Now - 06:03:39

Calculation and payment of sick leave

Sick Pay provided by the legislation of the Russian Federation, in particular TC and FZ No. 255. In addition, some rules are governed by the provisions of the civil code. Any employee upon the occurrence of a certain disease should contact a health facility, the physician which gives him the right to temporary disability. This period is paid initially by the employer, then the FSS.

General information

In 2018, compared with the previous not planned any changes in the order of sick pay. Seniority does not increase, the form sheet of disability remains the same as it was. The rules for its completion are stored. Remain valid formula for calculating the payment period, requirements to be presented for registration of sheet of invalidity. Payments are made by the employer and the social insurance Fund, as it was previously installed.

Cases of sick pay

The Officer must not only get in a medical facility filled out the sheet of disability, but also to present it at the place of work. Only in this case it is to be paid. The period of temporary disability not to exceed six months.

Sick leave may be surrendered to the appropriate medical facility in case of:

- Carrying out some manipulation, necessary for the health of the patient;

- Poisoning;

- Quarantine

- Care for a family member with a specific pathology;

- Injury.

- Acquired disease.

The reasons can be different.

However, keep in mind that not all illnesses and injuries are paid upon receipt of the hospital. So, will not receive a payment as a result of these reasons, if they were received due to the Commission of the crimes or attempts of suicide, which is fixed by the judgment.

Economic entities carrying out compensation payments for temporary disability

Sick Pay employer is performed for the first three working days, which are recorded in it. The time period during which the employee was incapacitated for work, is not considered. This period remains constant.

Sick leave is paid within 10 working days after its completion and submission to human resources. It is better to give to the service or the accounting Department immediately after return to work, however, the legislation allows for this action within six months after the employee commence their duties. If this deadline is missed, the employee will have to justify his reason for turning to the territorial authority FSS. For valid cases are:

Recommended

- Injury, illness or death in relation to the relative, who is a close;

- Enforced absence due to illegal dismissal;

- Move to relocate to another town;

- Long-lasting disease;

- The circumstances related to force majeure.

This list is open. If the employee does not agree with the fact that he pointed out the reasons that are not justified, it can go to court.

In the following days, payment of sick leave the social insurance Fund.

Order of payment

If the employee is disabled within 1-15 days sick leave he shall be paid in full. To this rule there are some exceptions, but in most cases if necessary to continue the treatment after 15 days of incapacity, this document need to write a new one. The payment will be made for both the old and the new sheet.

Child Care

In this case, the amount of the payment is determined by the term which, in turn, depends on the age of the child. Payment of sick leave to care for children up to 7 years is made for the entire period of the disease. The entry in the document is based on the words of an adult. However, keep in mind the fact that any children are present.

When caring for a child aged 7-15 years, the maximum period of payment of sick leave is 15 working days for each separate case.

When the disease children who have reached 15 years, the payment document will only be made three working days in the implementation of treatment in outpatient conditions.

Payment

The amount of compensation in case of temporary incapacity for work depends on several factors:

- The time period of this factor;

- Average daily wages;

- Total employment.

If an employee fell ill after a small amount of time, he will also receive paid sick leave, but based on the minimum wage. In addition, for unemployed persons registered at the employment centres, also rely on the handbooks.

Below is an example of the calculation of sick pay after work.

First, you need to calculate the average daily earnings, which is determined by the formula: SD=CD/730, where GZ is the total income of the employee for the last 2 calendar years. In addition, when calculating the labor factor, which depends on the overall experience. If it is more than 8 years, then sick leave is paid at 100% size. At the experience of 5-8 years workingthe ratio will be 80% and if less than 5 years — 60 %.

If an employee has worked in a business entity for less than 2 years, the percentage of sick pay will depend on whether it can provide information about wages at the previous job. There is a maximum wage limit above which charges will be made still on it. In 2018, the maximum size of sick pay is 755 thousand.

If the worker has seniority of less than six months, the average daily earnings calculated on the basis of the minimum wage.

If he had one of two years that fall within the terms of payment of sick leave, a pregnant cannot be replaced in other time periods when she worked. Thus, it is made for women who were on maternity leave, substantial relief.

