Property tax: the rate, the Declaration, the terms of payment

Every person and company that has their own property must pay the appropriate tax. It is calculated on the basis of the cadastral value of the object, although in some regions still use the inventory figure. Every taxpayer needs to understand how is calculated and paid the fee.

The Tax for individuals

He paid every Russian citizen, having a properly executed estate. It is used to calculate the rate in the range from 0.1 to 2 percent.

Certain taxpayers on the basis of their status, can count on special benefits. These include pensioners, veterans and invalids and some other categories of citizens.

What is taxable?

The Payment of property tax is made on the basis of cost values. The facility serves the properties owned by citizens in the property. In article 130 of the civil code lists all the types of real estate. To it is added:

- Different structures and buildings, and takes into account not only the completed object, but unfinished;

- Many sea and river vessels;

- Objects that are used in space;

- Aircraft;

- Other items which cannot be moved without causing them significant harm.

There are significant differences of real estate of movable property, which include the following:

- The property must be registered in Federal registration service;

- Different rules for the acquisition of these facilities;

- Property is inherited on the basis of their location;

- Trial must be carried out at the place of registration of the object.

The property Tax is calculated exclusively from the estate, so all citizens need to understand that it is possible for her to carry.

Recommended

Insurance for pregnant women when traveling abroad: features, views, and reviews

Currently, in our country there is a huge number of insurance companies that are willing to provide the necessary services at any time. Insurance expectant mothers – is a separate activity that SK are doing very reluctantly. The fact is that pr...

One of the most promising participants in the Russian real estate market, particularly in the joint construction, is the "Rosstroyinvest". Reviews of investors are saying about the leading role of the construction company year of Foundation, in 2002,...

The conditions for obtaining credit in modern banking institutions

Any aspiring entrepreneur is faced with the problem of insufficient funding of their own business. Currently, this problem can be solved by knowing the terms of the loan and taking the necessary amount from the Bank. This method is best for solving p...

Who pays?

The Payers of this fee are people who own objects:

- Premises, which are apartments, rooms, private houses, villas or cottages;

- Garages or Parking spaces for vehicles;

- Real estate complexes, which can have different purposes;

- Structure or building which is unfinished;

- Other buildings;

- The fractional part from any of the above-mentioned object.

Any building regardless of its size and purpose is subject to taxation if it is correctly framed on the citizen. Under the law object to the property tax cannot be a common property owned by all owners of apartments in high-rises.

Tax base

2020 is the transition in the calculation of the fee on the cadastral value of objects. If the specific region is not introduced these changes or have not conducted the cadastral valuation of a certain structure, you still need to calculate to apply the counting index.

When determining the tax base taken into account the possibility to use special privileges to everyone, so of squaring the subtracted object certain square meters

- For apartment it is necessary to deduct 20 sq m;

- When calculating the fee for the room the object is reduced to 10 sq m;

- For residential building the calculation is performed without regard to 50 sq m;

- The presence of a single complex in which there is at least one residential building, it is necessary to reduce the tax base by 1 mln.

Due to these exemptions, the situation may arise when the tax base has a negative value, therefore you do not need to pay tax on the property. According to article 403 of the NC, these deductions may be increased by the municipal authorities. If after the use of the deduction turns out a positive value, it is multiplied by the deflator coefficient, after which the tax rate.

Tax period

According to the article 405 of the NC tax period presented. Often the objects are purchased in the middle of this period, and in this case it is necessary to calculate the fees on the basis of full months of ownership. In this case, it is guaranteed that the right will be determined by the property tax. Terms of payment are the same for all citizens, therefore, to transfer the funds necessary to December 1 of the year following the reporting period.

Payment is made on the basis of information from receipts sent by FNS annually. Citizens can verify the correctness of the calculation, which you can use online calculators or standard formulas.

What are the stakes?

The Rate of property tax for individuals can vary depending on what object there is in the property. Therefore, values are used:

- 0.1 percent. This rate is used for all residential premises, complexes, and even unfinished projects.

- 2%. Apply to types of properties, the cadastral price of which exceeds 3 million rubles, which is accounted for in article 378.2 of the tax code.

- 0,5%. Used for all other objects.

The Regional authorities according to article 406 may reduce or increase the rate. When you increase this value the maximum it can be increased three times, but is allowed to reduce to 0.

Settlement Rule

The Payment of property tax is produced by specialthe receipts obtained from FNS. Additionally you can make the calculation yourself, why it is necessary to know the rate, the size of the deflator and the cadastral price of the object. Additionally take into account the area and the opportunity to enjoy the benefits.

For Example, a flat, the amount of which is equal to 48 sq. m. the deflator Coefficient is 7 and the rate used at the rate of 0.1%. The cadastral value of the object is equal to RUB 27 million. Originally deleted the deduction, therefore, reduced quadrature on 20 sqm Cost of 1 sqm is equal to: 2 700 000 / 48 = 56250. The tax base under these conditions is equal to: 56250 * 28 = 1 575 000. Reduced this figure by a factor deflator, so the tax base is equal to: 1 464 750 RUB.

