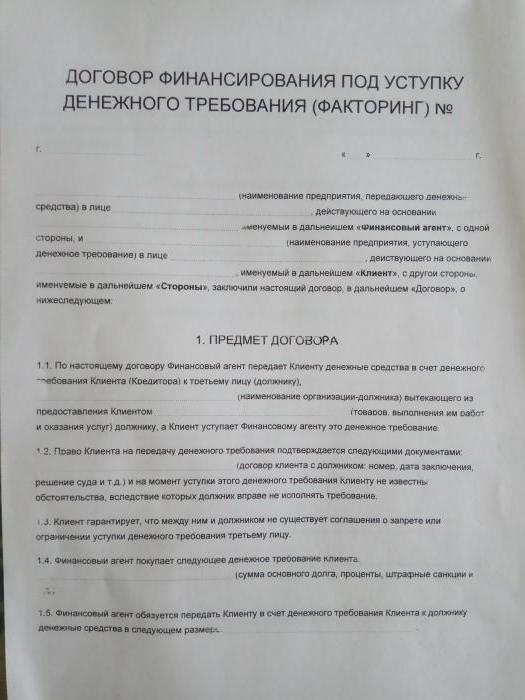

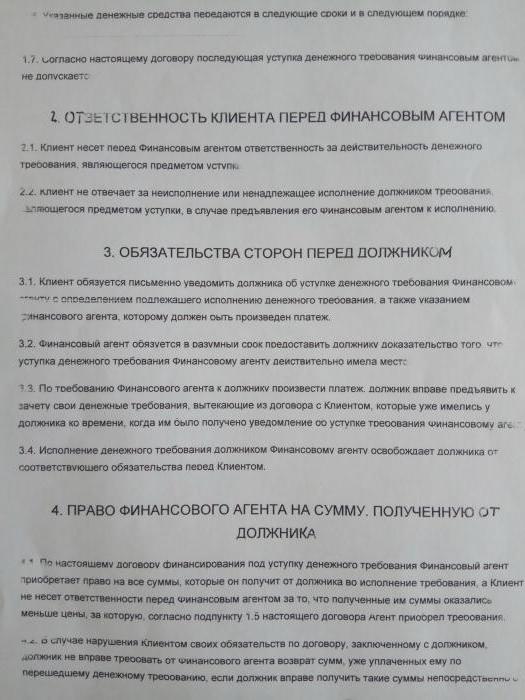

Sample contract of financing under concession of a monetary claim

The above points should be present in the agreement mandatory. Each of them needs to be spelled out as detailed as possible. It should be noted that if between the parties encounter any disputes, proceedings will be conducted on the basis of the text of the document. Therefore, for each participant it is important to register the agreement as many details as possible. However, it is understood that all terms of the agreement of financing under a concession of the monetary requirement, the counterparties must agree between themselves mandatory, because a signature will confirm familiarization with the text and acceptance of each item.

A Sample contract of financing under concession of a monetary claim can be viewed below. Note that in addition to mandatory items, the parties may make a contract other details, at its discretion, provided that they do not contradict the legislation and requests of each participant.

Scope of agreement

The Subject of the contract of financing under concession of a monetary claim – this is a significant condition that determines the essence of the transaction. Its role can be performed:

- The fact of the factor of financial requirements from the client, which is done in exchange for funding the last cash to the extent necessary;

- The fact of the transition requirements to factor in the possibility of performance of client's existing financial obligations to him (usually this applies to transactions with loans and financial requirement in such case may be transferred to the factor only in case if it will not perform its obligations to a commercial organization).

No matter what is the subject of the agreement, the agent, or otherwise, lends to a client, receiving a guarantee of return of their funds in the form of assignment of monetary claims. It causes a combination in the agreement of the features listed above of credit and assignment.

Note that the subject is an essential condition of the agreement, without whose instructions the transaction will not be considered a prisoner. Therefore, it is important to paint a piece as detailed as possible stating all the characteristics, allowing to identify it.

The Rights and obligations of contractors

The responsibility of the factor under this agreement is:

- Financial counterparty subsidies through transfer pricing (funds) in the manner prescribed herein;

- Acceptance of the client package of documents that allow the accounts in the cases specified in signed agreement;

- Rendering to the client of other services of financial nature, which have been agreed upon by the parties;

- Compilation for a customer a detailed financial report;

- Presentation to the debtor upon request evidence that a financial claim was indeed transferred to the factor.

Failure to comply with the latter condition gives the debtor the right to transfer the funds to the client, after which it obligations to him will be executed.

The right factor for this type of agreement is that it will receive funds from the debtor after the signed document.

Responsibilities of the client under the agreement included:

- Assignment of a commitment or a subsequent assignment, the factor of financial claims against the debtor;

- Transfer agent of documents that proves the financial requirements and information required for the implementation of this requirement;

- Informing the debtor about the transfer requirements in writing (preferably sending notice by registered letter with preservation of the receipt of dispatch);

- Payment for services of the factor (a financial agent).