What sick pay the unemployed? It is determined by the unemployment benefit and cannot exceed it. And you need to choose only one benefit. While not every unemployed can qualify for this payment, but only the one that was in a particular employment center, through which they are implemented.

Reduction of payment

The Legislation States that it is possible to change sick pay. It is the fault of the employee. The following reasons for the decline:

- Injury to drug or alcohol intoxication — the decline occurs from the first day of treatment;

- Failure to appear for the examination in the hospital without good reason;

- Violation mode.

The Last two causes are calculated in the payment of the violation. The first and third of these can cause a complete cancellation of the payment.

Change time

A Business entity must pay a medical sick-leave certificate in case of submission by the employee in his actual absence from the service. This may be due to the fact that he is a second or subsequent sick leave, and funds for accommodation of the employee are exhausted. The employer's present obligation to pay the sick-list after its submission to the personnel or accounting Department place of work of a mercenary.

If the employee died before payment provisions of compensation, she can claim his heirs, who must submit an application for the transfer payment of medical sick-leave certificate of the deceased person within 4 months after his death.

Payment Period

As mentioned above, an employer is given 10 days to calculate the benefits. It should be noted that payment will be made immediately, but on the day of payment of wages. Therefore, it can take up to 25 days, taking into account that payroll payments are made by economic entities twice a month.

In the case of payment of the disability sheet directly from the FSS this period could further be extended. This is because the organization may request the missing documents, to clarify some issues. Payment will be made at the time when it is made such in relation to the social.

In Addition, the employee may immediately submit the documents confirming his salary for other jobs in the past two years, and the new entity he works for less than six months. In this case, the payment will be assessed based on the minimum wage. Subsequently, however, the employee may submit a reference from previous employers, and it should be the appropriate allocation.

The Delay in payment threatens the employer with the appropriate penalties.

Cash severance

This question requires special consideration, because some people face this problem when they quit, and list of disability opens later. According to the requirements mentioned above FZ, a payment of sick leave after the dismissal is made in the case if before the opening day of this document was no more than 30 days. Thus, the employee may receive a payment if the illness, injury or other reason for the issuance of sick leave occurred in this period. This case must relate only to the employee — to pay for a close relative will not succeed.

Former employee is not paid sick leave in case he passed MSEK.

If the certificate of incapacity was opened until the time of dismissal, the procedure in time for the treatment cannot be carried out, with a few exceptions:

- The elimination of the business entity;

- The dismissal at own will.

The first cause of the corresponding subject of the economy dismissed all employees, including those who are on sick leave. If the latter is opened prior to the liquidation, allowance for illness will be paid in any case in full, taking into account the percent of the sick pay. Calculation and payments are made by the Manager or liquidator appointed prior to the closing entity. All payments, including those on leavesdisability must be made prior to repayment of other payments to creditors.

Sick Pay from seniority when the employee does not. In this case the labour coefficient is set at 60% in any General period of work. But if the incapacity occurred before the dismissal, the amount of payment depends on this parameter.

The Hospital during pregnancy when dismissing the employee on their own not paid, except in the following cases:

- Care for a sick relative, are part of the family;

- Any group I disability;

- Development of pathology, which prevents to live in the area, which is a business entity;

- Transfer the spouse in another locality.

But in these cases the hospital should be issued within one month period since the dismissal.