Next, we determine the amount of the fee, which takes into account tax rate: 1 464 750 * 0.1% = 1464,75 RUB.

Who benefits?

Privileges on property tax for individuals are provided by many categories of the population. They are all spelled out in article 407 of the tax code.

This includes retirees, veterans, disabled and other vulnerable categories of the population. To exercise your right to exemption only in respect to one object, so if a patient has two houses, for one he pays the fee on the same basis.

Tax companies

The property Tax is paid not only by individuals but also by different firms having properly registered objects which are used in the process of doing business. Firms and entrepreneurs pay him once a year or quarterly by Bank transfer in arrears.

The Object is the property, which is the basic means of the enterprise, so it must be taken in the process of the company.

Who pays the fee?

The property Tax on legal persons shall be paid by all enterprises in accordance with article 373 and 346 of the tax code. It does not matter what mode of taxation is used for this purpose.

Therefore the calculation is as firms on the BASIS and by the organizations applying simplified system for tax calculation.

Property Types

Companies pay tax not only real estate that was on them, but even with values that are used on the basis of trust management or temporary use. The objects of taxation are different buildings and land.

This takes into account values held on the balance sheet of the company.

The Tax base and the period

Every company should know how to calculate the fee, and what is the deadline for payment of property tax. The tax base is determined based on the value of the cadastral value of the object.

The Calculation is carried out quarterly, so you have every three months to list on advance payments. At the end of the year transferred balances. Regional authorities may change the term of payment of property tax, therefore, can set its own periods in a given subject of the Russian Federation.

Tax Rate

Set this indicator for the different regional authorities, but it may not exceed the rate established by a Federal law.

In different regions maximum, this value is 2%.

If the company has assets included in the special list, which is contained in article 381 tax code, it is not permitted that the rate was above 1.1%. If the regional authorities do not set their values, then we must use those indicators which are set out in the tax code.

Settlement Rule

Declaration for the property tax for the year of work of the enterprise rent four times a year, as it takes time to list advance payments.

The Rules of calculation are the use of topical formulas. To determine the amount of the advance payment required of the tax base, submitted to the cadastral price of the object, divided into 4 quarters, after which the resulting value is multiplied by the bet.

Payment per year is determined by multiplying the tax base by the rate. Supplement year-end is calculated by finding the difference between the total amount of tax and any advance payments listed in the budget for the year of the enterprise.

Terms of payment

As of the tax Declaration on the tax on property of organizations, payments required to be made on a quarterly basis, so the entire payment is divided into the advance payment. At the end of the reporting year is the final payment and payment of balance.

The tax must be paid before March 30 of the year following the reporting year. The deadline may change slightly by the regional authorities. For example, in Ryazan to transfer funds have until 1 April.

Advance payments are transferred on a quarterly basis.

Reporting

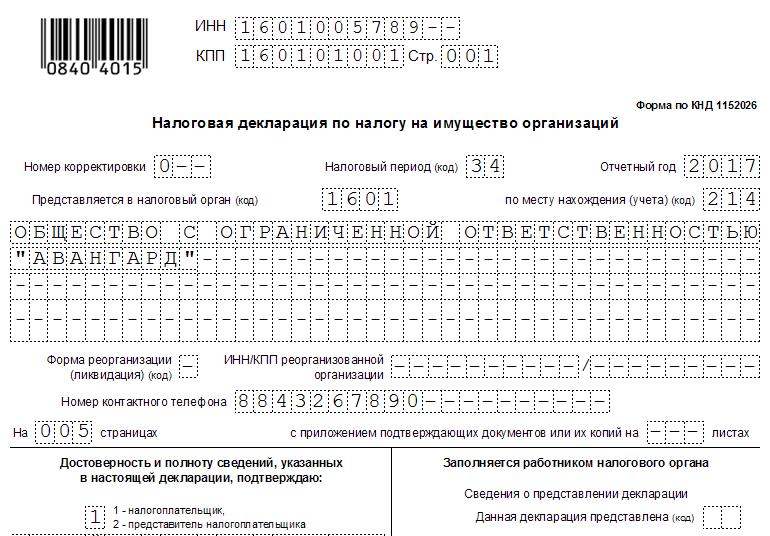

Company needs to create and submit the tax Declaration on the property tax. For each tax period, is represented by a block, you need to produce the document, after which he surrenders to the 30th of the month following the last month of each quarter.

At the end of the year also requires Declaration of property tax for the year, and it is passed before March 30 of the following year. In some regions there are no periods are represented by blocks. Enterprises under such circumstances are required to compile and submit reports only once a year for a year of work.

Where to pay the fees and hand over the Declaration?