The signing of the contract of financing under cession of monetary claim (factoring)imposes obligations on the debtor, who is not a party to the transaction. They are as follows:

- Payment processing agent, provided that the debtor was notified of the fact of transfer of rights of claim in writing (notice it can get from both the factor and the client, while it should contain information about the factor (financial agent), on account of which you want to transfer funds);

- A payment for this monetary requirement to the client in the event that if the agent did not produce evidence that the assignment was made.

If the debtor's obligations are performed before factor, it is automatically exempt from similar requirements to the client.

Liability under the contract

In accordance with paragraph 1 of article 827 of the civil code, the customer will be required to provide the factor guarantees the validity of the subject matter of the transaction (cash requirements). As such it will be under the following conditions:

- The client has the legal right to assign his right of claim;

- At the time of signing of the agreement, unknown to him the circumstances which give the debtor the right not to repay their debts (paragraph 2 of article 827 of the civil code).

If the client does not need to bear any responsibility if the debtor does not fulfill the requirement that was against him a factor or it will perform improperly (provided that the contract does not specify otherwise). Also the client is not required to bear the responsibility if the debtor can not fulfill the requirement because of its insolvency (provided the validity requirements).

The Advantages of funding agreements under the assignment

Despite the relatively recent emergence of contracts of financing against the assignment of right of demand on the Russian financial market, there is a large percentage of their conclusion. It said the undoubted benefits of deals of this nature, which include:

- No need for the collateral;

- Loyal to the solvency requirements of the client;

- Guarantee uninterrupted and accelerating the turnover of financial resources;

- The possibility of full use of funds (if credit is necessary, that the account has always been a certain amount);

- The possibility of obtaining additional financial services of high quality;

- Protection from non-payment of their services, and foreign exchange risks in international transactions;

- Guarantee of timely fulfillment of their tax obligations (eliminating the risk that they will occur before the client will receive pay for their work).

You Can see all the advantages of the contract of financing under cession of monetary claim, for example.

OOO "Daisy" (the client) has been manufacturing furniture for offices and February 15, concludes with “Vector” (the debtor) contract of supply of goods in the amount of 250 thousand rubles. In accordance with the agreement, the buyer shall transfer the payment for the goods not later than 2 March. Urgently needing financing, February 21, OOO ‘Daisy’ signs a factoring agreement with a Commercial Bank “Constellation” (financial agent/factor), according to which gives him the right of the requirement to “Vector”. 22 February, the factor remits to the client account of 200 thousand rubles, which equals 80% of the debt of OOO “Vector”. When is the payment deadline (February 26), the factor puts the monetary requirement to the debtor. February 27, OOO “Vector” translates in his account of 250 thousand rubles, of which KB holds the amount by which made the financing of the client, plus remuneration for the service, and the rest transferred to the account of OOO "Daisy". If we assume that the reward is 3%, it is equal to 7500 rubles. Accordingly, the Bank shall transfer the client 42500 roubles.

Thus, under the contract of financing under cession of monetary claim, the customer:

- Receives the demand amount without any collateral;

- Has the ability to fulfill their tax obligations before the end of the reporting period (until March 1).

Disadvantages of funding agreements under the assignment

Despite the large number of advantages, such transactions also have disadvantages. These include:

- High Commission (it comes to 10% of the debt or up to 30% per annum);

- The need to provide detailed information on the debtor;

- Applicability only to transactions that are paid via a Bank transfer.

But despite the disadvantages, many businesses prefer to enter into such agreement instead of Bank loans.

On the basis of above facts it can be concluded that factoring is a convenient and advantageous type of transaction, which allows you to:

- The customer to get the desired amount in a specific period of time;

- The agent to receive compensation for their service to the client.

As for the debtor, he does not pay any additional fees on factoring. Consequently, there is no significant difference where to transfer funds for services rendered or the goods, for the account of the client or agent.

Article in other languages:

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

The time of the sale of alcohol in Moscow region. The law on the sale of alcohol

the government of the Russian Federation is actively fighting the problem of alcoholism in the country. Unfortunately, today a habit to have people of all ages. Time alcohol sales in Moscow region not known to many. However, this ...

Property division in a divorce

Quickly flew to the wedding, the honeymoon and a few years, and maybe decades of their life together. And only now you realize that to live with this man don't want don't. The time has come when the thoughts of divorce become a re...

Escrow account and its opening

recently, in July 2014, the Civil code of the Russian Federation was introduced a new type of contract between the Bank and the citizen - escrow account. This agreement is created for the account or block received from the owner (...

human Life is not homogeneous in nature. Quite often each of us overcome any difficulties. To cope with them helps hard work and an iron will. But there are times when a person to solve a particular problem, it is necessary to cre...

Vacuum bomb: the destructive power without radioactive contamination

Not long ago the army of the Russian Federation was adopted vacuum bomb. According to experts, it is the most powerful non-nuclear warhead. This weapon has a high destructive characteristics and does not contaminate the area with ...

Missile complex "Caliber". Cruise missiles "Caliber". Combat missile complex

in the Spring of 2009 at the exhibition of defense systems in Asia OKB “Innovator” introduced missile system with a cruise missile "Calibre". It includes four such missiles. The missile system «Calibre» loo...

Comments (0)

This article has no comment, be the first!