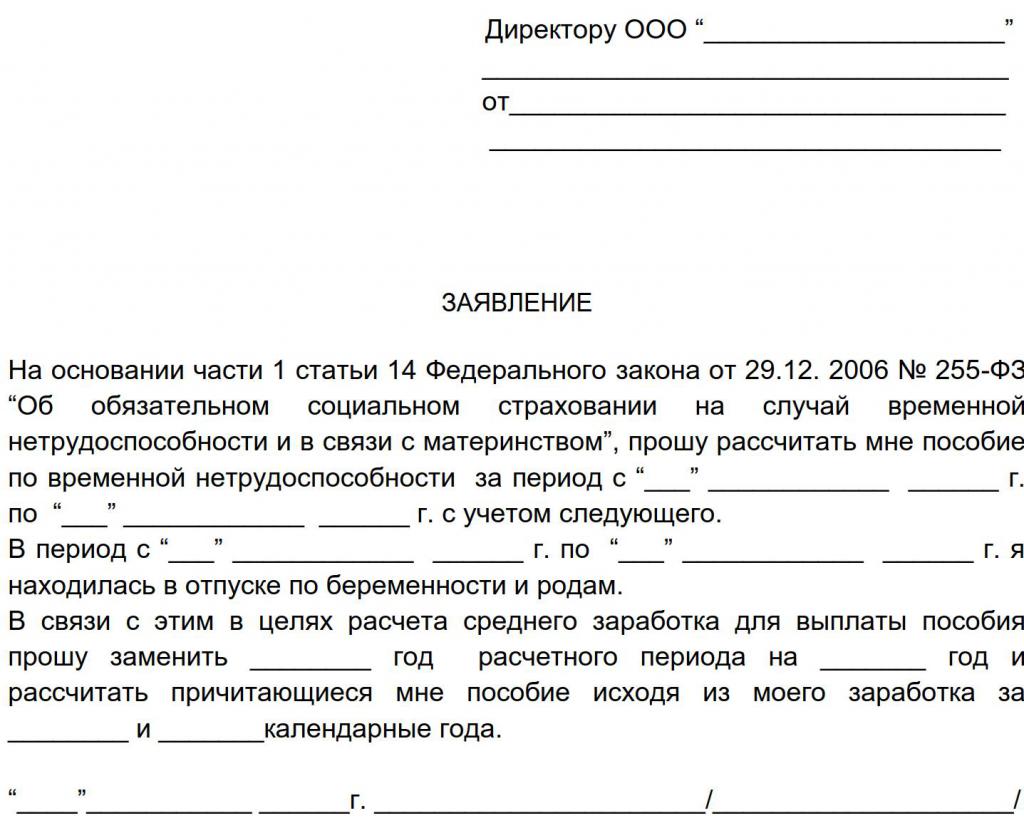

Registration statements

In order to get the money that is owed to the employee, he must not only take sick leave in the HR or accounting Department of the appropriate business entity, but to write an application for paid sick leave.

The Employer must transfer the documents to the territorial representation of the FSS within five days.

The application Form is not mandatory, however, it was developed by a specified Fund, it would be preferable to use it, although it is a recommendation. The employee can use a free form of writing statements.

The completion of this document can be accessed in the traditional way — with a ballpoint pen or using modern means — computer and black-and-white printer. As in any other statement, erasures and corrections are not allowed. Records must be legible, clear. If a statement is issued on the letterhead of the FSS, in the absence of any data must be placed dashes.

This document should contain the following information:

- Discharge date hospital leaflet and its number;

- The reimbursement amount;

- Place of registration;

- Date of birth;

- Identifies the employee information: full name, passport details.

The Employee may request a cash withdrawal or transfer in the form of cash on a Bank card. Accordingly, the statement must specify either the details of the account to which must be paid, or the address of the post office, where he will come for receiving money.

After completing the application, it shall be given to the accounting Department of the entity where it is checked, it make help-calculation and a copy of the sick list, after which they are sent to the FSS. The Foundation carries out the verification of the submitted package, and then decides on the production payment.

The Concept of e-hospital form and the manner of its payment

This sheet (ABL) was implemented in 2017. It helps:

- Reduce accounting costs;

- Simplification of the settlement of insurance cases;

- Details the risks of non-payment of the prescribed allowances to zero;

- To eliminate fraud in the insurance industry;

- Strengthening the control of the FSS for facts of disability.

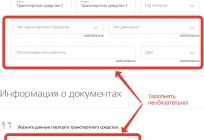

To date, the economic entity is not obliged to accept ALL, but if desired it can join this project. Statement on use of electronic version of the certificate for incapacity for work shall be made in the form developed by the Ministry of labor.

The Form the exact same as in the paper version. However, it significantly reduces the effort required to complete it.

EBL may be issued for a period exceeding 15 days but in this case it must be signed by the Chairman of the medical Board and a physician of the appropriate medical organizations.