When you select a branch on where you will be transferred funds and surrender of reporting, takes into account some rules:

- If the firm is located at the place of location of the property, it is necessary to work with the Department on where the company is registered;

- If the property is at the location of the unit, then clause 384 NC required to transfer funds and to send the Declaration to the Department on where the branch is registered;

- Often the property is located in another region, and in this case it is necessary to work with the office of the Inspectorate, which is responsible for maintenance of this site.

All the above conditions apply to the submission of the Declaration.

Rules for submission

Each firm, with the balance of the property should pay the property tax. The Declaration for this collection can be in paper or electronic form. The electronic form is mandatory under article 80 NK in situations where the firm employed more than 100 people.

The Declaration consists of several important sections:

- The title page, which indicates basic information about the taxpayer and the Department, on which receives the document;

- 1 section, includes an amount of tax;

- 2 section is designed for the correct calculation of the tax base on the basis of which calculates the fee;

- Section 2.1 is used for entering information for all objects, with which to pay the tax;

- 3 section used for calculation of the fee, which takes into account the cadastral value of the property.

So the Declaration must contain all the basic information about the company, available assets and other data.

Fill Rule

In the preparation of this document accountant of the company must adhere to certain rules. These include:

- Performance fit only in full rubles, therefore, are not considered penny;

- Required sequential numbering of pages, the first page represents the cover sheet;

- Not allowed to fix the detected errors with the use of different markers or other means;

- It is impossible to print the text on both sides of a single page;

- Sheets should not be stapled so so they were spoiled;

- During the filling of the document it is necessary to use black, purple or blue ink;

- Fill in all the lines only from left to right;

- If the document uses a special computer program, then you should use latest version of selected software.

In the Orders details are given on the basic rules of filling of the given document.

What to do if the property belonged to the firm only part of the year?

Often, companies buy or have different objects in the middle of the year, so it is not allowed to calculate the tax for the entire period. If you still use the inventory price, it is not this fact has any influence on the applied formula.

If the company already enjoys the cadastral price of the object, the calculation of advance payments it is necessary to consider the coefficient of possessions under article 382 of the tax code. To calculate this ratio we need the number of full months during which the company owned the facility, divided by the total number of months in the period. During the definition of full months of ownership is taken into account that if you had received item before the 15th of a particular month, it is included in the calculation. If the program was implemented after the 15th day, then the calculation is carried out as soon as next month.

Thus, the property tax as paid by individuals and different companies. It is important to understand how to determine the tax base, what is the price of real estate should be used, and how to report on this collection. The correct approach to the calculation and payment of the fee will be able to avoid penalties and fees. Firms are obliged to remit this tax regardless of the tax regime. PI in the calculation of this fee are equal to natural persons.

Article in other languages:

BE: https://tostpost.com/be/f-nansy/33726-padatak-na-maemasc-sta-ka-deklaracyya-term-ny-vyplaty.html

DE: https://tostpost.com/de/finanzen/33404-grundsteuer-rate-erkl-rung-frist-f-r-die-zahlung.html

KK: https://tostpost.com/kk/arzhy/34038-m-l-k-saly-y-stavka-deklaraciya-zh-ne-t-leu-merz-mder.html

TR: https://tostpost.com/tr/maliye/30455-emlak-vergisi-oran-beyan-deme-tarihleri.html

UK: https://tostpost.com/uk/f-nansi/34253-podatok-na-mayno-stavka-deklarac-ya-term-ni-splati.html

Alin Trodden - author of the article, editor

"Hi, I'm Alin Trodden. I write texts, read books, and look for impressions. And I'm not bad at telling you about it. I am always happy to participate in interesting projects."

Related News

Secondary securities market: specific features and differences

Primary and secondary securities market - basic concepts for any stock trader. The primary is usually defined as the market with which there is a transfer of property rights to securities, regardless of their method of production,...

The contribution of Tinkoff Bank, credit card, insurance, and other services

the Bank "Tinkoff" is one of the most advanced banking institutions, which operate on the territory of the Russian Federation. He has positioned himself as a Bank of new generation.And, most surprisingly, to work with more than 4 ...

Liability insurance under the contract: procedure, conditions, and guidance documents

In the modern world that requires separate attention insurance claims, related concepts and laws, as well as the nuances of civil security. It is important not only to understand what is reflected in the content of the contract of...

Before talking about what the audit of accounting of finished products, you should understand the concept of auditing. In our country the audit – control over the economic activity of an enterprise. To the extent that the de...

"Zubovsky Park" (Ufa): description, reviews

Each of us dreams of his own house, and if he is located in an ecologically clean area and is surrounded by all the necessary infrastructure, it will be a fairy tale. Currently increasingly popular cottages comfort class. And all ...

Customs duties are mandatory payments levied by the customs authorities of the state when moving any product through the so-called customs border. Such a function in any state usually lies with the state specifically authorized cu...

Comments (0)

This article has no comment, be the first!