When using an electronic version of the sheet of disability the patient has the following advantages:

- There is no time to collect stamps and signatures;

- Obtaining and closing the sick-list does not involve the assertion of queues in health facilities, than they are very often characterized by;

- After the closing sheet disability payments are obtained in the fastest mode;

- Funds are withdrawn to a Bank card or post office, there is no need of waiting for the salary day;

- The instrument may be damaged or lost by the employee;

- Calculation errors tend to zero.

The FSS For this type of sick leave also has a number of advantages:

- The space required to store paper versions;

- No need to use paper with water signs;

- High level of control;

- Easy to statistical data processing.

Disadvantages of EBL mainly characteristic of employers:

- Potential system failures;

- The need for the development;

- Additional costs FOR.

The Last two drawbacks characteristic of FSS.

Payment of ABL occurs in the same mode as in the paper version of the hospital. The main difference is that the payment can be made any day. Payment of sick leave for child care shall be at the expense of the FSS, other employees — first three days — forthe expense of the employer, then — at the expense of the Fund. The system has a special calculator, which may exercise control over correctness of payment.

In conclusion

Sick Pay made by the employer and the FSS. It depends on the General seniority of the employee and received wages for the last two years. To receive can apply pregnant, and with the possibility of postponement, is used for the calculation if one of the periods had maternity leave. The sick pay available after dismissal within one month after that. It will be condensed and made available only to the employee. The enumeration of the benefits depends on the salary day or the day of social payments from the social insurance Fund in case of using paper versions of the sick leave and does not depend on them when using EBL.

Article in other languages:

AR: https://tostpost.com/ar/the-law/22889-calculation-and-payment-of-sick-leave.html

BE: https://tostpost.com/be/zakon/40287-razl-k-aplata-bal-n-chnaga-l-sta.html

DE: https://tostpost.com/de/das-gesetz/39842-berechnung-und-krankheitsgeld.html

HI: https://tostpost.com/hi/the-law/21135-calculation-and-payment-of-sick-leave.html

JA: https://tostpost.com/ja/the-law/22435-calculation-and-payment-of-sick-leave.html

KK: https://tostpost.com/kk/za/37680-raschet-i-oplata-bol-nichnogo-lista.html

PL: https://tostpost.com/pl/prawo/36849-rozliczenie-i-p-atno-na-zwolnieniu-lekarskim.html

PT: https://tostpost.com/pt/a-lei/37071-o-c-lculo-e-o-pagamento-hospitalar-da-folha.html

TR: https://tostpost.com/tr/hukuk/37295-hesaplama-ve-deme-hastane-al-ma-sayfas.html

UK: https://tostpost.com/uk/zakon/37482-rozrahunok-oplata-l-karnyanogo-lista.html

ZH: https://tostpost.com/zh/the-law/18296-calculation-and-payment-of-sick-leave.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Employee certification for compliance with the post: purpose, procedure, result

Employers perceive the order of certification of employees as a formality. Regulations intended for commercial organizations, were not issued. Certification is required only for employees of the organizations designated in the law...

Registration of vehicle: procedure, sample application, certificate

Every person who buys a car needs to do its registration in the traffic police. It is necessary when purchasing new or used cars, as well as no matter whether the seller of natural persons or legal entities. Check the vehicle is i...

How to renew car: a step by step guide

How to re-register the car? To do it is easy. Especially if to behave correctly. The main problem is that the renewal can be done in different ways. For example, with the method of transfer of the property to another owner. This i...

The car without documents - stolen or not?

On various sites, ads and media, it is often possible to see the announcement “sell a car without documents”. Attractive aspect to these proposals is the price of the machine, which is much lower than that of similar u...

How to become a successful realtor? This question is breaking all records of popularity in the network. Indeed, the real estate market and everything connected with it, magically attracts people. After all, many think it is &ndash...

Law - what is it? Right, law. Institute of jurisprudence

For a long period of scientific practice, which lasted thousands of years, experts came to the conclusion that under the law you need to understand the science that investigates the law and the state. It is a kind of theoretical f...

Comments (0)

This article has no comment, be the first!